Swiss Franc The euro has appreciated by 0.47% to 1.1051 CHF. EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost %excerpt%.8000, it has reversed to toy with yesterday’s low. A convincing break of that area (~%excerpt%.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take note. Sterling moved higher in response to the stronger than expected rise in retail

Topics:

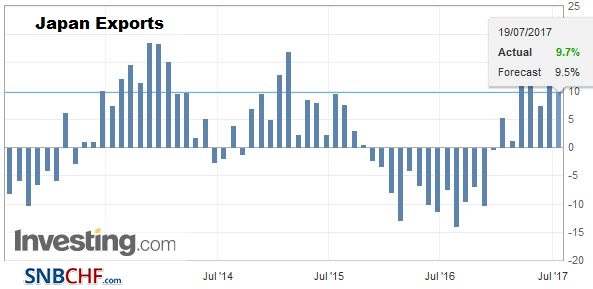

Marc Chandler considers the following as important: AUD, Australia Unemployment Rate, EUR, EUR/CHF, Eurozone Consumer Confidence, Eurozone Current Account, Featured, FX Daily, FX Trends, GBP, Germany Producer Price Index, Japan Exports, Japan Imports, Japan Trade Balance, JPY, newsletter, U.K. Retail Sales, U.S. Crude Oil Inventories, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe euro has appreciated by 0.47% to 1.1051 CHF. |

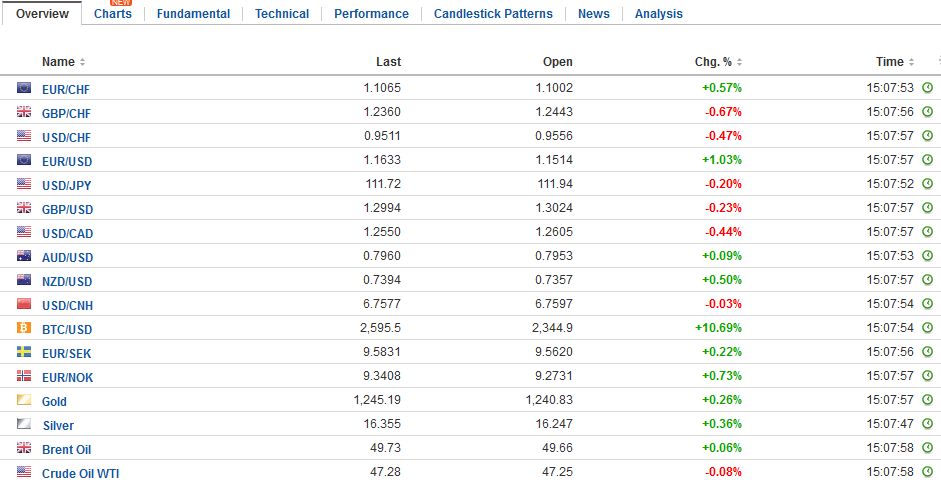

EUR/CHF and USD/CHF, July 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday’s low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take note. Sterling moved higher in response to the stronger than expected rise in retail sales. However, as we saw with the Australian dollar, data surprises are not the key driver of the price action today. Sterling was unable to turn higher on the session. It had been trading at new lows for the week, near $1.2970 before the data and popped up to almost $1.3020 before hitting new offers. There GBP360 mln option struck at $1.30 that expires today and another GBP225 mln at $1.2950, but potentially more significant is the nearly one billion euros struck at GBP0.8850 that will be cut today. |

FX Daily Rates, July 20 |

| The dollar recorded a high of nearly JPY114.50 on July 11 and trended lower. It reached nearly JPY111.55 yesterday and is recovered today toward JPY112.40. There is initial potential toward JPY112.70-JPY112.80 to complete the retracement of the recent decline. There are nearly $1.3 bln of options struck between JPY111.45 and JPY112.00 that are set to expire in NY today.

Yesterday the euro was confined to narrow ranges inside the broad range set on Tuesday (~$1.1470-$1.1585). While the euro is a little softer today, it remains within Tuesday’s range still. The focus is of course on the ECB meeting, and specifically Draghi’s press conference. The ECB President is expected to continue to prepare the market for what is likely to be an announcement at the September meeting, which will also feature new staff forecasts. The September meeting is seen as the likely venue for announcing an extension of asset purchases, albeit at a slower pace, into next year. However, premature tightening of financial conditions is not warranted either, and Draghi may lean against it by reiterating that the risks of deflation have ebbed primarily because of the extraordinary monetary stance. Prices have not yet entered a self-sustaining, durable path to the target. Draghi’s tone may be just as important as the content of his remarks today. Our reading of sentiment suggests a bias to buy euros on pullbacks. There is a large (~830 mln euro) option struck at $1.15 and another (~750 mln euro) at $1.14 that expire in NY today. |

FX Performance, July 20 |

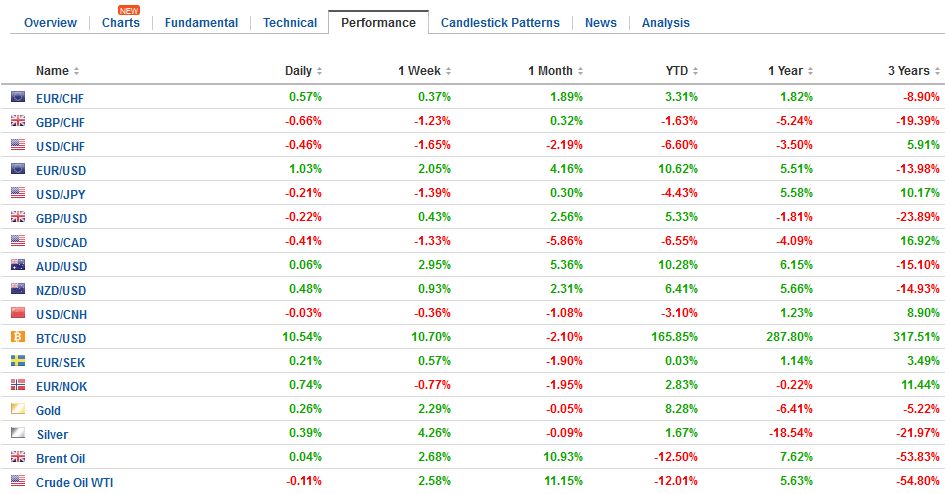

AustraliaAustralia created 62k new full-time positions while losing 48k part-time positions. It is the fourth strong full-time job creation over the last five months. Consider that in H1, Australia created on average nearly 28k full-time jobs a month. Last year, the monthly average was a loss of nearly 2k full-time jobs. Hours worked rose 4.6% at an annualized rate in Q2. The employment data bodes well for consumption, production, and exports. The central bank is likely to recognize the diminished downside risks while the substantial slack discourages a rate hike. Wage pressures are modest and next’s week’s Q2 CPI is expected to show steady to slower inflation. |

Australia Unemployment Rate, June 2017(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

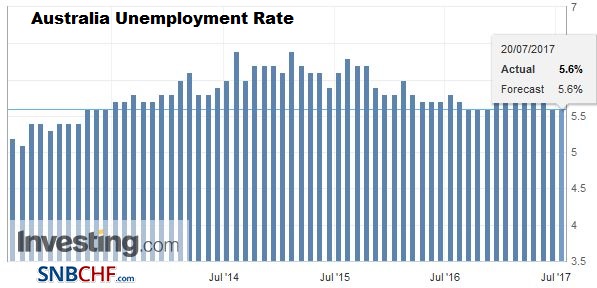

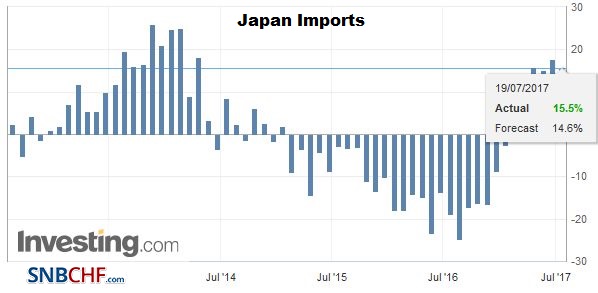

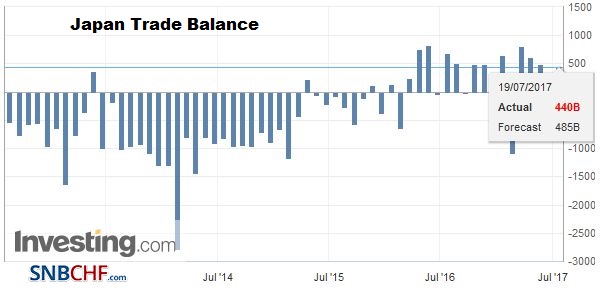

JapanAs widely anticipated the Bank of Japan stood pat and shaved its inflation forecasts. This fiscal year’s inflation forecast was cut to 1.1% from 1.4%. It pushed out for another year, now around FY19, that the 2.0% core inflation (excluding fresh food) is approached. This signals a BOJ that remains committed to its unorthodox stance. Despite coming under pressure from some in the Diet, the BOJ is not talking about exit or tapering. The BOJ also tweaked its growth forecasts. The economy is expected to expand by 1.8% this fiscal year compared with 1.6%, while FY18 GDP is forecast at 1.4% up from 1.3%. FY19 GDP is expected to slow to 0.7% (unchanged forecast) as it includes the expected sales tax increase. Separately, Japan reported that its trade balance swung back into surplus in June after a deficit in May. Exports rose 9.7% year-over-year. |

Japan Exports YoY, June 2017(see more posts on Japan Exports, ) Source: investing.com - Click to enlarge |

| While imports rose 15.5%. |

Japan Imports YoY, June 2017(see more posts on Japan Imports, ) Source: investing.com - Click to enlarge |

| Both were stronger than expected, though the resulting trade surplus was a little smaller than forecast. Stronger foreign demand is helping spur domestic activity, especially machine orders, industrial production, and capex. Japan’s exports to China, its largest trading partner are up 19.5% year-over-year. Exports to the EU are up 9.6%, while exports to the US have risen 7.1%. |

Japan Trade Balance, June 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

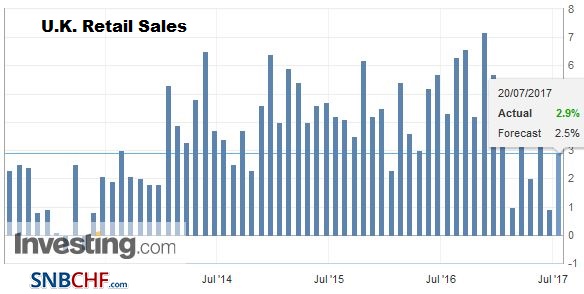

United KingdomUK retail sales, excluding auto fuel, rose 0.9%, nearly twice the median forecast from the Bloomberg survey, and follows a revised 1.5% decline in May (from -1.6%). Last month was the hottest June in more than 30 years, and this spurred strong demand for summer clothing. The underlying concern that higher prices and slowing wage growth will sap the purchasing power of households has not been alleviated by today’s report. Next week, the UK reports the first estimate for Q2 GDP. After slowing to 0.2% in Q1 from 0.7% in Q4 16, many expect the UK economy to have grown 0.3% in Q2. |

U.K. Retail Sales YoY, June 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

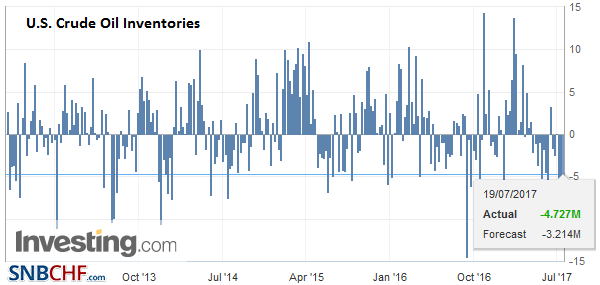

United StatesOil prices are consolidating today after rallying 1.5% yesterday on the back of the EIA report showing that US inventories fell 4.7 mln barrels in the week ending July 14. This brings the three-week drop to 18.6 mln barrels, the largest three-week drop since September. It was a larger drop than expected and contrasts with the API estimate of a 1.6 mln barrel build. The inventories of the other fuel products also fell, and gasoline stocks are 5% lower than a year ago. |

U.S. Crude Oil Inventories, July 19(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

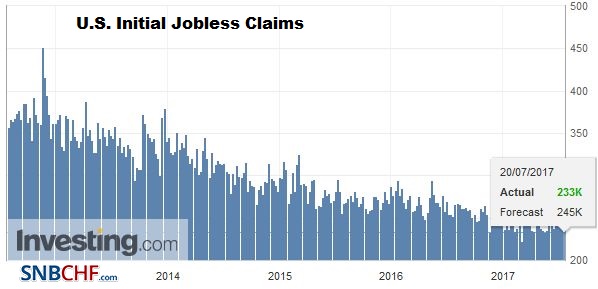

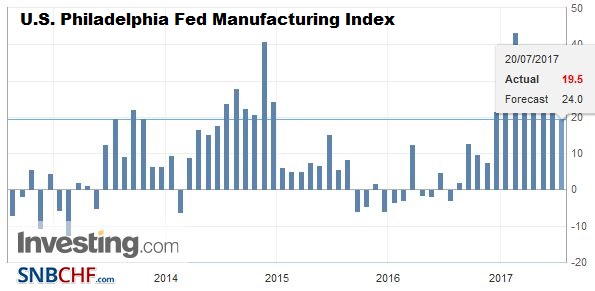

| The US data today includes weekly jobless claims, the July Philly Fed survey, and leading economic indicators. Although there has been some increased speculation that the US is recession-bound, evidence is unlikely to be seen in today’s report. Weekly jobless claims have edged higher recently, with the four-week moving average rising to its highest level in three months, though 246k is still consistent with a robust labor market. It is the week that the survey for the national figures was conducted. Leading economic indicators are also not suggesting anything like a recession. The LEI has averaged 0.4 this year and 0.2 last year. The June report is expected to match this year’s average. As an economic downturn approaches, one would expect weekly initial jobless claims to rise sharply and for the LEI to turn down. |

U.S. Initial Jobless Claims, July 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

U.S. Philadelphia Fed Manufacturing Index, July 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

|

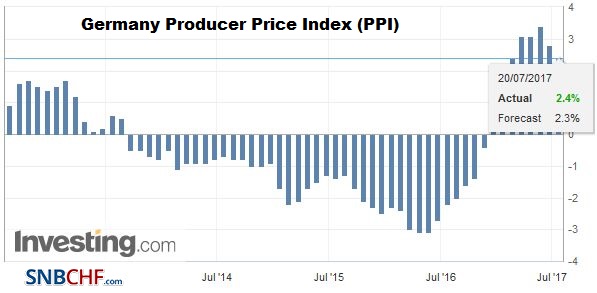

Germany |

Germany Producer Price Index (PPI) YoY, June 2017(see more posts on germany-ppi, ) Source: Investing.com - Click to enlarge |

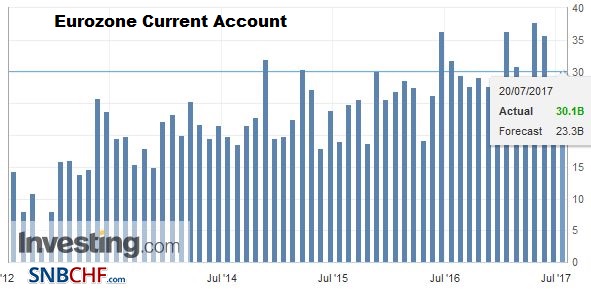

Eurozone |

Eurozone Current Account, May 2017(see more posts on Eurozone Current Account, ) Source: Investing.com - Click to enlarge |

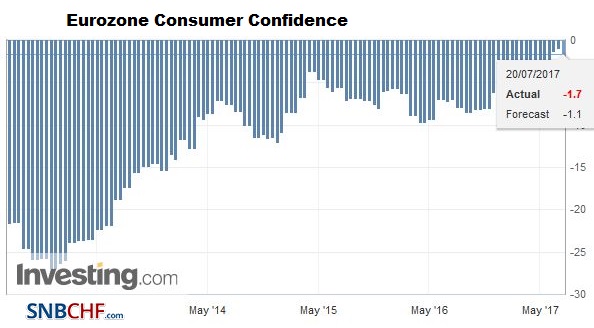

Eurozone Consumer Confidence, July 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Australia Unemployment Rate,EUR/CHF,Eurozone Consumer Confidence,Eurozone Current Account,Featured,FX Daily,Germany Producer Price Index,Japan Exports,Japan Imports,Japan Trade Balance,newsletter,U.K. Retail Sales,U.S. Crude Oil Inventories,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index,USD/CHF