There is still scope for sterling appreciation on the back of monetary policy divergences. However, the upside potential has been reduced given the BoE’s dovish stance. Market participants were eagerly awaiting the Bank of England’s assessment ahead of “Super Thursday”, looking for hints at the next policy move(s). Our impression is that the BoE failed to provide much clarity, postponing an actual decision to later this year or early next year. The BoE’s Monetary Policy Committee (MPC) voted by a majority of 8-1 to leave policy rates unchanged at their 5 November meeting (base rate at 0.50%), with only one hawkish member (Ian McCafferty), the same as last month. Meanwhile, the MPC voted unanimously to maintain the stock of QE purchases at £375bn, including the reinvestment policy, with no reduction expected until the bank rate reaches 2%. The all-important Quarterly Inflation Report (QIR) was dovish overall. The QIR fan chart was lowered – CPI inflation is expected to remain below 1% until H2 2016, with risks to the downside – pointing to only a slight inflation overshoot in the medium-term despite much lower market rates expectations, including a first rate hike priced in for Q1 2017, and a hawkish Fed. The 2016 GDP growth projection was revised down to around 2.5%.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

There is still scope for sterling appreciation on the back of monetary policy divergences. However, the upside potential has been reduced given the BoE’s dovish stance.

Market participants were eagerly awaiting the Bank of England’s assessment ahead of “Super Thursday”, looking for hints at the next policy move(s). Our impression is that the BoE failed to provide much clarity, postponing an actual decision to later this year or early next year.

The BoE’s Monetary Policy Committee (MPC) voted by a majority of 8-1 to leave policy rates unchanged at their 5 November meeting (base rate at 0.50%), with only one hawkish member (Ian McCafferty), the same as last month. Meanwhile, the MPC voted unanimously to maintain the stock of QE purchases at £375bn, including the reinvestment policy, with no reduction expected until the bank rate reaches 2%.

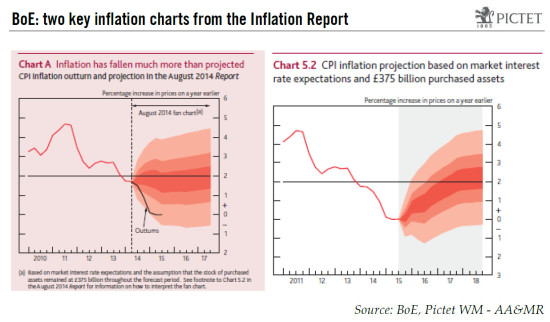

The all-important Quarterly Inflation Report (QIR) was dovish overall. The QIR fan chart was lowered – CPI inflation is expected to remain below 1% until H2 2016, with risks to the downside – pointing to only a slight inflation overshoot in the medium-term despite much lower market rates expectations, including a first rate hike priced in for Q1 2017, and a hawkish Fed. The 2016 GDP growth projection was revised down to around 2.5%. Finally, the BoE talked up external risks to EM growth as well as the disinflationary pressures stemming from the currency.

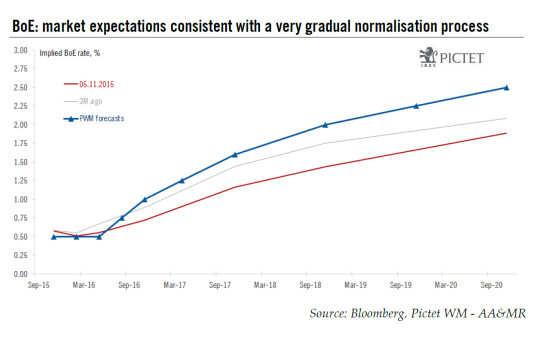

Although Governor Carney prepared the ground for a rate hike in 2016, he seemed broadly comfortable with current market pricing, showing no emergency to act. We still expect the BoE to hike rates around mid-2016, with policy rates reaching 1.0% at the end of the year.

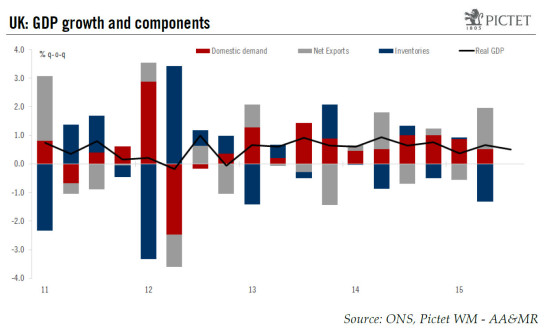

The BoE remains fairly optimistic about domestic prospects, and rightly so in our view. GDP growth was still solid, at 0.5% q-o-q in Q3, albeit down from 0.9% in Q2 and on a moderating path. Consumer confidence remains strong, real disposable income has been well supported by labour market conditions, nominal wage growth and low inflation. The outlook for investment remains quite encouraging as well. The main change in the QIR was the greater emphasis on external risks, including a sharper slowdown in EM growth.

The simple reason why the BoE is still erring on the dovish side despite domestic strength is that the Bank does not seem confident enough that inflation will reach its target over the forecast horizon, as shown in the fan charts below. The MPC projects that inflation will return to 2% “in around two years” as domestic price pressures build up and imported disinflation diminishes. However, the near-term CPI profile has been lowered with risks titled to the downside even assuming unchanged policy rates into 2017. CPI inflation, close to zero at the moment, is expected to remain below 1% until H2 2016 and to “slightly” exceed the 2% target in 2-3 years’ time. The lower path for policy rates would provide “more than adequate support to domestic demand to bring inflation to target even in the face of global weakness”, the BoE said.

This downward revision to the near-term inflation profile may indeed reflect the BoE’s broader concerns about the strength of the recovery and the extent to which it will translate into higher wages and prices. To some extent at least, it also reflects the BoE’s growing unease over currency strength – the downward impact of the latter on core inflation in particular was given a greater emphasis in this quarter’s inflation report. In short, the BoE appears to be leaning towards the ECB’s stance as regards external risks and FX developments rather than the Fed’s.

Like other central banks, the actual decision to raise rates will be data-dependent and, on balance, we still expect activity, labour, wage and price data to slightly exceed BoE expectations in the next few quarters. In the meantime, the Fed should have hiked at least once. As a result, our baseline remains for a BoE lift-off around mid-2016, most likely in August, and a cumulated 50bp in rate increases next year.

What to expect for the GBP? Down, but not out

The main factor for sterling appreciation comes from the BoE’s intent to raise interest rates. The latest monetary policy meeting signals no urgency to start hiking, which is in stark contrast to the recent stance by the Fed. Furthermore, the BoE has identified a strong domestic currency as a factor resulting in softer core inflation. Consequently, the attractiveness of sterling has taken a hit.

Still, given the current economic outlook, and using Carney’s own word, it is “reasonable” to expect rates to go up in the next 12 months. After the short-term disappointment of the rather dovish BoE stance, sterling should perform relatively well against currencies whose central banks remain highly accommodating (notably the ECB and the SNB). Indeed, with a first hike now fully priced by the market at the end of next year, there is scope for positive surprises on that front in the first half of 2016. Nevertheless, given the ongoing fiscal tightening, a very low household saving ratio and the uncertainties linked to the referendum on the EU, it is also reasonable to expect a limited appreciation of sterling.