Macroview Weak job creation figures reinforce our scenario that the Fed will likely wait until September to act Read full report here The May US employment report released on 3 June was clearly weak. Job creation surprised heavily on the downside (with downward revisions for the previous two months), and the unemployment rate fell, but for ‘bad’ reasons (a fall in the participation rate). Moreover, the pace of wage increases year over year did not pick up further and the proxy for household income in the form of wages and salaries was disappointing. Some slowdown in employment growth was to be expected over the course of this year, and today’s employment data are not weak enough to lead to any change in our growth forecasts. We continue to believe US GDP will grow at 2.5% annualised in Q2 and by 1.8% on average this year. Nevertheless, this is obviously not the best environment for the Fed to hike rates as early as June, or even in July. Today’s numbers clearly reinforce our scenario that the Fed will likely wait until September before acting, and that it will hike only once this year. Fed Chair Janet Yellen will give a crucial speech next Monday (6 June), just before the one-week blackout period ahead of the FOMC meeting on 14-15 June.

Topics:

Bernard Lambert considers the following as important: Macroview, US employment, US nonfarm payrolls, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Weak job creation figures reinforce our scenario that the Fed will likely wait until September to act

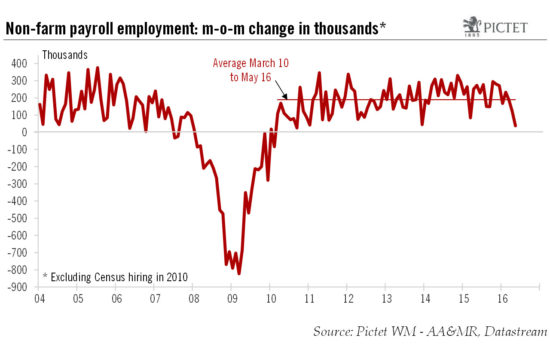

The May US employment report released on 3 June was clearly weak. Job creation surprised heavily on the downside (with downward revisions for the previous two months), and the unemployment rate fell, but for ‘bad’ reasons (a fall in the participation rate). Moreover, the pace of wage increases year over year did not pick up further and the proxy for household income in the form of wages and salaries was disappointing.

Some slowdown in employment growth was to be expected over the course of this year, and today’s employment data are not weak enough to lead to any change in our growth forecasts. We continue to believe US GDP will grow at 2.5% annualised in Q2 and by 1.8% on average this year.

Nevertheless, this is obviously not the best environment for the Fed to hike rates as early as June, or even in July. Today’s numbers clearly reinforce our scenario that the Fed will likely wait until September before acting, and that it will hike only once this year. Fed Chair Janet Yellen will give a crucial speech next Monday (6 June), just before the one-week blackout period ahead of the FOMC meeting on 14-15 June.