We believe however that the pace of rate tightening after the initial hike will be rather pedestrian. October’s employment report was more robust on all fronts. Job creation came in above expectations, the unemployment rate touched 5.0%, wages increased by a solid 0.4% m-o-m and the proxy for household wage incomes rose markedly m-o-m. We now believe the most likely scenario is that the Fed will hike rates in December. Non-farm payroll employment rose by a solid 271,000 m-o-m in October 2015, above consensus expectations (185,000). September’s figure was revised slightly down (from 142,000 to 137,000), but August’s number was revised slightly up (from 136,000 to 153,000). Cumulative net revisions thus worked out at a small positive 12,000. Although October’s headline number was clearly encouraging, monthly job creations are very volatile in the short run (see chart above) and are often significantly revised. Over the past three months, job creation has averaged 187,000, below what was recorded over the previous three months (243,000) and almost the same reading as the average since employment bottomed in February 2010 (192,000). Unemployment rate ticked down to 5.0% Meanwhile, the unemployment rate eased from 5.1% in September (5.051% before rounding) to 5.0% in October (5.036% before rounding), in line with consensus expectations.

Topics:

Bernard Lambert considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

We believe however that the pace of rate tightening after the initial hike will be rather pedestrian.

October’s employment report was more robust on all fronts. Job creation came in above expectations, the unemployment rate touched 5.0%, wages increased by a solid 0.4% m-o-m and the proxy for household wage incomes rose markedly m-o-m. We now believe the most likely scenario is that the Fed will hike rates in December.

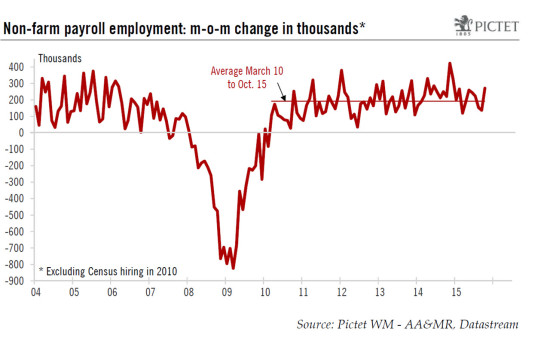

Non-farm payroll employment rose by a solid 271,000 m-o-m in October 2015, above consensus expectations (185,000). September’s figure was revised slightly down (from 142,000 to 137,000), but August’s number was revised slightly up (from 136,000 to 153,000). Cumulative net revisions thus worked out at a small positive 12,000. Although October’s headline number was clearly encouraging, monthly job creations are very volatile in the short run (see chart above) and are often significantly revised. Over the past three months, job creation has averaged 187,000, below what was recorded over the previous three months (243,000) and almost the same reading as the average since employment bottomed in February 2010 (192,000).

Unemployment rate ticked down to 5.0%

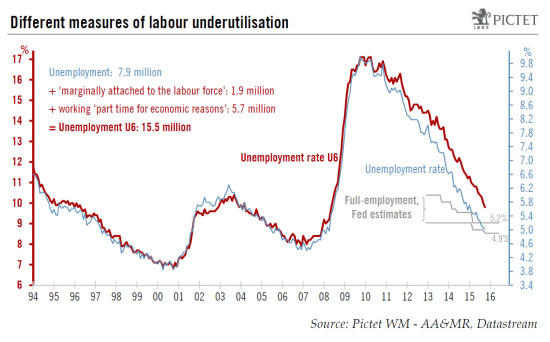

Meanwhile, the unemployment rate eased from 5.1% in September (5.051% before rounding) to 5.0% in October (5.036% before rounding), in line with consensus expectations. A more in-depth look at the household survey (the basis for calculating the unemployment rate) reveals that this stability reflects both robust employment growth and robust growth in the labour force. Employment as measured in the household survey – an often very volatile statistic – increased by 320,000 m-o-m in October whilst, at the same time, the size of the labour force rose by 313,000. The end-result was that the number of unemployed dropped by a marginal 7,000 (313,000 minus 320,000) while the participation rate remained unchanged at 62.4%. At 5.04%, the unemployment rate is now in the middle of the range the Fed feels corresponds to full employment (4.9%-5.2%).

The Fed has admittedly repeated many times that the unemployment rate probably underestimates the amount of resources available in the labour market. However, even if we consider a wider measure of unemployment, i.e. the U6 measure – which includes (1) employees working part-time, but who would prefer a full-time job, and (2) people who want a job, are available for work, have looked for a job sometime over the past 12 months, but did not do so during the current survey week and were therefore not counted as unemployed – it has fallen heavily so far this year. And in October it settled at 9.8%, down from 10.0% in September. On this yardstick, too, full employment does not look all that far away (see chart above).

Wage increases picked up somewhat in October

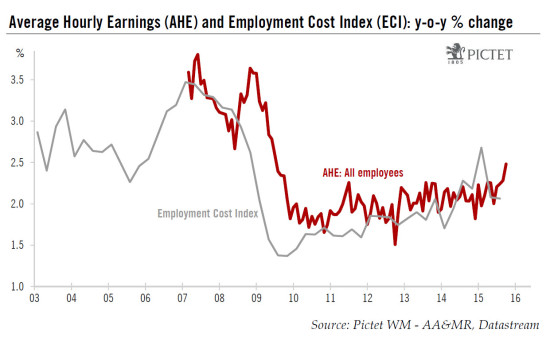

Meanwhile, average hourly earnings increased by a robust 0.4% m-o-m in October, above consensus estimates (+0.2%). On a y-o-y basis, wage increases picked up from 2.3% in September to 2.5% in October, the highest level recorded since July 2009. However, this higher figure should be put in its proper context. This series is quite volatile (see chart below) and at 2.5%, October’s y-o-y reading is not that much above what was recorded so far this year on average (2.2%) and is still low by historical standards. Nevertheless, according to these numbers, the pace of wage increases looks to have picked up somewhat in October. Meanwhile, the quarterly Employment Cost Index (ECI) – the most reliable measure of wages and salaries – is not pointing to any noticeable acceleration in wage increases so far this year. In any case, we continue to expect wage increases to gradually pick up further over the coming few quarters.

The average workweek was published at 34.5 hours in October, unchanged from September. As a result, the index of ‘aggregate weekly payrolls’ (calculated as a product of aggregate hours worked and average hourly earnings) rose by a robust 0.6% m-o-m in October. However, it followed a decline of 0.2% in September. As a result, this index – which is a good proxy for nominal household income coming in the form of private wages and salaries – grew by a healthy 4.3% annualised between Q3 and October, after a strong increase of 5.0% q-o-q annualised in Q3. This remains a supportive development for growth in household income in Q4, and for consumer spending.

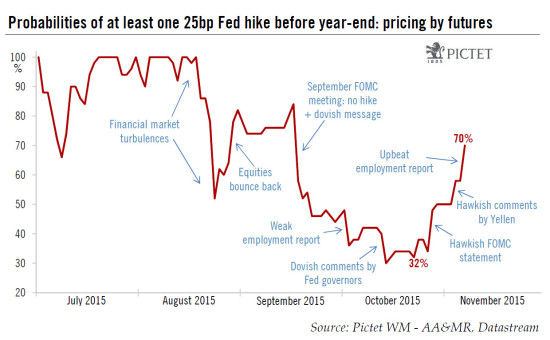

A December hike becomes the most likely scenario

In its last monetary policy statement, the Fed clearly stated that the FOMC would raise rates in December if (1) “it has seen some further improvement in the labour market” and (2) it “is reasonably confident that inflation will move back to its 2% objective over the medium term”. Following today’s employment report and the recent publication of other labour market indicators, the first criterion has been fulfilled. The second criterion is ostensibly more judgmental. As we wrote last week, our view was that in the current environment of uncertain growth prospects, low core PCE inflation, soft wage increases, low market inflation compensations and some recent decline in household inflation expectations, Fed confidence that inflation will rise towards 2% over the medium term was unlikely to improve by enough to lead to a hike as early as December.

However, last Wednesday, the tone of Fed chair Janet Yellen’s remarks was different. She basically said that the ongoing improvement in the labour market could be sufficient to gain enough confidence on inflation moving back towards 2% to hike rates, or at least enough confidence to hike once. She also said that “moving in a timely fashion “ is “a prudent thing to do because we will be able to move at a more gradual and measured pace”. In short, it seems that the Fed would like to start hiking as soon as possible, and then wait for data confirmation, notably regarding wages and inflation, before continuing to move.

In any case, Chair Yellen was quite explicit, in particular in saying that “it could be appropriate to raise rates next month, though no decision has been made”.

All these comments show that the bar for a hike in December is probably less high than we were thinking. Moreover, today’s employment report was robust on all fronts: hefty job creation, the unemployment rate touching 5% and some pick-up in wage increases. Together with Yellen’s hawkish comments, today’s employment report means that the probability of the FOMC starting to hike as early as December has clearly risen markedly. We now believe this has become the most likely scenario, although there are still quite important data to be published before mid-December (including another employment report) and the tightening in monetary and financial conditions is likely to continue over the coming few weeks.

Interestingly, Janet Yellen also said: “I know there is a great deal of focus on the initial move”…”but markets and the public should be thinking about the entire path of policy rates over time”. We agree. The exact timing of lift-off has its importance, but the pace of tightening is probably even more important. As mentioned above, we now expect the Fed to start hiking rates next month. However, we are not upwardly revising our forecasts regarding the cumulative tightening that will happen between now and the end of 2016. As monetary conditions will probably tighten further, we believe the pace of rate tightening after the initial hike will be particularly pedestrian. A lengthy pause after lift-off is even possible if the reaction on markets (FX, bonds and/or equities) is too adverse. Therefore, our forecast that the target range on the Fed funds rate will end 2016 at 0.75%-1.00% (three 25bp hikes from now to end-2016) remains unchanged. In any event, the trajectory of monetary policy will be highly data-dependent, and the Fed will act very carefully in trying to avoid any unwanted tightening of monetary conditions.