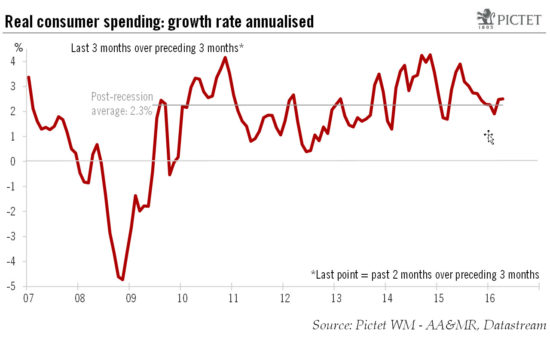

Macroview Latest data suggest spending growth could top 3% this quarter and remain buoyant for rest of the year Read full report here As widely expected, US consumer spending data for April were quite strong. The data, released on 31 May, showed that real personal consumption rose by a strong 0.6% month-on-month, slightly above consensus estimates (+0.5%). Data on April retail sales, car sales and output of utilities already published had been quite upbeat, suggesting a solid reading for overall consumer spending. Indeed, between Q1 and April, personal consumption grew by a very strong 4.5% annualised. After seasonal adjustments, gasoline prices in the US rose by 10.4% between February and April, and will likely increase by another 3% to 4% over May and June. However, even with such rises, fuel prices will still be around 5% lower than in December. And cheaper energy prices usually have a gradual, lagged positive effect on household consumption. A good part of the windfall from past declines in oil prices has still not been spent by US consumers, instead showing up in a relatively high savings rate. But this rate may well decline over the coming months. There are already signs this may be happening, with the savings rate falling sharply, to 5.4% in April from 5.9% in March. All in all, we continue to believe US personal consumption growth will likely top 3.

Topics:

Bernard Lambert considers the following as important: Macroview, US household consumption, US personal consumption growth, US savings rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Latest data suggest spending growth could top 3% this quarter and remain buoyant for rest of the year

As widely expected, US consumer spending data for April were quite strong. The data, released on 31 May, showed that real personal consumption rose by a strong 0.6% month-on-month, slightly above consensus estimates (+0.5%). Data on April retail sales, car sales and output of utilities already published had been quite upbeat, suggesting a solid reading for overall consumer spending. Indeed, between Q1 and April, personal consumption grew by a very strong 4.5% annualised.

After seasonal adjustments, gasoline prices in the US rose by 10.4% between February and April, and will likely increase by another 3% to 4% over May and June. However, even with such rises, fuel prices will still be around 5% lower than in December. And cheaper energy prices usually have a gradual, lagged positive effect on household consumption. A good part of the windfall from past declines in oil prices has still not been spent by US consumers, instead showing up in a relatively high savings rate. But this rate may well decline over the coming months. There are already signs this may be happening, with the savings rate falling sharply, to 5.4% in April from 5.9% in March.

All in all, we continue to believe US personal consumption growth will likely top 3.0% in Q2 2016 and remain solid throughout the second half of 2016 (at around 2½%).