Today’s retail sales report was rather disappointing. Nevertheless, we continue to expect overall consumption to grow robustly in Q4 and in 2016. Nominal total retail sales increased by 0.1% m-o-m in October, below consensus expectations (+0.3%). Total sales were dented by a 0.9% m-o-m fall in nominal sales at gasoline stations and a 0.5% decline in nominal auto sales. This latter decrease came as a surprise as already published data on unit car sales (real) had shown a 0.5% rise m-o-m to a new cycle-high. Meanwhile, sales of building materials and garden equipment bounced back (+0.9% m‑o‑m), following two consecutive monthly drops. Control sales: mixed results in October As usual, it is particularly important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, October’s results were rather mixed. Control sales increased by 0.2% m-o-m, below consensus expectations for a 0.4% rise. However, September’s figure was revised up from -0.1% to +0.1%. Nevertheless, the end-result is that between Q3 and October, core retail sales grew by only a modest 2.2% annualised, following +4.7% q-o-q in Q3 (revised up from +4.2%).

Topics:

Bernard Lambert considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Today’s retail sales report was rather disappointing. Nevertheless, we continue to expect overall consumption to grow robustly in Q4 and in 2016.

Nominal total retail sales increased by 0.1% m-o-m in October, below consensus expectations (+0.3%). Total sales were dented by a 0.9% m-o-m fall in nominal sales at gasoline stations and a 0.5% decline in nominal auto sales. This latter decrease came as a surprise as already published data on unit car sales (real) had shown a 0.5% rise m-o-m to a new cycle-high. Meanwhile, sales of building materials and garden equipment bounced back (+0.9% m‑o‑m), following two consecutive monthly drops.

Control sales: mixed results in October

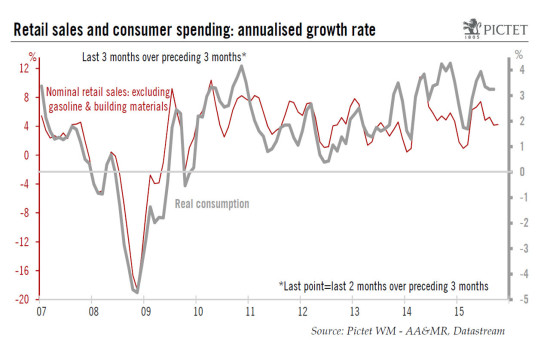

As usual, it is particularly important to look at what has happened to control (core) sales, i.e. sales excluding autos, gasoline and building-materials stores (the portion of retail sales that goes directly into consumption calculations). On that front, October’s results were rather mixed. Control sales increased by 0.2% m-o-m, below consensus expectations for a 0.4% rise. However, September’s figure was revised up from -0.1% to +0.1%. Nevertheless, the end-result is that between Q3 and October, core retail sales grew by only a modest 2.2% annualised, following +4.7% q-o-q in Q3 (revised up from +4.2%).

Today’s retail sales numbers suggest that Q3 real consumption may well be revised slightly higher from the initial estimate (+3.2% q-o-q annualised). In contrast, October’s data point to a more lacklustre growth rate in Q4. However, retail sales are measured in nominal terms: they can be very volatile on a monthly basis and they are often revised substantially. And in any case, core retail sales represent only some 25% of total consumption and they have given a poor indication of overall consumption growth over the past year and a half (see chart on first page). As a consequence, we would not take too negative a view on Q4 consumption merely on the basis of today’s mixed set of numbers.

We remain sanguine on consumption

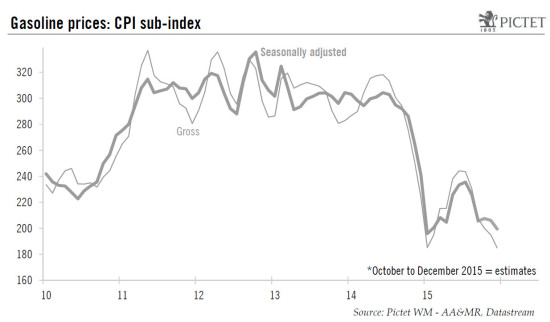

Gasoline prices have fallen heavily over the past few weeks. It is actually quite usual for them to decline at this time of the year. Nevertheless, even after seasonal adjustment, we estimate that gasoline prices should fall by around 8% q-o-q non annualised in Q4 (see chart above). If this proves right, it would imply something like a boost of 0.9 points to real disposable income q-o-q annualised in Q4. Moreover, job creation and hourly wages bounced back in October. As a result, we remain optimistic for consumption in Q4. Growth in consumer spending will likely settle just below 3.0% q-o-q annualised, following +3.2% in Q3.

Regarding next year, we also remain sanguine. Employment should continue to grow healthily and wage increases are likely to pick up gradually. Moreover, house prices are rising markedly, supporting household wealth; credit standards are being eased and consumer confidence is hovering at high levels. Therefore, we continue to expect healthy consumption growth next year. However, the boost to real income that the fall in gasoline prices has implied this year will not be repeated next year. In consequence, consumption growth should slow somewhat from the high rate recorded in 2015. On a yearly average basis, we expect consumption growth to settle at a still robust 2.8% in 2015, against 3.2% in 2015.