Published: 14th June 2016Download issue:Will Knut Wicksell be proved right? The Swede’s theories include the notion that there is a ‘natural’ level of interest rates, consistent with the economy operating at its full potential without overheating. But the actions of central banks have forced interest rates to artificially low levels in recent times, well below their ‘natural’ levels. If nature should reassert its predominance again, so the theory goes, then rates could shoot up, leading to...

Read More »Bond yields under pressure

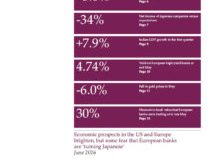

But investors should keep in mind that yields on government bonds could easily spike Global bond yields have plunged to new lows in recent days, as markets have switched to ‘risk off’ mode. This is just the latest manifestation of a trend: sovereign bond yields have been under downwards pressure for several years. Central bank QE and economic uncertainty are partly to blame. But investors should remember that sovereign bonds are not risk-free assets. And yields could easily jump over the...

Read More »The dollar still has limited potential, while yuan could be source of volatility

Just one rate hike this year will limit the greenback’s gains, but Asian currencies will be worth watching The US dollar has been in a long-term upward cycle, at least since July 2011. But the dollar stuttered in April after the release of some poor economic data, and again at the beginning of June, when poor nonfarm payrolls data was released, leading some to believe that we are at the end of this cycle. But we think this is not necessarily the case for at least two reasons. First, the...

Read More »Swiss growth fails to ignite, SNB likely to remain on hold

Macroview Although there were positive components in the Q1 GDP report, we are reducing our full-year growth forecast for Switzerland to 0.9% this year Read full report hereGrowth estimates from SECO (the Swiss economic affairs secretariat) released on June 1 suggest that real GDP in Switzerland expanded by 0.1% q-o-q (0.3% q-o-q annualised, 0.7% y-o-y) in Q1, lower than consensus expectations of 0.3% and Q4 2015 growth of 0.4%.But the GDP components were more encouraging than what the...

Read More »U.S. Treasuries tugged between fear and hope

Macroview Several factors have led us to revise downward our target 10-year U.S. Treasury rate for end 2016. Read full report hereAs we arrive close to the end of the first half of 2016, it is time to revisit our 2016 scenario for US Treasuries. Since we formulated our scenario in October 2015, giving a target 10-year US Treasury yield of 2.7% for the end of 2016, many things have changed. First, the beginning of the year saw considerable turmoil in financial markets, with negative...

Read More »Disappointing U.S. jobs report means Fed may wait before hiking rates

Macroview Weak job creation figures reinforce our scenario that the Fed will likely wait until September to act Read full report here The May US employment report released on 3 June was clearly weak. Job creation surprised heavily on the downside (with downward revisions for the previous two months), and the unemployment rate fell, but for ‘bad’ reasons (a fall in the participation rate). Moreover, the pace of wage increases year over year did not pick up further and the proxy for...

Read More »ECB on autopilot, sticks with very dovish message

Macroview There were few surprises at the ECB's Vienna meeting, apart from the modesty of staff projections for inflation. Greek banks' funding was left on hold. Read full report here The ECB left all its policy settings and its forward guidance unchanged at its 2 June Governing Council (GC) meeting in Vienna, implying low interest rates for an extended period of time. The bank’s focus remains on the implementation of new policy measures, with corporate bond purchases starting on 8 June...

Read More »U.S. consumer spending turning out to be quite strong

Macroview Latest data suggest spending growth could top 3% this quarter and remain buoyant for rest of the year Read full report here As widely expected, US consumer spending data for April were quite strong. The data, released on 31 May, showed that real personal consumption rose by a strong 0.6% month-on-month, slightly above consensus estimates (+0.5%). Data on April retail sales, car sales and output of utilities already published had been quite upbeat, suggesting a solid reading...

Read More »Inflation pressures in the U.S. are still contained

Core PCE, the Fed's favoured inflation gauge, remained stable 1.6% in April Read full report here As widely expected, core Personal Consumption Expenditure (PCE) inflation in the US came in at 1.6% in April, the same rate as in March. Overall, we continue to believe that year-on-year (y-o-y) PCE core inflation — a key price measure for the Fed — will end this year at around 1.9%, i.e. only slightly higher than the average rate registered so far this year (1.7%). The marked pick-up in...

Read More »The ECB seeks balance between caution and confidence

Macroview Signs that inflation is picking up should not prevent ECB heads from striking a dovish tone when they meet in Vienna on 2 June Read full report here The next ECB meeting on 2 June in Vienna will be all about communication. Mario Draghi will need to strike a fine balance between confidence and cautiousness. While we expect the first upward revision to ECB staff projections since Quantitative Easing (QE) started in March 2015, including a rise in its forecast for 2018 HICP...

Read More » Perspectives Pictet

Perspectives Pictet