Swiss Franc The euro has depreciated by 0.13 to 1.1043 CHF. EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is very much unloved. The apparent stabilization of the political situation in Europe and sustained pace of above trend growth contrasts with the US where the political situation leaves much to be desired and the economy is uninspiring. The President’s agenda of deregulation, tax reform, and infrastructure that had fueled the last leg up of the dollar’s multi-year rally is now doubted, and those dollar gains have been unwound. At the same time, the dollar’s negatives are being exaggerated as the pendulum of market sentiment

Topics:

Marc Chandler considers the following as important: AUD, CAD, Canada consumer price index, Canada Retail Sales, EUR, EUR/CHF, Featured, FX Daily, FX Trends, GBP, JPY, newslettersent, NZD, Spain Trade Balance, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe euro has depreciated by 0.13 to 1.1043 CHF. |

EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

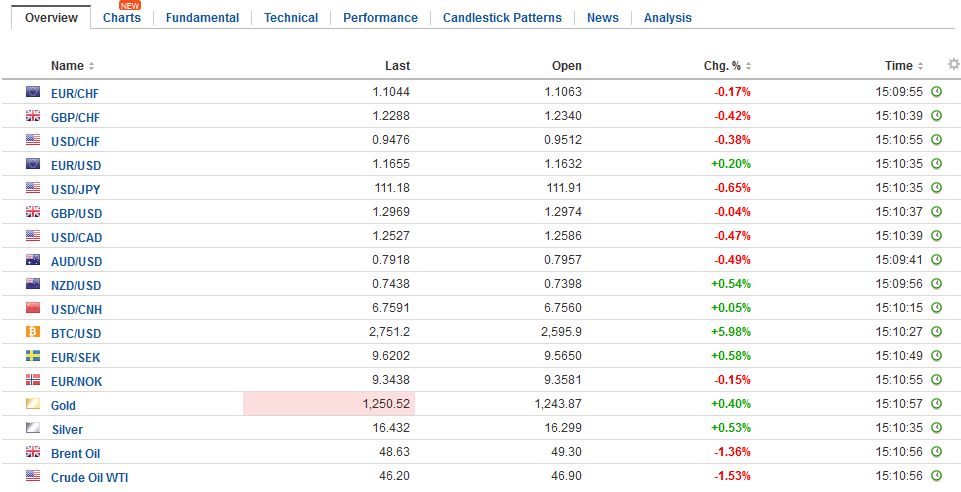

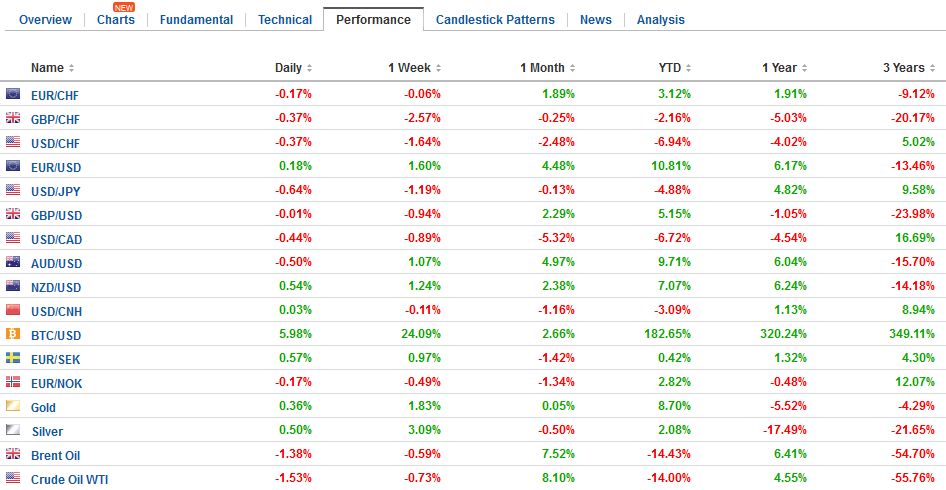

FX RatesThe US dollar is very much unloved. The apparent stabilization of the political situation in Europe and sustained pace of above trend growth contrasts with the US where the political situation leaves much to be desired and the economy is uninspiring. The President’s agenda of deregulation, tax reform, and infrastructure that had fueled the last leg up of the dollar’s multi-year rally is now doubted, and those dollar gains have been unwound. At the same time, the dollar’s negatives are being exaggerated as the pendulum of market sentiment swings against it. Yesterday’s positive news included an unexpected drop in the weekly jobless claims for the period that covered the non-farm payroll survey. Also, Leading Economic Indicators rose a stronger-than-expected 0.6 in June the fastest since January, which matched the highest level since the end of 2014. Despite what some argue the flattening of the yield curve tells us, the economic data shows no sign of an impending economic downturn. Nor are investors abandoning the US. The TIC data showed foreign demand for long-term US securities rose to $92 bln in May. Such flows this year are running at more than twice last year’s pace (~$48 bln vs. $22 bln monthly average). Moreover, despite the preference for European shares over the US on various grounds, including valuation, since May 1, the US S&P 500 has outperformed the Dow Jones Stoxx 600 for Europe by four percentage points. |

FX Daily Rates, July 21 |

| It is not only Draghi that seemed fairly relaxed about his currency’s strength. The New Zealand Finance Minister recognized the economic benefits of a strong currency. This saw the Kiwi rally almost 0.5% and recoup some recent ground lost against the Aussie. The Reserve Bank of Australia seemed unperturbed by the Aussie’s strength, but comments from Deputy Governor Debelle cautioning against seeing a discussion of the neutral rate as a signal of the central bank’s intent to tighten policy weighed on the unit. This has sparked a bout of profit-taking after the $0.8000 level was approached yesterday. The Aussie retreated to nearly $0.7880, where a good bid was found. If the market is looking for the pain threshold of officials, they have not found it.

The US 10-year yield is slightly softer today, bringing this week’s decline to seven basis points. European bonds yields are also extended this week’s pullback. The two-three basis point decline today, bring the decline on the week to 8-9 basis points in the core and 14-15 bp in the periphery. This has seen the German bund yield slip to two-week lows near 50 bp. Recall that the 50 bp level capped yields in January, March, and May before breaking through at the end of June. It does look as if the highwater mark is behind us, and that the near-term risk is that German yields continue to correct lower. Technically, the potential exits back into the 37-40 bp area. However, with US Treasury (and European yields) softening, some of the downside pressure on the yen is alleviated. Yesterday, the dollar traded under JPY111.50 for the first time since June 27. It is holding above yesterday’s lows today, but the tone is heavy. This area that the dollar is straddling corresponds to a 50% retracement of the gains since the June FOMC meeting (~JPY111.65). The next 61.8% target is found at JPY111.00. For its part, the euro reached the high for the year against the yen near JPY130.75 on July 11. The euro made new highs for the week today near JPY130.50 where it has stalled. A break below JPY130 would be the first sign of a near-term top. |

FX Performance, July 21 |

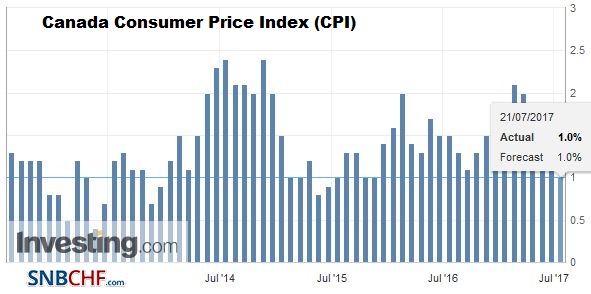

CanadaThere are no economic reports on tap for the US today, but Canada reports June CPI and May retail sales. Sequentially both look to slow. The headline CPI is expected to ease 0.1%, which would bring the year-over-year pace to 1.1% from 1.3%. The central bank has recently introduced new underlying measures, and they are all running a little hotter than the headline. Just like low inflation readings are limiting the degrees of freedom of the ECB, Fed, and BOJ, they also will likely deter a tightening cycle in Canada after officials unwind the accommodation provided in 2015 (two cuts). May retail sales are expected to slow from the heady 0.8% gain in April. However, note that the four-month average gain in Canadian retail sales this year (0.9%) is near twice the pace as last year (0.5%). This will be the fourth consecutive week the US dollar has fallen against the Canadian dollar. It is the longest losing streak since April 2016. The US dollar is trading within yesterday’s ranges. Resistance is seen near CAD1.2640, while many see the psychological importance of the CAD1.25 level that corresponds to $0.8000. |

Canada Consumer Price Index (CPI) YoY, June 2017(see more posts on Canada Consumer Price Index, ) Source: investing.com - Click to enlarge |

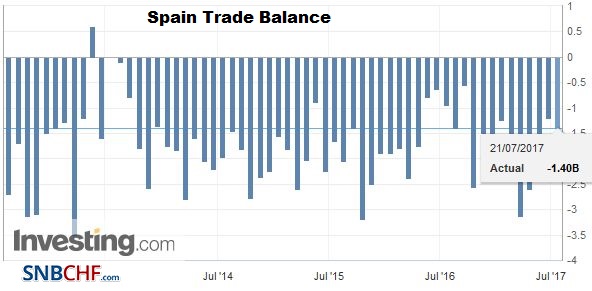

Spain |

Spain Trade Balance, July 2017(see more posts on Spain Trade Balance, ) Source: investing.com - Click to enlarge |

ECB President Draghi did not argue forcefully enough at yesterday’s press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year’s high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near. There continues to be talk of keen interest in $1.20 strikes and the indicative pricing in the options market is consistent with euro call buying.

The ECB retained the warning that it could boost its asset purchases if necessary, but no one really believes it will. There was nothing in Draghi’s comments that undermine our expectation that at the September meeting, the ECB will announce that it will reduce the assets it buys but extend the purchases through the first part of next year. The first robust expansion in a decade still needs to be nursed to ensure that it absorbs the space capacity and boost wages and prices.

Sterling is the only major currency to have lost ground to the dollar this week. A little below $1.30, puts it off 0.75% on the week, which surrenders half of the gains from the previous week. Since the beginning of May, sterling has alternated between weekly gains and losses against the dollar without fail. However, no such pattern is evident in the euro-sterling cross. Since the start of May, the euro has gained about 6% against sterling. In the 11 weeks, sterling has been alternating against the dollar; it has fallen against the euro in all but three weeks. The euro extended its recent gains to approach GBP0.9000, it highest level since last November.

The MSCI Asia Pacific Index snapped a nine-day advance today by slipping less than 0.15%. Broadly speaking, markets in Japan and the Greater China (Shanghai, Shenzhen, Hong Kong, and Taiwan) all eased, while most of the other markets in the region advanced. European bourses are also mixed. The Dow Jones Stoxx 600 is off fractionally today as it nurses a 0.6% loss on the week. Although the Dow Jones Industrial and the S&P 500 slipped lower yesterday, the NASDAQ managed to extend its winning streak to its 10th session yesterday. The kind of momentum that such a streak entails has often been seen a month later. Of the roughly 20 times a 10-day rally has been recorded by the NASDAQ, it was higher a month later 80% of the time, according to a study cited by a news wire.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Canada Consumer Price Index,Canada Retail Sales,EUR/CHF,Featured,FX Daily,newslettersent,NZD,Spain Trade Balance,USD/CHF