The ECB decided to extend its QE programme beyond March 2017 at a slower pace of EUR60 bn, until December 2017, or beyondThe ECB made the following announcements at its 8 December meeting:• QE extension: asset purchases will be continued for an extra nine months, at a pace of EUR60 bn month from April to December 2017 (or beyond, if necessary), with an option to increase the size and/or duration of purchases if “the outlook becomes less favourable or if financial conditions become...

Read More »From deflation to reflation, from bonds to equities

Published: 8th December 2016Download issue:Although Pictet Wealth Management does not expect a significant acceleration in real global economic growth next year, it believes 2017 will see an upturn in price pressures that spark a rise in nominal GDP growth and provides momentum for global reflation.In December’s Perspectives, Pictet Wealth Management’s head asset of asset allocation and macro research, Christophe Donay, discusses the implications of this, his central scenario, for the global...

Read More »Signs of life in Japanese inflation

Despite the lack of wage growth, yen weakening and higher commodity prices mean inflation in Japan may start to move higher.The labour survey for October shows that wage growth remains sluggish in Japan, despite increasing signs of tightness in the labour market. Nonetheless, inflation in Japan may start to move higher on account of external factors such as the exchange rate and commodity prices.Japanese workers’ cash earnings rose by just 0.1% year-over-year in October. Earnings have been...

Read More »Global sentiment indicator supports growth scenario

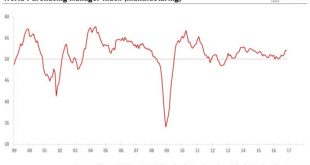

Aggregate purchasing manager indices are pointing to upticks in growth and inflation in developed markets in line with our central scenario, but emerging markets are lagging.Global sentiment improved slightly in November, to 52.1 from 52.0 in October, according to Markit’s global Purchasing Manager Index (PMI). This is the third monthly improvement in a row. One has to look back to August 2014 to find a higher level.Advanced economies are among the more upbeat. Business sentiment in November...

Read More »What next for Italy after referendum?

Rejection of the government-backed constitutional referendum opens up a period of uncertainty for the Italian economy and financial system, but ECB’s continued dovishness will provide support.The Italian referendum on Senate reform was rejected on 4 December by a surprisingly wide margin (59% versus 41%) on high voter turnout. In the short run, the main risk is that rejection of the government-backed referendum will render a market-based recapitalisation of the Italian banking sector more...

Read More »Healthy U.S. jobs report points to early rate hike

The unemployment rate fell to a fresh cyclical low in November, and while wage growth disappointed, we expect it to pick up progressively next year.US non-farm payroll employment rose by a healthy 178,000 month-on-month (m-o-m) in November, in line with consensus expectations. Unexpectedly, the US unemployment rate fell further in November, to 4.6% from 4.9% in October, reaching its lowest level in more than nine years. At 4.6%, the US unemployment rate is now below the median rate of 4.8%...

Read More »Search for policy flexibility poses dilemma for ECB

Our base forecast is that the ECB will extend QE by six months, but will modify forward guidance.The European Central Bank (ECB) faces a communication dilemma ahead of its 8 December meeting. Amid growing evidence of a more robust recovery and improved policy transmission, there is a case for a reduction in the pace of asset purchases at some point in 2017. However, signalling an eventual tapering of asset purchases now would almost certainly trigger an unwarranted tightening of monetary...

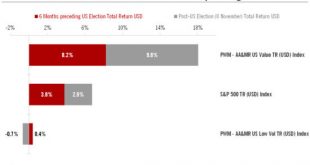

Read More »Arbitraging between equity investment strategies

The market leadership of US ’Value' has strengthened considerably in the aftermath of the US elections.The US Value equity strategy’s outperformance has accelerated since the US elections on November 8. Over the 15 trading days following the elections, our Value index returned 9.8% (in US dollars), compared with 8.2% during the preceding six months.Current economic and equity market dynamics reveal an opportunity to arbitrage between two distinct equity investment strategies: US ‘Low Vol’...

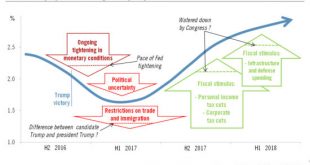

Read More »U.S. growth to slow in H1 2017 before rising again in H2

The tightening of monetary conditions is impeding near-term prospects for the US. But a probable fiscal stimulus will help revive growth again in the latter part of 2017.US GDP growth was revised up from 2.9% to 3.2% for the third quarter. The main reason was a higher estimate of growth in consumer spending. Turning to Q4, economic data published so far have been mixed. Data on consumption in October were a bit disappointing. And advance estimates for the trade deficit and inventories showed...

Read More »The Family Consilium 2016

Published: 30th November 2016Download issue:This Chronicle presents the highlights from The Family Consilium held in Gstaad in June 2016. Topics covered include: emerging disruptions in geopolitics, disruptive forces in technology, how investors might respond to the changing financial environment, and strategies to manage the challenges of passing wealth from one generation to the next. Other highlights are Elif Shafak, Turkey’s most-read female author, on the growing political opposition to...

Read More » Perspectives Pictet

Perspectives Pictet