Pictet Report Read the full analysis on page 51 of the linked reportIn the Summer 2016 issue of Pictet Report, Pictet managers and analysts set out the megatrends behind the success of premium brands and the financial pillars that make them attractive to investorsPremium brands have proved to be profitable long-term investments, offering strong revenue growth, superior operating margins and robust balance sheets over the long term. There are four fundamental megatrends behind their success...

Read More »Pictet Perspectives – Polarisation poses risks

Cesar Perez Ruiz, Chief Investment Officer at Pictet Wealth Management, explains the impact of the current polarisation in politics and markets on investment strategy.

Read More »Investing in a post-Brexit world

Published: 11th July 2016Download issue:Brexit should not lead to a repeat of the financial crisis of 2007-2008. So argue Pictet analysts and economists in the July issue of Perspectives. Central banks are better prepared and banks are less leveraged. In the last resort, the European Central Bank can be expected to step in again should financial stress noticeably increase in the weeks ahead. Longer term, an ideal post-Brexit scenario for European financial markets would be a renewed push for...

Read More »Pick-up in U.S. job creation in June masks slowdown in Q2 as a whole

Job creation, unemployment, and wage growth figures for June were a mixed bag. We maintain our expectation for one Fed rate hike this year. The US Labor Department’s employment report for June showed nonfarm payrolls rising by a strong 287,000 in June, well above consensus expectations. However, this followed a very weak number for May (11,000, revised down from 38,000). Job creation slowed noticeably in Q2 overall.Meanwhile, the unemployment rate bounced back from 4.7% in May to 4.9% in...

Read More »Brexit highlights issue of political polarisation

The UK’s vote to quit the European Union (EU) shook markets in late June and revealed a sharply divided country. And while the EU27 are likely to take a tough line with the UK to discourage other countries from going down the same road, there is clearly a risk that Brexit is followed by further fragmentation of the EU.It is important to understand how we have arrived at such a crisis. There are, of course, many reasons (political, historic, institutional). But along with opposition to...

Read More »Brexit to have limited impact on the Swiss economy in the short term

But in the medium to long term, Swiss growth will depend on the terms of the UK’s exit from the EU While it is outside the EU, Switzerland is not immune to external shocks such as Brexit. The transmission channels are multiple (direct trade exposure, financial markets, confidence effect, political agenda…). That said, while the Swiss economy is mainly an export economy, its exposure to the UK is limited. Exports of goods to the UK represent 6% of total Swiss exports, for example, and half...

Read More »There’s life in Europe after Brexit—an early assessment

The effects of the UK referendum continue to reverberate throughout the euro area. But the ECB stands ready to steady nerves, and we believe Brexit could bring some benefit to the euro area. As a result of the Brexit vote, our in-house model points to a net drag on euro area GDP of around 0.50% over the next three years through direct trade and financial linkages. This is similar to the ECB’s own forecast. In addition, we have lowered our euro area GDP forecast to 1.5% in 2016 (from 1.8%)...

Read More »Modelling suggests Brexit will cost euro area 0.5% of growth over three years

Macroview In-house simulations of growth impact match those of the ECB PWM has on-boarded the models used in the major central banks to tell us the cost of Brexit for the euro area economy. Using the same models used in major central banks gives our asset allocation policy important advantages. We have the same diagnosis of the situation as the monetary authorities and we are able to enter their mind-set. In the case of Brexit, the challenge has been how to simulate what is essentially a...

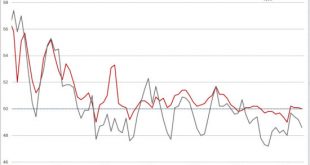

Read More »Chinese nonmanufacturing activity holds up, but manufacturing slightly down

Macroview Nonmanufacturing helped by construction, but growth may slow given stimulus pull-back China’s official and Caixan purchasing manufacturing indices (PMI) declined in June. The official figure stood at 50 (down from 50.1 in May), right at the mid-point between expansion and contraction, while the Caixin PMI fell to 48.6. At the same time, the official PMI figures show that activity at large companies, many of them state owned, was much stronger than at small and medium-sized...

Read More »The ECB and the capital key question

We see the ECB making its QE programme progressively more flexible in response to the shortage of eligible bonds Press reports suggest the European Central Bank (ECB) may be weighing up the idea of loosening its QE rules via a deviation from the capital keys which the central bank uses as a basis for balancing its sovereign bonds purchases across euro area member states.The ECB faces a problem, because a Brexit-led flight-to-safety has reduced the universe of core bonds eligible for...

Read More » Perspectives Pictet

Perspectives Pictet