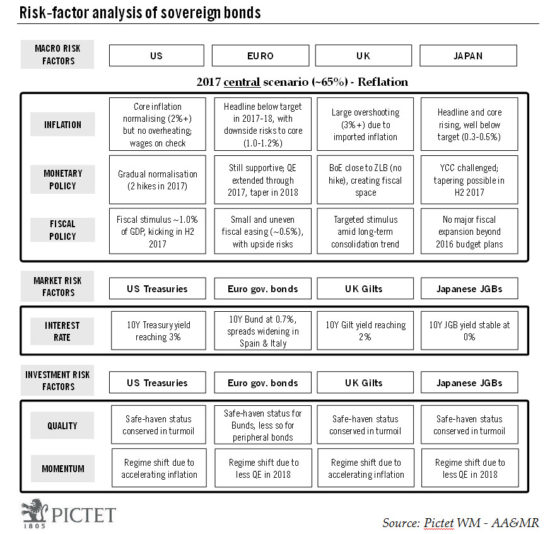

Total returns from government bonds could come under pressure in 2017.Our central scenario for developed markets sovereign bond yields in 2017 is based on our in-house risk-factor analysis, which is leading us to conclude that there is a 65% probability that 2017 will be a year of reflation (see table).Underpinning the economic environment will be the following three macroeconomic factors:Inflation, which should accelerate in the US, the euro area, the UK and Japan.Monetary policy, which should become less accommodative, with the US Federal Reserve hiking Fed funds rates twice, the Bank of England stopping its quantitative easing (QE) , and both the ECB and the Bank of Japan (BoJ) announcing a tapering of their own QE programmes for 2018.Fiscal policy, which may be loosened, especially in the US if Donald Trump goes through with his fiscal plans.In such a reflationary environment, interest rates become a market risk factor of some importance, with 10-year sovereign bonds yields likely to rise globally, except in Japan where the BoJ is committed to hold the Japanese 10-year government bond (JGB) yield at 0%. We forecast that at the end of 2017 the 10-year US Treasury yield will reach 3%, the German Bund 0.7%, the UK gilt 2% and the Japanese JGB 0%.Due to the expected rise in sovereign bond yields, total returns from benchmark government bonds may be negative in 2017.

Topics:

Laureline Chatelain considers the following as important: bond bull market, government bond market, government bond yields, Macroview, sovereign bonds

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Total returns from government bonds could come under pressure in 2017.

Our central scenario for developed markets sovereign bond yields in 2017 is based on our in-house risk-factor analysis, which is leading us to conclude that there is a 65% probability that 2017 will be a year of reflation (see table).

Underpinning the economic environment will be the following three macroeconomic factors:

- Inflation, which should accelerate in the US, the euro area, the UK and Japan.

- Monetary policy, which should become less accommodative, with the US Federal Reserve hiking Fed funds rates twice, the Bank of England stopping its quantitative easing (QE) , and both the ECB and the Bank of Japan (BoJ) announcing a tapering of their own QE programmes for 2018.

- Fiscal policy, which may be loosened, especially in the US if Donald Trump goes through with his fiscal plans.

In such a reflationary environment, interest rates become a market risk factor of some importance, with 10-year sovereign bonds yields likely to rise globally, except in Japan where the BoJ is committed to hold the Japanese 10-year government bond (JGB) yield at 0%. We forecast that at the end of 2017 the 10-year US Treasury yield will reach 3%, the German Bund 0.7%, the UK gilt 2% and the Japanese JGB 0%.

Due to the expected rise in sovereign bond yields, total returns from benchmark government bonds may be negative in 2017. We do not expect the safe-haven status of benchmark bonds to come under threat, with positive total returns in case of market turmoil. But the insurance protection offered by sovereign bonds in portfolios could become costly, which has rarely been the case over the past 35 years, characterised by a bull market in developed-market government bonds. Moreover, a significant upward move in government bond yields could represent the start of a reversal of this 35-year bull market, meaning that the momentum could change and that yields could rise to be closer in line with ‘fundamentals’, (historically considered to be near the issuing-country’s nominal GDP growth).