One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income. Real Personal Income excluding...

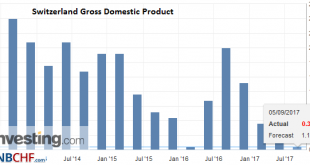

Read More »Switzerland Q2 GDP: +0.3 percent QoQ

Switzerland’s real gross domestic product (GDP) grew by 0.3 % in the 2nd quarter of 2017. Manufacturing, the financial sector and the hotel and catering in-dustry significantly boosted growth, while developments in trade, public administration and the healthcare sector were sluggish. On the expenditure side, growth was driven by domestic demand, with positive momentum coming from both consumption and investment. By...

Read More »Cow fights

In Switzerland, springtime means it's cow fights season again. Want to know the rules of that traditional contest? Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »Swiss Consumer Price Index in August 2017: Consumer prices remained stable in August

Neuchâtel, 05.09.2017 (FSO) – The consumer price index (CPI) remained unchanged in August 2017 compared with the previous month, reaching 100.6 points (December 2015=100). Inflation was 0.5% compared with the same month of the previous year. Switzerland Consumer Price Index (CPI) YoY, Aug 2017(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to enlarge Swiss Consumer Price Index...

Read More »S&P 500 Index: A Single Day Beats the Entire Week!

Recurring Phenomena Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods. In today’s report I...

Read More »Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August Gold posts best month since January, up nearly 4% Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month Platinum is best performing metal climbing over 5% Palladium climbs over 4% thanks to seven year supply squeeze Fear, uncertainty and political sanctions are...

Read More »Swiss employee associations not opposed to a 60 hour week

© Racorn | Dreamstime Swiss employee associations are not opposed to a 60 hour week. Several parliamentary initiatives aim to loosen Swiss labour rules. The first aims to allow staff and employers more flexibility regarding hours worked and time off. The second aims to loosen rules on recording hours of work by managers and specialists. Another initiative aims to extend this to include employees with shareholdings in...

Read More »Finding a place to rent getting easier in Switzerland

© Tea | Dreamstime A recent Credit Suisse report, entitled: Tenants Wanted, says capital continues to flow into Swiss real estate, boosting the supply of rental properties. Against a backdrop of negative interest rates at Switzerland’s central bank, investors continue to plough money into constructing new residential properties. At the same time, declining immigration has hit the demand for rental apartments. Estimated...

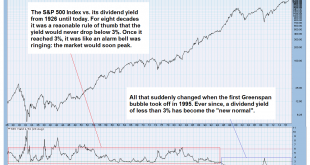

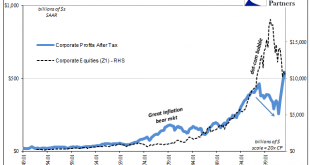

Read More »The Two Parts of Bubbles

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really...

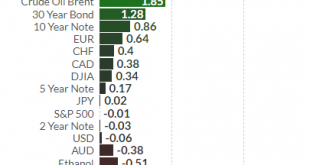

Read More »Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » SNB & CHF

SNB & CHF