Swiss Franc The euro has depreciated by 0.13 to 1.1043 CHF. EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is very much unloved. The apparent stabilization of the political situation in Europe and sustained pace of above trend growth contrasts with the US where the political situation leaves much to be desired and the economy is...

Read More »Swiss government to take aim at high Swiss prices

© Robert Kneschke | Dreamstime 20 Minuten. Switzerland’s Federal Council wants to introduce new measures to lower prices in Switzerland to curb cross-border shopping, something that it says hurts Swiss businesses. Minister for Economic Affairs, Johann Schneider-Ammann, said in an interview with the newspaper Schweiz am Wochenende that he’s working on a package of measures to tackle high retail prices in Switzerland. He...

Read More »Court sentence in multimillion fraud scheme

Swiss authorities have been targeting money laundering (Keystone) A massive money laundering case unfolded on Tuesday in a Swiss cantonal court where an Englishman, his wife and a financial adviser were found guilty in an elaborate multimillion-franc scheme. The district courtexternal link in the canton of Vaud sentenced the unidentified Englishman to a year in prison on charges of laundering nearly CHF7 million ($7.34...

Read More »Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008 BOE, Prudential Regulation Authority (PRA) concerns re financial system Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules EU & UK corporate bond markets may be bigger source of instability than ’08 Credit card debt and car loan surge could cause another financial crisis PRA warn banks returning to similar practices to...

Read More »Russell 2000: The Dangerous Season Begins Now

Old Truism Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail. The result: in just two out of eleven international stock...

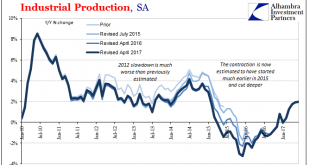

Read More »U.S. Industrial Production: Industrial Drag

Completing a busy day of US economic data, Industrial Production was, like retail sales and inflation data, highly disappointing. Prior months were revised slightly lower, leaving IP year-over-year up just 2% in June 2017 (estimates for May were initially 2.2%). Revisions included, the annual growth rate has been stuck around 2% now for three months in a row, suggesting like those other accounts a pause or even...

Read More »FX Daily, July 20: ECB Game Day

Swiss Franc The euro has appreciated by 0.47% to 1.1051 CHF. EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs,...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Switzerland Hosts Meeting on Tax Transparency

An international meeting on transparency and exchange of tax data is underway in the Swiss city of Geneva. The five-day gathering of the Global Forum peer review group is to examine the implementation of so-called group requests and the issue of the identification of beneficial owners, according to the State Secretariat for International Financial Matters. “This meeting confirms that Switzerland supports the...

Read More »Oil Update

Summary: OPEC meets on July 24. Nigeria and Libya may be pressured to cap output although they were exempt from quotas. US exports and refining appear to be the driving force behind the 13.8 mln barrel decline in inventories. Mexico has reportedly made two large oil finds. It may not be on your economic calendar, but on July 24 OPEC meets in St. Petersburg, and there is a reasonably good chance that efforts to...

Read More » SNB & CHF

SNB & CHF