Taper Is Coming: Got Bonds? The solid economic recovery and easing of COVID restrictions lead us to believe a tapering of QE may not be far off. Further supporting our opinion, inflation has fully recovered to pre-pandemic levels, and employment is improving rapidly. On top of that are whispers from within the Fed questioning financial stability given extreme asset valuations driven to some degree by excessive QE. Most importantly, various Fed members are starting to talk the taper talk. The eventual tapering of QE will foster a change in investor behaviors. This article focuses on bond yields and a few interest-rate-sensitive equity sectors to provide forward guidance on how fixed income and interest-rate-sensitive assets may perform in a tapering environment.

Topics:

Michael Lebowitz considers the following as important: 9) Personal Investment, 9a.) Real Investment Advice, Featured, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Taper Is Coming: Got Bonds?

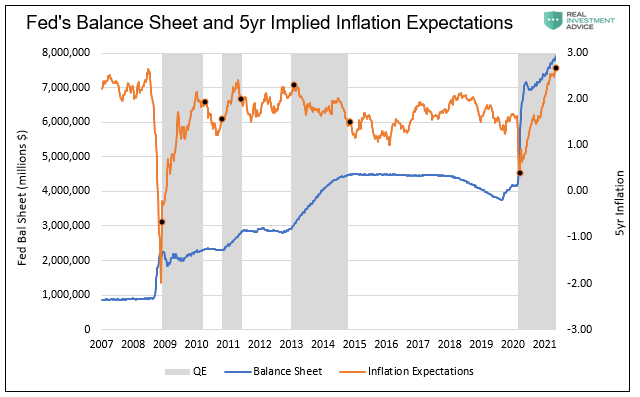

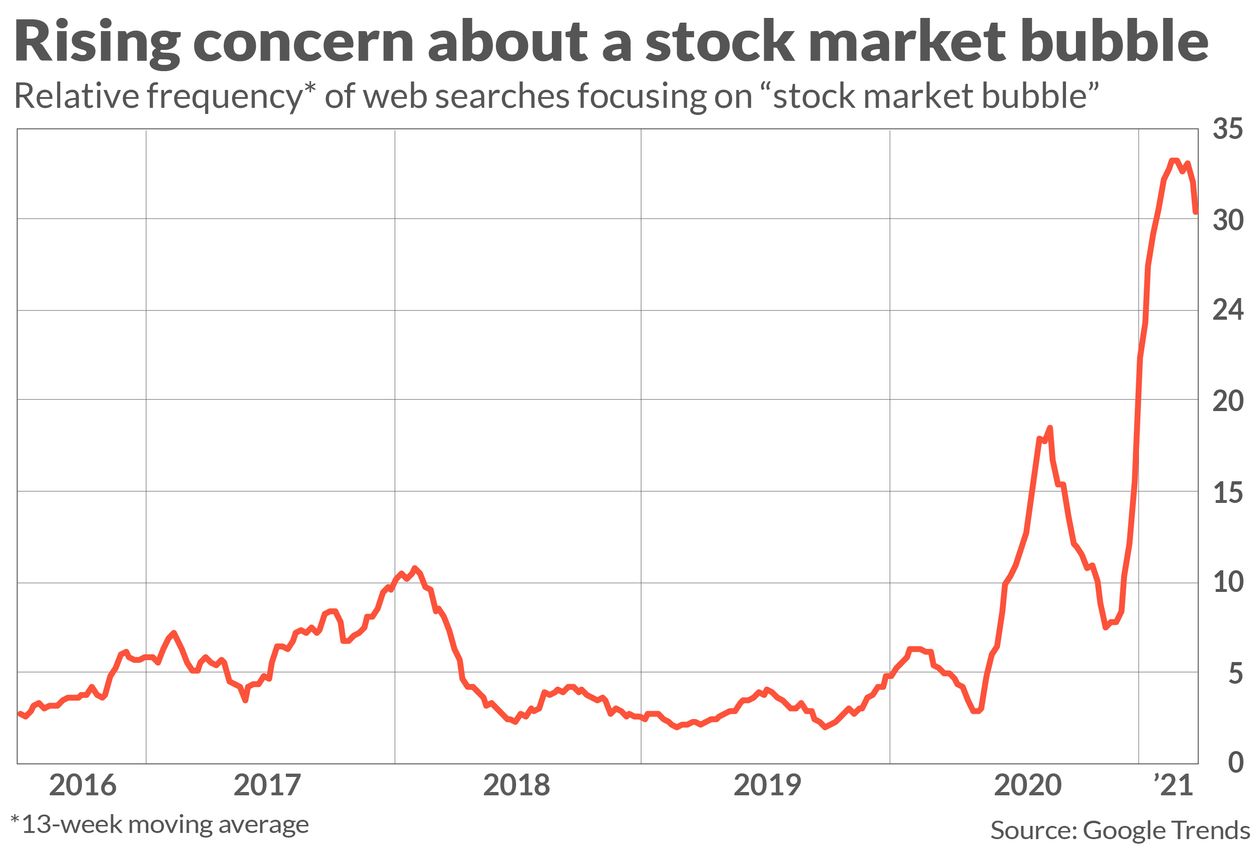

The solid economic recovery and easing of COVID restrictions lead us to believe a tapering of QE may not be far off. Further supporting our opinion, inflation has fully recovered to pre-pandemic levels, and employment is improving rapidly. On top of that are whispers from within the Fed questioning financial stability given extreme asset valuations driven to some degree by excessive QE.

Most importantly, various Fed members are starting to talk the taper talk.

The eventual tapering of QE will foster a change in investor behaviors. This article focuses on bond yields and a few interest-rate-sensitive equity sectors to provide forward guidance on how fixed income and interest-rate-sensitive assets may perform in a tapering environment.

Talking Taper

Jerome Powell repeatedly affirms the Fed “isn’t even thinking about thinking about tapering.” Of course, as Chairman of the Fed, his opinions take precedence over those from other Fed members.

Regardless, other Fed members are not entirely on the same page as Powell.

The following comments and headlines came out over the last month.

- BULLARD: U.S. MAY BE “GETTING CLOSE” TO THE POINT WHERE PANDEMIC IS OVER, THEN ATTENTION COULD TURN TO POST-PANDEMIC MONETARY POLICY

- Lael Brainard: “Vulnerabilities associated with elevated risk appetite are rising.” The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a repricing event.”

- Robert Kaplan: “The Fed should start talking about tapering bond-buying soon.” & “I am beginning to feel differently regarding the advantages and drawbacks of the Fed’s QE purchases.”

- Eric Rosengren: “the mortgage market probably doesn’t need as much support now.“

- “It may be that interest rates will have to rise somewhat to make sure our economy doesn’t overheat,” Yellen said in an interview with the Atlantic recorded Monday that was broadcast on the web on Tuesday. “It could cause some very modest increases in interest rates.” – Treasury Secretary Janet Yellen, per Bloomberg.

Other Taper Worthy Factors

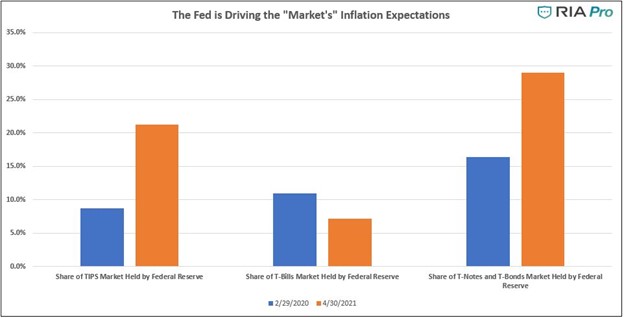

Beyond hints from Fed members and robust economic data, banks and the money markets are encountering QE-related problems.

First, banks are struggling to digest the reserves they receive when the Fed purchases assets from them. As a result, their ongoing ability to facilitate additional amounts of QE is increasingly becoming problematic.

Zoltan Pozsar, credit analyst and Fed expert at Credit Suisse, summed the situation as follows:

“(The) use of the (reverse repurchase program RRP) facility has never been this high outside of quarter-end turns, and the fact that the use of the facility is this high on a sunny day mid-quarter means that banks don’t have the balance sheet to warehouse any more reserves at current spread levels.“

The second problem facing the Fed is the recent reduction of Treasury balances held at the Fed. As a result, the Treasury is issuing fewer short-term bonds, resulting in a scarcity of money market securities and collateral supporting derivatives. Consequently, short-term interest rates are starting to go negative.

The two problems make it progressively more challenging to maintain the pace of QE and keep rates from going negative.

Summary

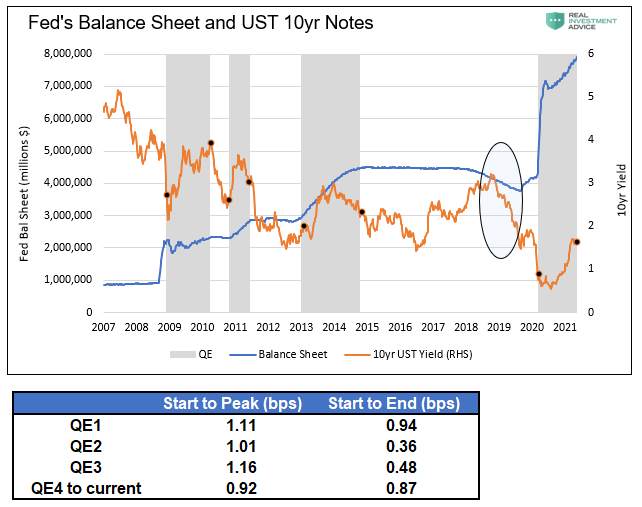

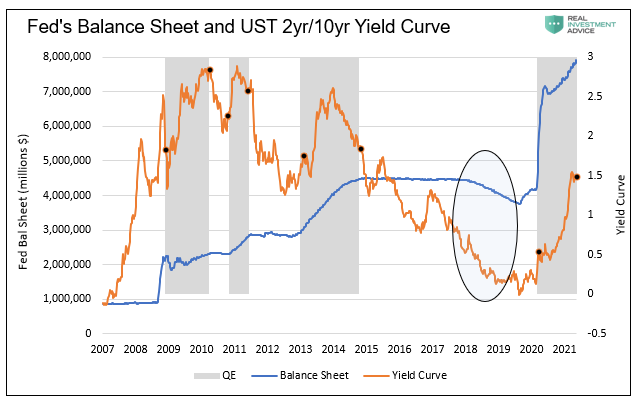

We know it may sound crazy to stock investors when we say “fade the Fed.” The stock market has taught equity investors to buy when the Fed is buying and be careful when they are not. What stock investors may not know is the poor performance of bonds during QE and their strong performance afterward.

Bond investors should sell when the Fed is buying and buy when they are selling.

The Fed is potentially on the precipice of tapering their asset purchases. How they might accomplish that and when are big unknowns. However, it is coming, and there is a good amount of money to be made or not lost when the market senses the Fed is ready to change its tune.

The post Taper Is Coming: Got Bonds? appeared first on RIA.

Tags: Featured,Investing,newsletter