The US jobs market ends 2016 in good shape and wage growth reaches a new cyclical high.Non-farm payroll employment in the US rose by 156,000 month on month in December, slightly below consensus expectations of 175,000, while payroll growth figures for the previous two months were raised by 19,000. The unemployment rate rebounded slightly to 4.7% in December, only partly reversing the sharp decline of the previous month. The broader U6 unemployment rate fell to a new low of 9.2%.Looking beyond volatile monthly figures, the latest payroll gains continue to reflect healthy labour market conditions overall. We have long expected a slowdown in job creation in an economy that is likely close to full employment, but still lacks stronger corporate earnings and productivity growth. Even if GDP growth were to surprise to the upside in 2017, it is unlikely that employment gains will accelerate meaningfully from here.One key highlight of the December jobs report was the rebound in wage growth, to a new cyclical year-on-year high of 2.9% in December (+0.4% m-o-m). Although most wage indicators remained subdued in 2016, there has lately been growing evidence of a slightly stronger pick-up in the pace of wage increases. Meanwhile, aggregate weekly payrolls rose by 5.1% q-o-q annualised in Q4, up from 4.2% in Q3 and 3.2% in Q2, further supporting household income.

Topics:

Frederik Ducrozet considers the following as important: Macroview, nonfarm payrolls, US employment, US unemployment rate, US wage growth

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The US jobs market ends 2016 in good shape and wage growth reaches a new cyclical high.

Non-farm payroll employment in the US rose by 156,000 month on month in December, slightly below consensus expectations of 175,000, while payroll growth figures for the previous two months were raised by 19,000. The unemployment rate rebounded slightly to 4.7% in December, only partly reversing the sharp decline of the previous month. The broader U6 unemployment rate fell to a new low of 9.2%.

Looking beyond volatile monthly figures, the latest payroll gains continue to reflect healthy labour market conditions overall. We have long expected a slowdown in job creation in an economy that is likely close to full employment, but still lacks stronger corporate earnings and productivity growth. Even if GDP growth were to surprise to the upside in 2017, it is unlikely that employment gains will accelerate meaningfully from here.

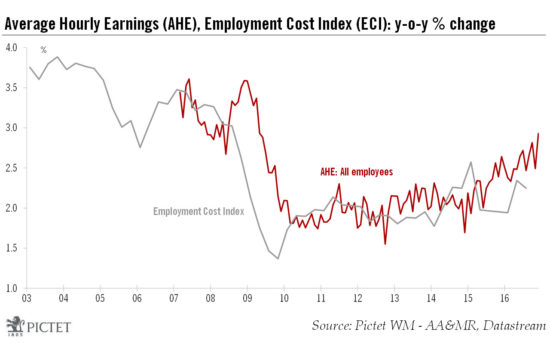

One key highlight of the December jobs report was the rebound in wage growth, to a new cyclical year-on-year high of 2.9% in December (+0.4% m-o-m). Although most wage indicators remained subdued in 2016, there has lately been growing evidence of a slightly stronger pick-up in the pace of wage increases. Meanwhile, aggregate weekly payrolls rose by 5.1% q-o-q annualised in Q4, up from 4.2% in Q3 and 3.2% in Q2, further supporting household income.

Total US employment grew by 1.45% annualised in the fourth quarter, down from +1.75% in the previous one. We do not see this slowdown in the pace of job creation as a sign of broader weakness in the economy, but rather as another sign that the economy is nearing full employment. If anything, a growing number of people will have to enter the labour force in the future if employment gains are to be sustained close to recent levels.

The latest jobs report does not challenge our near-term forecasts. We continue to expect US GDP growth to accelerate to 2.0% in 2017 (with upside risks) and the Fed to hike rates twice this year.