Our GDP growth forecasts for Q4 (+2.6%) and 2016 (+2.4% on a yearly average basis) remain unchanged. The ISM indices continue to diverge quite markedly. The Manufacturing index ticked down to almost 50% in October, whereas its Non-Manufacturing counterpart bounced back sharply, reaching its second highest reading in a decade. Taken together, they point towards economic growth running at around 3.8% in October. We continue to expect GDP growth to settle at 2.6% in Q4. ISM Manufacturing...

Read More »Gold: challenging environment in the short term

The expected March 2016 lift-off and negative short-term seasonal patterns are likely to result in a challenging short-term environment for the gold price. Our scenario favours a medium-term consolidation above the $1000/oz threshold. The recent trend of the gold price has been closely linked to how the Fed’s tightening cycle is likely to pan out. The rationale is that higher rates make gold less attractive. While gold has no credit risk, it is a non-yielding asset. As a result, when...

Read More »Hedge funds: bull or bear on China?

Macroview Global managers are developing a pronounced bearish stance towards China, while several local managers are building up their exposure to Chinese equities, arguing the rest of the world is far too pessimistic. China has been slowing down and the outlook for emerging markets is far from positive. Summer events in China shook markets worldwide and the consensus is that the worst is yet to come. Chinese economic data has been below expectations for the past year and a half, with the...

Read More »US wages and monetary policy: surprisingly hawkish FOMC statement in October

Quarterly wage data (ECI) for Q3 pointed to modest increases, and core PCE inflation remained stable at a low 1.3% in September. Although the October FOMC statement was surprisingly hawkish, we continue to believe that the most likely scenario will see the Fed biding its time until March next year before making a start on lifting rates. Friday saw some key data being published: the quarterly Employment Cost Index (ECI), admittedly the most reliable measure of wages and salaries....

Read More »Spain: solid rate of growth in the third quarter

Spain is the first country of the four biggest economies to publish Q3 figures. Its good performance bodes well for the euro area as a whole. According to INE’s flash estimate, Spanish real GDP expanded by 0.8% q‑o‑q (3.4% y-o-y) in Q3, in line with consensus expectations. This comes after GDP grew by 1.0% q-o-q in Q2 and 0.9% q-o-q in Q1. Details of the expenditure breakdown for Q3 are not yet available (to be published on 26 November). Nevertheless, based on monthly macroeconomic...

Read More »Inflation in the euro area: the beginning of the end of negative base effects

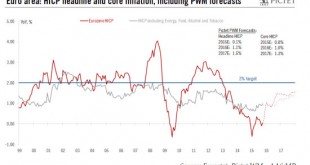

Whatever the ECB does in the coming months, this threat of “low-flation for ever” is likely to keep the central bank under pressure The euro area HICP flash estimate rebounded to zero in October, or +0.04% y-o-y, after -0.08% in the previous month, as negative energy-related base effects diminished. Looking at HICP components, energy inflation continued to drag the headline rate down, rising only slightly from -8.9% to -8.7% y-o-y as Brent oil prices more or less stabilised in euro terms...

Read More »Central banks are running out of steam

“After a long period when market volatility was relatively subdued, it has risen sharply this year. ” The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still […]

Read More »United States: strong final demand, but soft GDP growth in Q3

GDP grew by a soft 1.5% q-o-q annualised in Q3, marginally below consensus expectations. Growth was dampened by a sharp drop in the pace of stockbuilding (negative contribution of 1.4 percentage points) and another massive fall in energy-sector investment. US real GDP, curbed by lower stockbuilding, grew by a soft 1.5% in Q3. However, final demand increased by a buoyant 2.8%. Our forecasts for Q4 (+2.6%) and 2016 (+2.4%) remain unchanged. In Q3 2015, US real GDP grew by a soft 1.5%...

Read More »Central banks are running out of steam

Central banks are becoming increasingly interdependent, which adds to uncertainty for markets. Christophe Donay, Chief Strategist at Pictet Wealth Management, explains the implications for investors.

Read More »Q&A on the ECB’s negative rates – Its decision to cut rates again should be FX-dependent

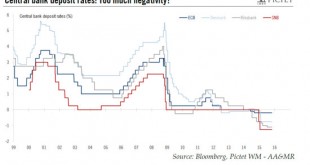

The ECB has explicitly (re-)opened the door to further cuts in the rate applied to its deposit facility, currently standing at -0.20%. The ECB is one of four major central banks to have lowered one of its policy rates into negative territory; the ECB’s rate on the deposit facility used to remunerate banks’ reserves – or the ‘depo rate’ – currently stands at ‑0.20%. The other negative experimenters, in Switzerland, Denmark and Sweden, have even lower repo and deposit rates (see chart below)....

Read More » Perspectives Pictet

Perspectives Pictet