Yields on DM sovereign bonds are catching up with the wider equity market rally, as fears about deflation have dissipated and a first Fed rate rise is now likely in December. The rebound in equity markets has played out as expected since the beginning of October, after excessively negative perceptions about the global economy, notably China, abated. Data continue to confirm broadly robust global economic fundamentals, even if growth lacks momentum. The S&P 500 has now moved back into the trading range (roughly between 2050 and 2120) that it occupied from February to August, while the Stoxx 600 has reached the lower bound of its range for the same period (around 380 to 410). Falls this week in anticipation of a Fed rate rise in December are unlikely to herald a major reversal; conversely, further gains will be limited for as long as downward revisions to earnings forecasts continue. Bond yields catch up with the rally Sovereign bonds lagged the equity market rebound, with yields on 10-year US Treasuries initially rising only gently. Until recently, fears about deflation, linked in part to lower oil prices, were still dampening long-term interest rates. But this changed with very strong job creation data in the US last week, which, in conjunction with hawkish comments from Janet Yellen, considerably increased the likelihood of a Fed rate rise in December.

Topics:

Christophe Donay considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Yields on DM sovereign bonds are catching up with the wider equity market rally, as fears about deflation have dissipated and a first Fed rate rise is now likely in December.

The rebound in equity markets has played out as expected since the beginning of October, after excessively negative perceptions about the global economy, notably China, abated. Data continue to confirm broadly robust global economic fundamentals, even if growth lacks momentum.

The S&P 500 has now moved back into the trading range (roughly between 2050 and 2120) that it occupied from February to August, while the Stoxx 600 has reached the lower bound of its range for the same period (around 380 to 410). Falls this week in anticipation of a Fed rate rise in December are unlikely to herald a major reversal; conversely, further gains will be limited for as long as downward revisions to earnings forecasts continue.

Bond yields catch up with the rally

Sovereign bonds lagged the equity market rebound, with yields on 10-year US Treasuries initially rising only gently. Until recently, fears about deflation, linked in part to lower oil prices, were still dampening long-term interest rates.

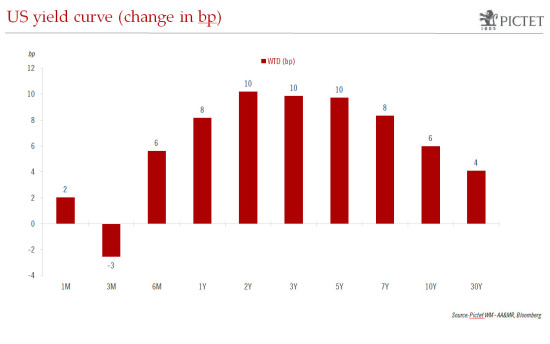

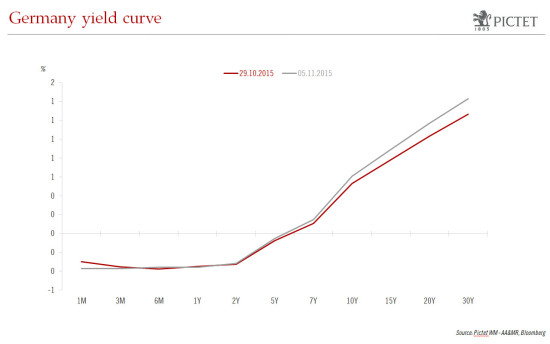

But this changed with very strong job creation data in the US last week, which, in conjunction with hawkish comments from Janet Yellen, considerably increased the likelihood of a Fed rate rise in December. US 10-year Treasury yields promptly jumped to 2.33% and German Bund yields rose to 0.70%, up from mid-October lows of 1.97% and 0.44% respectively—although these increases have pared back slightly this week.

The short end of the US sovereign yield curve also rose last week, in anticipation of the first Fed rate rise, with 6-month interest rates up by 8 basis points, 2-year by 16 bp and 5-year by 21 bp. The rise in the German yield curve was more modest, with 6-month interest rates up by 2 bp, 2-year by 2 bp and 5-year by 5 bp. The difference between the US and Europe reflects the divergence of monetary policies, with the Fed set to raise rates while the ECB still seems likely to announce a further loosening of monetary policy in December.

We continue to expect long-term interest rates in the US to rise gradually to around 2.7% by the end of 2016, since Fed tightening will be unusually drawn-out (we think that there will only be three interest rate rises between now and end-2016). 10-year Treasuries are on track for a poor year in terms of returns in 2015 (only around 2%), but will likely remain attractive to protect portfolios against shocks to equity markets, given their negative correlation with equities.

The dollar should strengthen further

Monetary policy divergence also points to a further strengthening of the dollar against the euro. The EUR/USD is now testing 1.07; a combination of Fed rate rise and ECB loosening in December could well push it below 1.05.