With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international governance, territorial dominance and supplies of raw materials.Along with competition between China and the US we see a number of other key geopolitical flashpoints: tensions between Russia and the West; the Middle East; India-Pakistan tensions; North Korea; Africa; terrorism; immigration and the rise of populism in the US and Europe. Overshadowing all of this is uncertainty over US foreign policy after Donald Trump’s election as US president.Geopolitics is often given insufficient attention by investors, mainly because it is a non-quantifiable risk: distinguishing geopolitical ‘noise’ from events that will seriously impact markets is difficult, and over time markets have shown considerable resilience to geopolitical events. But geopolitics can still trigger major shocks.This is why geopolitics is progressively gaining importance for investors, bringing both risks and opportunities.

Topics:

Christophe Donay considers the following as important: geopolitical instability, geopolitical shocks, Geopolitics, geopolitics and investment, Macroview

This could be interesting, too:

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Marc Chandler writes US CPI, New Security Initiatives with Tokyo and Manila, Bank of Canada Meeting

Claudio Grass writes 2024 outlook: Gold Shines Bright in the Gathering Storm

Claudio Grass writes 2024 outlook: Gold Shines Bright in the Gathering Storm

With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.

We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international governance, territorial dominance and supplies of raw materials.

Along with competition between China and the US we see a number of other key geopolitical flashpoints: tensions between Russia and the West; the Middle East; India-Pakistan tensions; North Korea; Africa; terrorism; immigration and the rise of populism in the US and Europe. Overshadowing all of this is uncertainty over US foreign policy after Donald Trump’s election as US president.

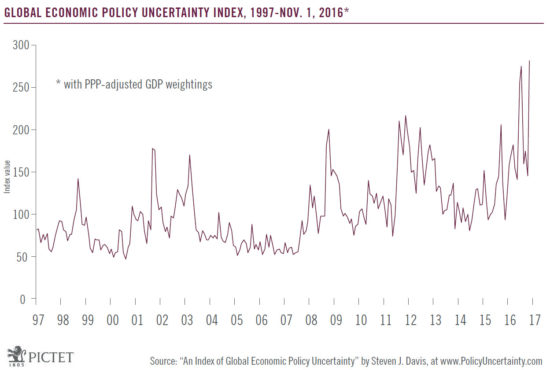

Geopolitics is often given insufficient attention by investors, mainly because it is a non-quantifiable risk: distinguishing geopolitical ‘noise’ from events that will seriously impact markets is difficult, and over time markets have shown considerable resilience to geopolitical events. But geopolitics can still trigger major shocks.

This is why geopolitics is progressively gaining importance for investors, bringing both risks and opportunities. Moreover, the increased interconnectedness of the world economy has contributed to increased correlation between asset classes, and events abroad can affect even purely domestic investment strategies. It therefore makes sense to hedge against certain geopolitical risks — we at Pictet Wealth Management used equity put options in 2016 to this end, for example. We will also continue to exploit volatility prompted by geopolitical shocks for tactical trading to boost returns in the current low-return environment.

Ultimately, risk analysis is best handled through a well-diversified, long-term asset allocation that fits an investor’s particular parameters and objectives. However, it makes sense to hedge against certain geopolitical risks.