Macroview There were few surprises at the ECB's Vienna meeting, apart from the modesty of staff projections for inflation. Greek banks' funding was left on hold. Read full report here The ECB left all its policy settings and its forward guidance unchanged at its 2 June Governing Council (GC) meeting in Vienna, implying low interest rates for an extended period of time. The bank’s focus remains on the implementation of new policy measures, with corporate bond purchases starting on 8 June and the first TLTRO II on 22 June. The only surprise came from lower-than-expected staff forecasts for inflation. While the forecast for HICP inflation was revised higher to 0.2% in 2016, the median projections for 2017 and 2018 were left unchanged at 1.3% and 1.6%, respectively, despite higher oil prices and the anticipated effects of unconventional measures. It is difficult not to see a political signal in the way the staff projections were built this time round. In our view, the staff’s relatively low inflation projections appear to result from a decision by the GC to avoid sending a hawkish signal to the markets at this stage.

Topics:

Frederik Ducrozet considers the following as important: ECB forecasts, ECB staff projections, ECB Vienna meeting, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

There were few surprises at the ECB's Vienna meeting, apart from the modesty of staff projections for inflation. Greek banks' funding was left on hold.

The ECB left all its policy settings and its forward guidance unchanged at its 2 June Governing Council (GC) meeting in Vienna, implying low interest rates for an extended period of time. The bank’s focus remains on the implementation of new policy measures, with corporate bond purchases starting on 8 June and the first TLTRO II on 22 June.

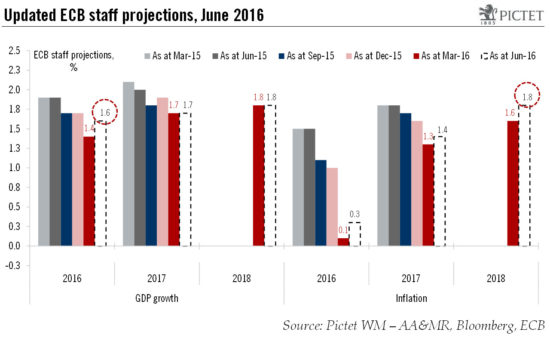

The only surprise came from lower-than-expected staff forecasts for inflation. While the forecast for HICP inflation was revised higher to 0.2% in 2016, the median projections for 2017 and 2018 were left unchanged at 1.3% and 1.6%, respectively, despite higher oil prices and the anticipated effects of unconventional measures. It is difficult not to see a political signal in the way the staff projections were built this time round. In our view, the staff’s relatively low inflation projections appear to result from a decision by the GC to avoid sending a hawkish signal to the markets at this stage.

The result is a strengthening of the ECB’s dovish bias, and we are sticking with our view that the ECB will end up extending asset purchases as part of its quantitative easing (QE) programme beyond March 2017, forcing it to adjust the parameters of the programme, starting with higher issuer limits. We also think the GC could continue to distance itself from the ECB staff assessments in its decision making. This distancing was already perceptible in the minutes from the April GC meeting, which noted that the medium-term horizon employed by ECB staff should not be consumed with the GC’s own policy horizon.

On Greece, the ECB GC made no decision, postponing the likely reinstatement of the collateral waiver on sovereign debt until its next meeting. As a result, Greek banks will not benefit immediately from a 100bp+ reduction in funding costs by shifting from costly emergency liquidity assistance (ELA) funding to 0% ECB funding. We continue to believe that Greek government bonds will be judged eligible for the ECB’s QE programme once a comprehensive analysis of Greece’s debt sustainability is undertaken in H2 2016.