The domestic economy is picking up, but downbeat manufacturing and inflation data may still be factors in Fed policy decisions After a habitually disappointing first-quarter GDP figure of 0.5% (first estimate, to be revised on May 27), we expect a significant pick-up in US GDP to about 2.5% in the second quarter, not least because of strong consumer spending, which, according to our estimates, could grow by 3.0% in Q2 2016. Admittedly, consumer spending in the first quarter was...

Read More »Eurogroup deal relieves pressure on Greece

The deal should help Greek banks and bonds, but major questions on Greek debt relief were postponed and Greece’s economy remains in the doldrums Read full report here In the early hours of May 25, the Eurogroup, made up of euro area finance ministers, reached an agreement on Greece. The agreement will see the disbursement of the second tranche of loans (EUR 10.3bn) as part of Greece’s third bailout programme. In addition, a road map was drawn up that opens the way to debt relief after...

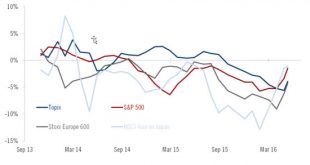

Read More »Does Q1 mark start of upward earnings revisions?

In 2016, we could see upward revisions in earnings expectations as the year progresses. But while earnings may be improving, we believe equity markets hold limited upside potential Read full report here The first quarter results season is almost over, and has been marked by positive surprises from Europe and, less so, the US, while Japanese earnings appear to have suffered from the strength of the yen. US and European net earnings came out 1.4% and 11.2% ahead of expectations, respectively,...

Read More »Purchasing Manager Indices signal modest downside risks to near-term euro growth

Flash estimates for euro area composite PMI eased slightly in May, pointing to a slowdown in economic growth after a strong first quarter Read full report here Following a strong performance in Q1, when real GDP expanded by 0.5% q-o-q (2.1% in annualised terms), the euro area economy was expected to slow down a gear to more sustainable levels of growth. The flash purchasing manager indices (PMI) released on May 23 may signal just that, although mixed news at the national level—with...

Read More »Accommodative European policy mix helps offset political upheaval

Against the backdrop of a charged political climate, greater flexibility on debt and deficit rules plus ECB largesse are helping national economies We are entering a period of heightened political risk across many countries in Europe, marked by the progress of populism, as seen in the surge of support for non-mainstream parties. Not only do we have the Brexit referendum on June 23, but three days later there will be a re-run of the Spanish general election. We still expect strong Spanish...

Read More »Surprisingly hawkish FOMC minutes unsettles observers

Macroview Although the probability of a June/July rate hike by the Fed has increased, the minutes also highlighted downside risks still facing the US economy Read full report here The minutes of the April Federal Open Market Committee meeting published on 18 May surprised by their hawkish tone. The key phrase that unsettled observers was that should conditions continue to improve, “it likely would be appropriate for the Committee to increase the target range for the federal funds rate...

Read More »How much would Brexit cost the world economy?

On 23 June, the British will decide whether to stay in the European Union or not. Using econometric models, we can attempt to measure the impact a vote to leave the EU would have on global and European growth, as well as on equities and bonds Read full report here The relatively small size of the UK economy (2.4% of world GDP) means the global impact of Brexit would be almost negligible in strictly economic terms, according to global-VAR models of the kind used by central banks to assess...

Read More »Core U.S. retail sales surge

Macroview Strong April figures and revisions to March and February numbers mean sonsumer spending is on course to rise around 3% in second quarter Full report April US retail sales The US retail sales report for April was very encouraging, with core retail sales increasing strongly month on month (m-o-m) in April, while the figures for February and March figures were revised upward. Consumer spending growth should approach a strong rate of 3.0% q-o-q annualised in Q2. According to the...

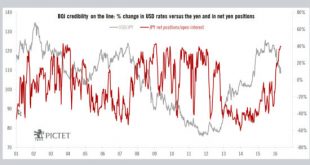

Read More »Central banks face test of credibility

Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been...

Read More »Pictet Perspectives – Central banks risk loss of credibility

A loss of confidence by markets in the effectiveness of monetary policies is the biggest risk investors face at present. Cesar Perez Ruis, Chief Investment officer at Pictet Wealth Management, discusses the issue and explains what we expect from central banks. http://perspectives.pictet.com/

Read More » Perspectives Pictet

Perspectives Pictet