The Swiss economy has proved more resilient than expected to the sudden appreciation of the Swiss franc in January 2015, but negative deposit rates could remain in place through 2017.On 15 January 2015, the Swiss National Bank (SNB) decided to discontinue the minimum exchange rate of CHF1.20 per euro introduced in September 2011. The SNB’s announcement came as a shock for the Swiss economy, and resulted in a sharp appreciation of the Swiss franc. But two years later, the Swiss economy has proven to be more resilient than expected: recession has been avoided and inflation is gradually rising. In summary:Swiss real GDP grew by 0.8% in 2015, may have grown by 1.5% in 2016, and could grow by 1.4% in 2017. Domestic demand has been robust. Exports of goods have performed better than expected, mainly due to the chemical and pharmaceutical industries.The unemployment rate has remained pretty steady, rising from just 3.1% to 3.3%.The franc has strengthened against the euro by 12%, but has remained pretty stable against the US dollar.Swiss headline inflation has remained in negative territory, mainly due to the drop in commodity prices and the sharp appreciation of the franc. But headline inflation is expected to turn positive in 2017 for the first time in five years, averaging 0.4%.

Topics:

Nadia Gharbi considers the following as important: Frankenshock, Macroview, Swiss economy, Swiss franc appreciation, Swiss National Bank

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

The Swiss economy has proved more resilient than expected to the sudden appreciation of the Swiss franc in January 2015, but negative deposit rates could remain in place through 2017.

On 15 January 2015, the Swiss National Bank (SNB) decided to discontinue the minimum exchange rate of CHF1.20 per euro introduced in September 2011. The SNB’s announcement came as a shock for the Swiss economy, and resulted in a sharp appreciation of the Swiss franc. But two years later, the Swiss economy has proven to be more resilient than expected: recession has been avoided and inflation is gradually rising. In summary:

- Swiss real GDP grew by 0.8% in 2015, may have grown by 1.5% in 2016, and could grow by 1.4% in 2017. Domestic demand has been robust. Exports of goods have performed better than expected, mainly due to the chemical and pharmaceutical industries.

- The unemployment rate has remained pretty steady, rising from just 3.1% to 3.3%.

- The franc has strengthened against the euro by 12%, but has remained pretty stable against the US dollar.

- Swiss headline inflation has remained in negative territory, mainly due to the drop in commodity prices and the sharp appreciation of the franc. But headline inflation is expected to turn positive in 2017 for the first time in five years, averaging 0.4%.

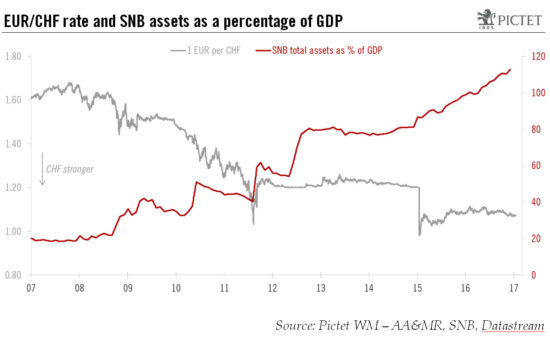

Since January 2015, the SNB has maintained its two-pillar strategy of negative interest rates and repeated FX interventions. The interest rate on sight deposits has remained fixed at -0.75%, while the central bank’s total assets have increased by CHF176 bn. SNB’s total assets now represent 113% of GDP (see chart).

A recent addition to the SNB’s monetary policy statement suggests that the central bank is transitioning away from tight control of the Swiss franc against the euro in favour of paying greater attention to the stability of the franc against a basket of currencies.

Our baseline scenario for 2017 is that FX interventions will remain the SNB’s policy tool of choice. The interest rate paid on sight deposits with the SNB is likely to remain unchanged at -0.75% until the end of the ECB’s quantitative easing programme, or at least until upward pressure on the Swiss franc starts to fade. We currently believe the SNB will keep its policy rate unchanged in 2017.