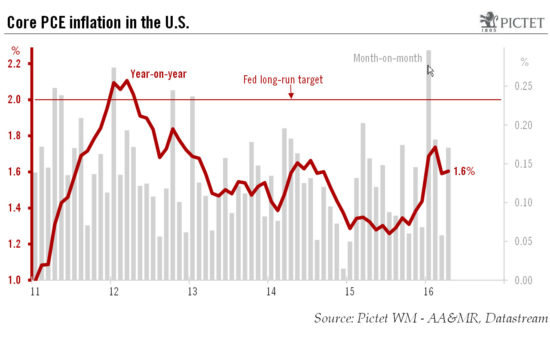

Core PCE, the Fed's favoured inflation gauge, remained stable 1.6% in April Read full report here As widely expected, core Personal Consumption Expenditure (PCE) inflation in the US came in at 1.6% in April, the same rate as in March. Overall, we continue to believe that year-on-year (y-o-y) PCE core inflation — a key price measure for the Fed — will end this year at around 1.9%, i.e. only slightly higher than the average rate registered so far this year (1.7%). The marked pick-up in y-o-y core PCE inflation between October 2015 (1.3%) and February 2016 (1.7%) was thus followed by stabilisation in March and April, supporting our scenario that it will not pick up much further until the end of the year. The global economic backdrop is not conducive to more US inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present, limiting pricing power in the US. Moreover, as Fed chairwoman Janet Yellen has repeated on many occasions, domestic inflation expectations play an important role in the inflation process. And on that front, recent developments appear quite disturbing. Although they have bounced back a little over the past three months or so, market inflation expectations remain extremely low by historical standards. Survey-based inflation expectations have also declined noticeably over the past couple of years.

Topics:

Bernard Lambert considers the following as important: Macroview, US core inflation, US inflation, US PCE inflation, US wage inflation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Core PCE, the Fed's favoured inflation gauge, remained stable 1.6% in April

As widely expected, core Personal Consumption Expenditure (PCE) inflation in the US came in at 1.6% in April, the same rate as in March. Overall, we continue to believe that year-on-year (y-o-y) PCE core inflation — a key price measure for the Fed — will end this year at around 1.9%, i.e. only slightly higher than the average rate registered so far this year (1.7%).

The marked pick-up in y-o-y core PCE inflation between October 2015 (1.3%) and February 2016 (1.7%) was thus followed by stabilisation in March and April, supporting our scenario that it will not pick up much further until the end of the year.

The global economic backdrop is not conducive to more US inflation – quite the opposite in fact. Inflation remains pretty low worldwide, and deflationary forces are still present, limiting pricing power in the US. Moreover, as Fed chairwoman Janet Yellen has repeated on many occasions, domestic inflation expectations play an important role in the inflation process. And on that front, recent developments appear quite disturbing. Although they have bounced back a little over the past three months or so, market inflation expectations remain extremely low by historical standards. Survey-based inflation expectations have also declined noticeably over the past couple of years. More specifically, the long-term (5 to 10 years) inflation expectations contained in the Michigan consumer sentiment survey fell back to a record low of 2.5% in May. All this suggests that higher inflation is not around the corner.

Although wages seem to have picked up somewhat over the past few months, most measures of wages continue to show only very modest growth. At some stage, the fall in unemployment should feed through and push up wage inflation. We continue to expect wage increases to pick up gradually over the coming months. However, we think their influence on overall core inflation should remain pretty muted, at least this year.

In conclusion, we do not see any reason to modify our scenario on PCE inflation. We continue to believe that y-o-y PCE core inflation will end this year at around 1.9% , i.e. only slightly higher than the average rate registered so far this year (1.7%).