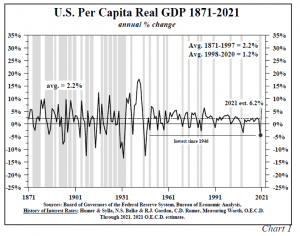

Lacy Hunt at Hoisington Management has some interesting thoughts regarding the inflation debate and the potential for decelerating inflation.

Case For Decelerating Inflation

In its Quarterly Review and Outlook for the First Quarter of 2021 Lacy Hunt makes a case for decelerating inflation.

Contrary to conventional wisdom, disinflation is more likely than accelerating inflation. Since prices deflated in the second quarter of 2020, the annual inflation rate will move transitorily higher. Once these base effects are exhausted, cyclical, structural, and monetary considerations suggest that the inflation rate will moderate lower by year-end and undershoot the Fed Reserve’s target of 2%. The inflationary psychosis that has gripped the bond market will fade away in the

Articles by Mike Shedlock

Consumer Mood Darkens On Employment Prospects

September 27, 2020A Fed survey of expectations shows that the consumer mood darkens on employment and job prospects.

Job Transitions

This chart shows the changes in employment status of respondents who were employed four months ago. The Fed survey asks individuals currently employed (excluding self-employment) whether they are working in the same job as when they submitted their last survey.

If in the past four months they have answered that they now work for a different employer, they are classified as “With a new employer”, and otherwise they are “With the same employer”.

Workers currently self-employed who were also self-employed four months ago are classified as “With the same employer”, and otherwise as “With a new employer.”

Job Transitions, 2014-2020 – Click to enlarge

Read More »China No Longer Needs US Parts In Its Phones

December 4, 2019Authored by Mike Shedlock via MishTalk,

China was once very dependent on US chips for its phones. The latest Chinese phones have no US parts.

The Wall Street Journal reports Huawei Manages to Make Smartphones Without American Chips.

American tech companies are getting the go-ahead to resume business with Chinese smartphone giant Huawei Technologies Co., but it may be too late: It is now building smartphones without U.S. chips.

Huawei’s latest phone, which it unveiled in September—the Mate 30 with a curved display and wide-angle cameras that competes with Apple Inc.’s iPhone 11—contained no U.S. parts, according to an analysis by UBS and Fomalhaut Techno Solutions, a Japanese technology lab that took the device apart to inspect its insides.

In May, the Trump

Are Rate Hikes Bad For Gold?

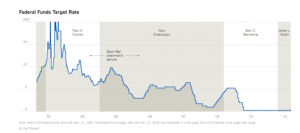

February 24, 2017Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other.

Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. – Click to enlarge

Here’s an alternative view courtesy of @HedgeEye.

– Click to enlarge

Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Rate Hike Cycle vs. the US Dollar

Conventional wisdom suggests rate hikes will support the US dollar.

US Dollar Conventional Wisdom vs. Rate Hike Reality

Currency trends seem to linger in both directions at the end of the rate hike and rate cutting episodes.

Dollar cycles have run about 7.5-8.5 years. If the pattern hold, this latest strengthening may soon be over, if it’s not over already.

The dollar peaked in February of 1985, long after the Fed stopped hiking.

The Dollar fell in 1984, just as Fed embarked on 17 consecutive hikes. The dollar then continued its decline for several more years after the Fed paused. At that time, hyperinflationists came out of the woodwork, predicting a dollar collapse. Three years later the dollar tested the low then blasted higher well before the Fed started to hike.

Federal Funds Rate vs.

Read More »Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

December 9, 2016Submitted by Michael Shedlock via MishTalk.com,

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord.

Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

But leading experts say the nomination of Scott Pruitt, Oklahoma’s attorney-general as head of the Environmental Protection Agency and the policy he pursues, may have less effect than many imagine on global greenhouse gas emissions.

Analysis by PwC, the financial services firm, shows G20 countries need to reduce their carbon intensity — the amount of carbon dioxide they emit for every dollar of GDP they produce — by an annual average of 3 per cent to meet their Paris agreement targets.

Even if the US abandoned the deal it would have a limited direct impact on the overall G20 effort. If all other countries stayed on track to meet their carbon targets, but the US returned to business as usual, the average annual cut for the G20 as a whole would only fall slightly, from 3 per cent to 2.8 per cent.

Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

December 9, 2016Submitted by Michael Shedlock via MishTalk.com,

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord.

Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

But leading experts say the nomination of Scott Pruitt, Oklahoma’s attorney-general as head of the Environmental Protection Agency and the policy he pursues, may have less effect than many imagine on global greenhouse gas emissions.

Analysis by PwC, the financial services firm, shows G20 countries need to reduce their carbon intensity — the amount of carbon dioxide they emit for every dollar of GDP they produce — by an annual average of 3 per cent to meet their Paris agreement targets.

Even if the US abandoned the deal it would have a limited direct impact on the overall G20 effort. If all other countries stayed on track to meet their carbon targets, but the US returned to business as usual, the average annual cut for the G20 as a whole would only fall slightly, from 3 per cent to 2.8 per cent.

Daniel Hannan – The Right Approach To Brexit

October 18, 2016Submitted by Michael Shedlock MishTalk.com,

Daniel Hannan – Click to enlarge

Daniel Hannan, a British member of the European Parliament (MEP), made an eloquent, impassioned speech this weekend on what should take place in Brexit talks.

After listening to Hannan on Brexit, regulation and trade, I am certain he would make a far better US president than anyone in the entire field from 18 months ago.

A few videos will make the case, the first is only a minute long.

Hannan on Switzerland and a Reasonable Brexit Approach

[embedded content]

Some may that was a self-serving speech. Perhaps, it was. However, Hannan’s proposed framework is also in the best interest of the EU.

Unfortunately, the Eurocrats are far more interested in punishing the UK than negotiating a win-win settlement. Doing so makes the EU nothing more than a prison, with walls restricting trade.

Outside of war, it never make sense to restrict trade. But here we are, with the EU bound and determined to punish the UK, even though they will fear even worse by doing so.

Hannan on Brexit

I was so impressed with Hannan’s speaking ability in that short clip, I sought out more videos. Here is a great 12 minute clip from June 15, prior to the Brexit vote.

Case For -2 percent Rates, Banning Cash? Jim Grant Blasts Lunatic Proposals

September 11, 2016Submitted by Michael Shedlock via KMichTalk.com,

Looking for group think, extrapolation of extreme silliness, linear thinking, and belief in absurd models?

Then look no further than Fed presidents, their advisors, and academia loaded charlatan professors.

Today’s spotlight is on Marvin Goodfriend, a former economist and policy advisor at the Federal Reserve’s Bank of Richmond, and Ken Rogoff, a chaired Harvard economics professor, a one-time chief economist at the International Monetary Fund.

Case for Minus 2% Rates

Goodfriend says the Fed Might Need to Cut Rates to Minus 2 Percent.

The U.S. Federal Reserve might need to cut interest rates to as low as negative 2 percent, far lower than levels other global central banks have tested, a former Fed economist said.

That’s what would likely be needed to engineer a recovery if the U.S. economy were to fall into a recession in the next couple of years, Marvin Goodfriend, who was an economist and policy advisor at the Federal Reserve’s Bank of Richmond from 1993-2005, told CNBC’s “Squawk Box” on Thursday.

Goodfriend, who is currently a professor of economics at Carnegie Mellon University, pointed to data on the eight recessions in the U.S. since 1960.

“In eight of those recessions, the Fed had to push the short rate 2.

Read More »