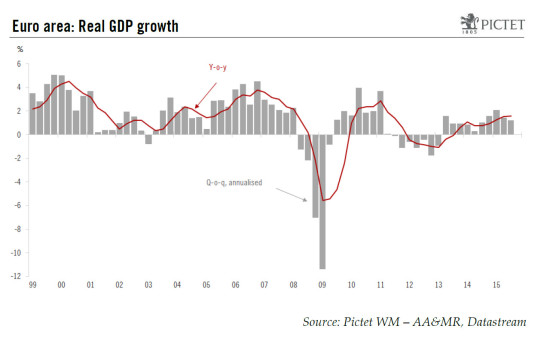

Today's preliminary GDP reports came in broadly in line with expectations and are therefore unlikely to alter the ECB’s assessment of economic activity. We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength. According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q (1.2% q-o-q annualised; 1.6% y-o-y) in Q3, below consensus expectations (0.4%), thus marking a gentle slowdown from the 0.4% q-o-q recorded in Q2 2015. Although detailed components are not made available with the preliminary GDP estimate, evidence from core countries suggests that private consumption was once again the main driver of growth in Q3. Inventories probably contributed positively as well, following a negative contribution in Q2 (-0.5pp). Lastly, foreign trade contributed negatively to GDP growth in France and Germany, although part of the drag probably came from decent import growth. We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength. While private consumption is likely to remain robust, we expect a credit-led rebound in investment to support aggregate demand in 2016. The latest business surveys (PMI indices, the European Commission survey and the IFO reading) remain consistent with robust growth in the services sector.

Topics:

Perspectives Pictet considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Today's preliminary GDP reports came in broadly in line with expectations and are therefore unlikely to alter the ECB’s assessment of economic activity. We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength.

According to Eurostat’s preliminary estimate, euro area real GDP grew by 0.3% q-o-q (1.2% q-o-q annualised; 1.6% y-o-y) in Q3, below consensus expectations (0.4%), thus marking a gentle slowdown from the 0.4% q-o-q recorded in Q2 2015. Although detailed components are not made available with the preliminary GDP estimate, evidence from core countries suggests that private consumption was once again the main driver of growth in Q3. Inventories probably contributed positively as well, following a negative contribution in Q2 (-0.5pp). Lastly, foreign trade contributed negatively to GDP growth in France and Germany, although part of the drag probably came from decent import growth.

We continue to forecast a gradual pick-up in the pace of economic expansion, largely led by domestic strength. While private consumption is likely to remain robust, we expect a credit-led rebound in investment to support aggregate demand in 2016. The latest business surveys (PMI indices, the European Commission survey and the IFO reading) remain consistent with robust growth in the services sector. Industrial hard data have been more mixed, but even there the forward-leading indicators (export orders and IFO expectations) point to a rebound towards year-end. However, weaker EM demand, which accounts for almost 50% of extra euro area exports, does entail some downside risks. As a result, we expect the euro area economy to speed up from 1.5% in 2015 to 1.8% in 2016.

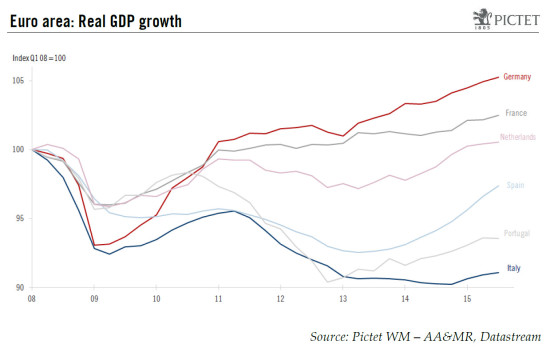

German growth fails to gather pace

German real5)GDP increased by 0.3% q-o-q in Q3, in line with consensus expectations (0.3%), but was still slightly down on the 0.4% q-o-q growth recorded in Q2. Germany’s Federal Statistics Office (Destatis) does not yet provide any figures on the breakdown of expenditure. Nevertheless, based on its press release and on monthly indicators, German Q3 GDP growth was mainly driven by strong private consumption. In contrast, net trade weighed down Q3 GDP growth as imports grew much more than exports. One negative surprise came from investment, with Destatis mentioning a slight drop over the quarter after the poor Q2 performance (-0.4% q-o-q).

Overall, despite this slight slowdown in Q3, we remain confident about the German economic outlook. Domestic demand should continue to be supported by favourable labour market and financing conditions. Moreover, further stimulus should be provided from additional public spending as a result of the influx of refugees. In contrast, weaker EM demand and the Volkswagen scandal might entail some downside risks for industrial sector performance and trade dynamics.

France gaining ground

After stagnating in Q2, French GDP growth accelerated to 0.3% q-o-q in Q3, in line with what the consensus had expected (0.3%). The detailed picture shows that private consumption accelerated (+0.3% q-o-q after 0.0%) whereas investment (+0.1% q-o-q) grew positively owing to a slight pick-up in investment by non-financial enterprises (+0.2pp to +0.7% q-o-q) and less investment contraction from households (+0.6pp to -0.5% q-o-q). This resulted in an acceleration of total domestic demand (excluding inventory stocks). Exports fell (-0.6% q-o-q from +1.9%) whereas imports gathered pace (+1.7% from +0.5%). This resulted in a negative foreign trade balance contribution.

Disappointment in the Netherlands, Italy and Portugal

The disappointment came from Italy, the Netherlands and Portugal. In the case of Italy, Q3 GDP (+0.2% q-o-q) came in weaker than expected (0.3%) although the country still recorded its third consecutive quarter of positive growth, confirming that cyclical recovery is still on its way. The Netherlands disappointed as well, with q-o-q expansion of just 0.1% in Q3 (expected +0.4%). Meanwhile, Portuguese GDP stagnated in Q3 (expected at +0.4%), marking a slowdown after an upwardly revised Q2’s GDP figure (+0.1pp to 0.5% q-o-q). Recent political uncertainty might weigh consumption and investment prospects for the quarter ahead, but systemic risk remains low.

Decent growth in Spain

In Spain, GDP (released by INE on 30 October) expanded by a still impressive 0.8% q-o-q (3.4% y-o-y) in Q3, although it marked a slight slowdown on the 1.0% q-o-q and 0.9% q-o-q posted in Q2 and Q1 respectively. Next year the Spanish economy is likely to grow faster than its peers as well, even though the slight slowdown in quarterly growth might mark a cyclical peak in the y-o-y rate. The main uncertainties remain on the political front with Catalonia, but also with general elections on 20 December.

Lastly, the Greek economy contracted less than expected. Indeed, Greek GDP decreased by 0.5% q-o-q in Q3 (expected -1.0%), after a downwardly revised Q2’s GDP growth (-0.5pp to +0.4% q-o-q).

Today's preliminary GDP reports came in broadly in line with expectations and are therefore unlikely to alter the ECB’s assessment of economic activity. If anything, evidence of domestic strength should strengthen the ECB's view that external risks, whether they stem from weaker EM growth or from a tightening in financial conditions ahead of the first Fed hike, can be offset. At the same time, euro area GDP growth is not strong enough to tip the balance of risks to the upside while the focus remains very much on price stability, with downside risks dominating, including those resulting from weak commodity prices. All in all, we remain very confident that the ECB will announce a number of new measures at its 3 December meeting, including a 6-month QE extension and a 10bp deposit rate cut (see “ECB policy meeting preview” and ECB: Q&A on negative rates).