Despite a 1% weaker EUR/USD than three months ago, the ECB is likely to announce new easing measures at its 3 December meeting, for several reasons. Firstly, Mario Draghi effectively made a pre-commitment to further easing at the October meeting and he is unlikely to risk disappointing the markets. Secondly, and more fundamentally, we expect the new set of staff forecasts to lead to a downward revision to the 2017 HICP inflation median projection, to 1.6% (see chart and assumptions below), clearly below the 2% target. This argument alone should be enough to tip the balance. Thirdly, the trade-weighted exchange rate remains too strong, especially against a broader basket of currencies, adding to downside risks for inflation. In the run-up to the December meeting, the focus should remain on the composition of the new ECB easing measures. This week various press reports suggested that the Governing Council was leaning towards a consensus, including on a deposit rate cut. Meanwhile, Draghi repeated today that the QE programme was flexible enough to address downside risks. We believe that the most likely package will include a 6-month QE extension, until “at least March 2017”, as well as a 10bp deposit rate cut.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Despite a 1% weaker EUR/USD than three months ago, the ECB is likely to announce new easing measures at its 3 December meeting, for several reasons.

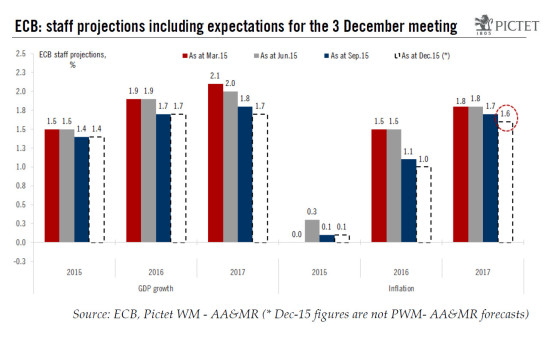

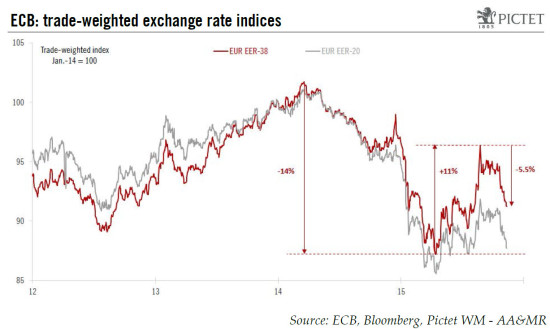

Firstly, Mario Draghi effectively made a pre-commitment to further easing at the October meeting and he is unlikely to risk disappointing the markets. Secondly, and more fundamentally, we expect the new set of staff forecasts to lead to a downward revision to the 2017 HICP inflation median projection, to 1.6% (see chart and assumptions below), clearly below the 2% target. This argument alone should be enough to tip the balance. Thirdly, the trade-weighted exchange rate remains too strong, especially against a broader basket of currencies, adding to downside risks for inflation.

In the run-up to the December meeting, the focus should remain on the composition of the new ECB easing measures. This week various press reports suggested that the Governing Council was leaning towards a consensus, including on a deposit rate cut. Meanwhile, Draghi repeated today that the QE programme was flexible enough to address downside risks. We believe that the most likely package will include a 6-month QE extension, until “at least March 2017”, as well as a 10bp deposit rate cut.

We have expressed our reservations about a deposit rate cut (see our Q&A on the topic), but our impression is that the ECB will still deliver it, partly for the wrong reasons. Finally, an increase in the pace of asset purchases looks less likely, but some (growth-friendly) changes to their composition are possible.

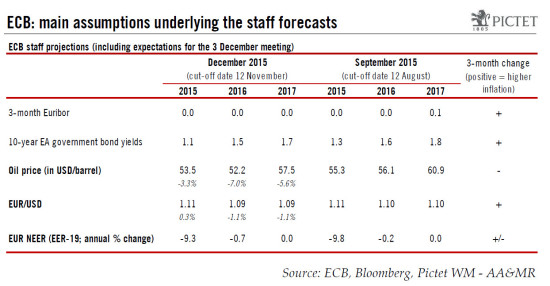

Today is likely to be the ECB’s “cut-off date”, or the day when the staff of economists sets their assumptions for interest rates, exchange rates and other external variables to be put into their forecasting models in order to produce the new set of macro projections to be presented at the 3 December policy meeting – two weeks before the 16 December FOMC.

In terms of economic growth, some risks at least have diminished in the past three months. China has managed to stabilize its currency while economic indicators have not been consistent with an imminent hard landing. The Fed dropped its reference to external risks and the very strong October employment report led the majority of market participants to price in a December rate hike. At the domestic level, hard data have been a bit of a mixed bag, which should be reflected in tomorrow's preliminary Q3 GDP report, but the outlook for the next couple of years remains reasonably positive and we would not expect significant revisions to ECB staff growth projections. At the margin, the refugee crisis could even lead to a modest demand stimulus to be included in the 2016-2017 forecasts.

The outlook for price stability, however, has failed to improve in the meantime. Today Draghi said that “signs of core inflation turnaround weakened” which, even if we are not sure to agree with this statement, clearly reflects the ECB's uneasiness with future price developments. Taking into account recent inflation data as well as the staff assumptions described in the table below, we expect the staff forecasts for inflation to be revised slightly lower, from levels that were already not consistent with price stability over the medium-term. In particular, the median projection for 2017 HICP inflation is likely to be lowered by 0.1pp, to 1.6%. Note that projections for 2018 will not be unveiled before March 2016.

Our estimates of the upcoming staff projections are described in the table above. Even though the bilateral EUR/USD exchange rate averaged 1.09 in the two weeks prior to the cut-off date, or 1% below the assumption used in September, we believe that the ECB will cut its deposit rate by 10bp at its December meeting nonetheless. We expect the ECB's main refinancing rate to be left unchanged at +0.05%, leading to a de facto widening of the rates corridor.

In particular, some ECB officials have insisted on the fact that the broader (EER-38) EUR Nominal Effective Exchange Rate index remains stronger than the narrow indices, adding to those risks to the outlook for price stability.

One could justify a deposit rate cut with appropriate arguments, including the need to address an “unwarranted tightening” of financial conditions through the exchange rate (see Q.4 in our Q&A). Indeed the ECB is unlikely to risk disappointing the market, which would likely lead to such a tightening regardless of the Fed's decision on 16 December.

Our concern is that the ECB will cut rates for the wrong reasons. Some of the arguments we have heard include the incentive for banks to “use the excess liquidity” to grant loans, but such a reasoning ignores the very functioning of interbank markets in the euro area. At best, one could expect some sort of “hot potato” effect increasing the velocity of money, but the fact is that more negative rates will act as a tax on cash-rich banks while excess liquidity looks set to increase steadily towards the €1trn mark. The volume of trading exchanges in the Eonia market had already fallen close to €10bn. A solution would be for the ECB to introduce exemptions via a certain level of non-remunerated current accounts for banks like in other European countries.

Another very debatable argument that had been made is that a deposit rate cut would increase the universe or QE eligible securities. We still fail to comprehend the argument as we expect the ECB to leave the door open to further cuts and the yield curve to adjust accordingly. There is no guarantee whatsoever that the amount of eligible German Bunds the ECB could buy would increase accordingly, unless the ECB drops the threshold above which it buys those securities. If the market were to price in more rate cuts in the future, the QE universe could even shrink as a result.

Meanwhile, a lengthening of the QE programme, by at least 6 months in our view, is less controversial and therefore more likely. An increase in the pace of asset purchases looks less likely in our view, although some (growth-friendly) changes to their composition are possible including towards regional public debt securities as mentioned in recent press reports.