If running a fintech start-up isn’t hard enough, then try pivoting to healthtech in mid-stride. The transition from digital payments to Covid diagnostics has proven a bumpy ride for Achiko, resulting in its shares being suspended from trading on the Swiss stock exchange.

SIX Group, which runs the stock exchange, was forced to act on June 28 when auditor Grant Thornton raised doubtsExternal link about whether the indebted Zurich-based company could be assumed a going concern and whether its proposed 2021 financial statements “comply with Swiss law”. “The Group is currently unable to finance its short-term liabilities and product commercialization due to the fact that the required funds cannot be made available because of restrictions on available share capacity as

Articles by Matthew Allen

Students demand a bitcoin education

April 18, 2022A few years ago, during a bitcoin price rally, a colleague relayed a story about her husband attending a university lecture. He noticed several students glued to their smartphones. Peering over a few shoulders he saw they were more focused on crypto profits than the lecture.

Roll on five years and bitcoin has now become the central subject of lectures in several Swiss universities.

A study by blockchain start-up incubation company CV VC and PwC has identified 20 higher education establishments offering courses on blockchain and decentralised finance (DeFi).

Here’s a run down of how Swiss universities are embedding blockchain and bitcoin into their curricula, often in collaboration with foreign universities.

Why are universities suddenly interested in the crypto

New Swiss bank pitches itself as digital, but not robotic

April 9, 2022Switzerland’s shrinking banking universe has been bolstered by a new wealth management entrant, Alpian, which is aiming for the sweet spot between digital and human-centric services.

Alpian has just secured a Swiss banking license along with a CHF19 million ($20.5 million) capital boost from the Italian banking group Intesa Sanpaolo.

Looking at the bare figures, Switzerland could do with some reinforcements. The number of separate banking entities in the Alpine state has withered from 375 at the start of the Millennium to 243 in 2020.

Alpian’s niche is to connect mass-affluent investors (people with savings of between CHF100,000 and CHF1 million) with client advisors via digital channels rather than bricks and mortar.

The bank plans to start onboarding customers

Swiss privacy technology tackles rampant online intrusion

April 3, 2022Anyone using the internet is being watched, and possibly manipulated, via a trail of digital breadcrumbs known as metadata. Two Swiss companies, one backed by former United States military whistleblower Chelsea Manning, are setting up smokescreens to confuse prying eyes and protect web users from big tech companies and government surveillance.

Nym Technologies and HOPR employ mix networks (mixnet) to churn together the metadata that people leave behind when they surf the internet, making it impossible to link the scrambled digital footprints to any individual.

They are part of a small band of international companies, such as Orchid and xxnetwork (founded by cryptographer David Chaum who first introduced the mixnet concept in 1981) who are attempting to fight back

Blockchain heavyweights leverage Swiss start-ups for growth

March 21, 2022Switzerland is anchoring the European and Middle East expansion of one of the world’s fastest growing cryptocurrency exchanges.

The Bermuda-based FTX group is building its regional headquarters on the foundations of a small, yet successful, Swiss company that was established just two years ago.

Like many projects I encounter in “Crypto Nation” SwitzerlandExternal link, Digital Assets came together in rapid time, surfing on the rising value of bitcoin.

From the office of his law firm in the eastern Swiss canton of Appenzell Outer Rhodes, Patrick Gruhn chanced upon the profitable cryptocurrency advisory business during the bitcoin boom in the middle of the last decade.

The law firm changed its name to Crypto Lawyers in 2018. Gruhn and his fellow crypto advocates

Swiss ‘Unicorn’ Banking App Reincarnates as Bitcoin Vault

January 22, 2022Swiss fintech company Numbrs has blamed jealous banks for killing off its original business model as a third-party provider of financial products. So it has reinvented itself under the banner of the ultimate bank killer – bitcoin.

The company, fêted as a rare Swiss fintech unicorn (worth at least CHF1 billion), has just announced it has transformed into a bitcoin storage vault.

This is quite a startling strategic shift. More than two million people (mainly in Germany) had downloaded the original Numbrs app. It collected clients’ financial accounts in one place and offered them products from banks. Now all these apps have been shut down.

Why is that? Changes to European Union laws to create Open Banking should have made it easier for agile fintechs to plug into the

Swiss crypto industry unfazed by New Year bitcoin crash

January 10, 2022The New Year has started with a sharp fall in the price of bitcoin – and some intriguing stories surrounding the Swiss cryptocurrency scene.

The industry is well used to volatility in the price of cryptocurrencies and is ploughing on with expansion plans regardless of how many dollars you can currently get for your bitcoin.

New heads at Switzerland’s oldest crypto firm

As management shake-ups go, Bitcoin Suisse has raised the bar to a new level. The crypto company’s chairman (and founder) and its CEO have both decided to quit their posts in the space of three weeks.

Chief Executive Arthur Vayloyan has just announced he will hand over the reins to former Barclays and UBS bank executive Dirk Klee in April. Flamboyant founder Niklas Nikolajsen has only just stepped

UBS fails to overturn French tax evasion guilty verdict

December 13, 2021Keystone / Sebastian Gollnow

An appeal court in Paris has confirmed that Swiss bank UBS is guilty of having assisted French tax evaders – but reduced the penalty from €4.5 billion (CHF4.7 billion) to €1.8 billion.

Switzerland’s largest bank systematically helped French clients evade taxes between 2004 and 2012 by enticing them to hide their money in Switzerland, the appeal court said on Monday.

In 2019, UBS was originally fined €3.7 billion and ordered to pay €800,000 in civil damages to the French state after walking away from deferred prosecution negotiations.

UBS immediately signaled that it would appeal the 2019 verdict, suggesting that it had been politically motivated. That appeal took place in March 2021 with the verdict being delayed by several months as a

Arm wrestling over the control of money

December 12, 2021The Swiss National Bank (SNB) is doing its best to keep up with the fast-evolving world of cryptocurrencies and decentralised finance.

Switzerland’s central bank has again showcased the capabilities of its fledgling digital franc – an example of a central bank digital currency (CBDC).

The SNB has revealed that last month it clubbed together with the Bank of France and mainstream financial companies to pull off a cross-border trade using CBDCs on a distributed ledger technology (DLT) platform.

“Project JuraExternal link” was has been declared a success. Central bank issued digital francs and euros were traded between Swiss and French counterparties on the Swiss SDX Digital Exchange.

Why the fuss? Because it’s widely acknowledged that trading across different

Swiss expats thrown limited banking lifeline by digital disruptor

November 10, 2021Swiss expats have found it increasingly difficult to get the most basic banking services in recent years. © Keystone / Gaetan Bally

Digital bank Yapeal is offering basic accounts to Swiss people living in neighbouring countries that undercut the rising fees of mainstream competitors.

Swiss expatriates have long complained that banks in their homeland are giving them a rough deal with extra costs and account closures.

Attempts by the Organisation for the Swiss AbroadExternal link to make the state-owned Postfinance bank offer the same services to expats as Swiss residents have been rejected by parliament.

Banking restrictions followed a global crackdown on tax evasion, led by the United States, which heaped increasing compliance costs on Swiss banks. Their answer

Controversial crypto exchange hopes for warm Swiss welcome

November 2, 2021Two months after paying a $100 million fine in the US for illegal trading operations, cryptocurrency exchange BitMEX is lining up a test for Switzerland’s financial regulator.

With a raft of recent legislative amendments, “Crypto Nation” Switzerland is bidding to become a global hub for legally-compliant cryptocurrency activities. Crypto derivatives exchange BitMEX wants to leverage this legal basis to launch a brokerage service.

As I’ve said previously, the Swiss authorities see great advantages in gentrifying the upstart blockchain industry. While Switzerland has set up a legal framework in which the crypto industry can operate, regulators in the US and other countries have been wielding a big stick to bring rebellious companies to heel.

The

Switzerland fears impact of minimum corporate tax rate

April 27, 2021Switzerland may have to find alternative ways to welcome foreign companies to Switzerland. Keystone / Peter Klaunzer

The looming shadow of a global minimum corporate tax rate could threaten Switzerland’s status as a hub for multinational company headquarters.

The United States says that no country should tax companies less than 21%, a proposal that has added momentum to talks over a worldwide minimum corporate tax rate. The average corporate tax rate among Swiss cantons currently stands at around 15%, according to KPMG.

“I can imagine a 21% tax rate would deter foreign investment coming into Switzerland,” Swiss Business Federation (economiesuisse) tax expert Frank Marty told SWI swissinfo.ch. “Switzerland is a small nation with few natural resources and no links

Swiss banks queuing up to jump on blockchain train

April 13, 2021Digital bank Swissquote is expanding its crypto business by delving into the new world of blockchain-compliant digital assets. It appears that they are not alone: several high street banks also plan to launch “tokenization” services.

Swissquote is teaming up with digital assets service provider Taurus to allow clients to issue and invest in tokenized assets. Blockchain – or other distributed ledger technology systems – promises to simplify the process of creating a wide range of assets, from company shares to fine wines and traditional securities, and to speed up transactions.

“Many cantonal banks, retail banks and large systemic banks will be entering this space in the near future,” Taurus co-founder Lamine Brahimi tells me. “We see increasing interest”. He cites

Blockchain trading venue challenges stock exchange dominance

November 26, 2020Blockchain is set to challenge the dominance of national stock exchanges. Keystone / Walter Bieri

Digital assets bank Sygnum says it will open up new sources of funding for small companies by creating and trading shares on the blockchain. Its new trading facility will also target venture capital, real estate and the arts and collectibles market.

The goal is to translate traditional assets into blockchain-compatible digital ‘tokens’ that can speed up trading and make it more affordable to participate in the financial markets. Such trading venues offer an alternative to established stock exchanges.

On Thursday, Sygnum unveiled its ‘Desygnate’ token issuance service and the ‘SygnEx’ trading exchange. Sygnum’s virtual DCHF currency, backed by the Swiss franc, will be

Which US president would be best for Swiss business?

November 5, 2020Swiss-US trade has been booming in recent years. Would it be better for the Alpine country to stick with the current set-up or trust in a potentially more conciliatory new American president?

Swiss business with the US has never been better. Exports from Switzerland rose by a fifth between 2017 and the end of last year. Half of this trade was from the pharmaceutical and chemical sector. Precision tools, machinery and electrical manufacturing also saw trade with the US grow last year while trade with the rest of Europe shrank. And watch sales gained in strength in the US market before the Covid-19 pandemic struck.

The US presidential elections are being followed closely throughout the world. Copyright 2020 The Associated Press. All Rights Reserved.

Even Swiss

Investors stake their money on postponing death

October 4, 2020Researchers insist that not only can people live longer, but they can also enjoy a healthier life. Keystone / Fernando Bizerra Jr.

A group of wealthy investors is gathering virtually in Switzerland to stake their money on a new asset class. It’s longevity, underpinned by the science and technology of longer and healthier lives, and it could be a multi-billion-dollar market.

“Longevity will become one of the largest investment opportunities in the coming decades. It will disrupt not only the healthcare system, but society and the economy in general,” says Marc Bernegger, a Swiss entrepreneur who is co-hosting the investor conference.

“Longevity is a topic that moves investors. Besides making a nice profit, they share an interest in staying healthy and living

How much blockchain does the financial world need?

September 30, 2020Switzerland’s central bank is exploring the potential of blockchain but is in no rush to produce digital cash. © Keystone / Gaetan Bally

Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word.

And it turns out that an SNB issued digital Swiss franc for institutional players (such as banks) is not a done deal either. “We are conducting cutting-edge research in this area but there are no plans to issue a wholesale CBDC at this time,” says the SNB’s Head of Banking Operations Sébastien Kraenzlin.

“Central banks need to be ready to respond

Crypto Nation Switzerland evades Covid’s clutches (for now)

September 17, 2020The blockchain sector started in Zug’s Crypto Valley (represented here with a chart of companies), but has spread to other areas of Switzerland. © Keystone / Urs Flueeler

The Swiss blockchain industry appears to be in rude health despite the economic fallout of the coronavirus pandemic. The number of new companies and jobs produced by the sector increased in the first six months of the year. Is this trend set to last?

The number of Crypto Nation (including Liechtenstein) blockchain ventures expanded from 842 at the end of 2019 to 919 in the second half of this year, according to a biannual industry survey. The number of people they hire also increased – from 4,400 to nearly 4,800. There has also been no shortage of private equity funding flowing into companies.

Swiss law reforms make crypto respectable

September 13, 2020Simply buying bitcoin does not require a law change but legislation needs to keep up with a host of blockchain developments in finance and the way companies operate. © Keystone / Christian Beutler

Bitcoin used to be something of a dirty word, associated with crime and money laundering. Switzerland has now amended its legal code to welcome cryptocurrencies and blockchain technology into the mainstream.

Parliamentarians in the Senate rapidly passed a wide-ranging set of financial and corporate law reforms on Thursday. The so-called “Blockchain Act” had sailed through the House of Representatives unopposed in the summer, meaning the law will likely come into effect early next year.

The legislation could open the doors not just to decentralised finance but also the

Swiss-UK financial services pact antidote to EU intransigence

September 12, 2020Switzerland and Britain are talking of closer cooperation as two major economies that are not part of the EU. © Keystone / Peter Schneider

Switzerland and Britain are thrashing out a post-Brexit financial services treaty that is being billed as a global standard for common sense. It also takes aim at perceived EU inflexibility that has seen the Swiss stock market frozen out of European markets.

The proposed treaty to “deepen cooperation” on a whole range of financial services will be based on “outcomes”. This means it will be less about matching the precise wording of each country’s regulatory code than agreeing on broader objectives.

“This looks at the spirit and result of financial regulation rather than focusing on comprehensive harmonisation,” said Jan

Fintech firm Achiko hits Cayman-related compliance problems

June 16, 2020Achiko says its Cayman issues only came to light after listing in Switzerland. Keystone / Georgios Kefalas

Cayman Islands fintech company Achiko has run into “compliance issues” just months after listing on the Swiss stock exchange. The firm has called a meeting of shareholders this week to approve a plan to create a Swiss company and re-list the shares from this entity.

But some shareholders are upset that they will not be able to cast their votes the annual general meeting, called for June 18 in Zurich, because they have not yet received their shares more than six months after the listing.

Achiko is a holding company that includes Indonesian digital payments firm Mimopay and Korean digital media company Kryptonite in its portfolio. Shortly after its Swiss direct

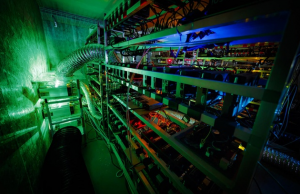

How crypto mining tried, but failed, to gain a Swiss toehold

May 20, 2020This crypto mine in Gondo could not keep up with competitors with cheaper electricity. (Keystone/ Valentin Flauraud)

There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps.

This week saw a special event in the bitcoin life cycle, called “Halving”. Like a super-rapid solar eclipse, blink and you missed it. So what happened?

Bitcoin is produced as a reward for “miners” (those warehouses of souped-up PCs) who create blocks of bitcoin transactions. The total supply of bitcoin is limited to 21 million, programmed to emerge at a regular pace until the year 2140.

Part of the bitcoin supply

Digital grassroots response to government bailouts

April 19, 2020Restoring shuttered companies back to health may take more than state handouts. (Keystone / Laurent Gillieron)

The CHF60 billion Swiss state bailout of companies is well underway. But there is a feeling that government funds that hand out loans and pay workers’ wages will not be enough. How do companies maintain contact with customers and develop their brands during a lockdown?

The obvious solution is to embrace digital. The last few weeks has seen a number of digital platforms focus their efforts on small enterprises.

Wemakeitexternal link, a crowdfunding platform, has opened a “solidarity” channel to invite people to donate money to struggling fitness studios, photographers, musicians and concert venues. Small businesses have signed up to projects such as

Sygnum bank creates digital version of Swiss franc for trading

March 23, 2020A number of projects around the world aim to create digital versions of money. (© Keystone / Gaetan Bally)

Sygnum bank has launched a digital version of the Swiss franc (DCHF) to allow faster payments when trading a new breed of securities. The DCHF digital tokens will be backed by the corresponding amount of Swiss francs that Sygnum will hold at the Swiss National Bank (SNB).

Sygnum is part of a consortium of companies taking part in the SDX digital assets trading platform, which SIX Group plans to launch by the end of this year. The platform, along with others being developed around the world, promises faster, more cost-effective trading of company shares, bonds and other financial assets.

A digital currency is required to settle the payment of such trades.

Should rail commuter data be monetised through advertising?

February 26, 2020Federal Railways has the personal data of some 3.7 million commuters. (SRF-SWI)

Swiss Federal Railways is coming under fire for using the personal data of commuters for advertising purposes. The data commissioner and a watchdog group have sounded the alarm bell as the volume of data being harnessed grows.

Thanks to the increasing digitisation of its services, the Federal Railways now has customer names, addresses, age, sex, telephone numbers, photos, details of trips taken and even the geo-positioning of commuters on its database. For example, some 500,000 people have signed up to the EasyRide app that makes it easier to buy fares.

“If you know where someone is working or sleeping, you also know who they are,” Adrian Lobsiger, Federal Data Protection

Central banks weigh up response to Libra and bitcoin

February 10, 2020Creating money may soon look entirely different in the digital age. (Keystone / Lm Otero)

Central banks are contemplating a response to alternative money systems, such as bitcoin or Libra, with new digital versions of their own currencies. They go by the name of Central Bank Digital Currencies, or CBDCs.

Libra’s stablecoin project launched in Geneva last year was a “watershed” moment that “kicked everyone in the pants”, Michael Sung, a professor at Fudan University, told the recent Crypto Finance Conferenceexternal link (CfC) in St Moritz.

This prompted China to “massively accelerate” its drive to digitize the renminbi. Sung is convinced that the plan is to spread the RMB far from China’s borders and “increase adoption throughout the world.”

Aleksander Berentsen,

Swiss fintech firms venture deeper into Middle East

February 7, 2020Qatar and other Middle East nations have announced fintech strategies. (Keystone / Yoan Valat)

Swiss fintech company Instimatch has launched into the Middle East, having won a licence to operate in Qatar, and signed up its first Kuwaiti bank. The mineral and cash-rich region is proving a magnet for financial innovation from Switzerland.

Instimatchexternal link’s digital platform directly connects deep-pocketed corporate, financial and municipal lenders with global investments. The unsecured money-lending market shifts $200 billion (CHF194 billion) per day in Europe alone.

The company, which is poised to incorporate Islamic finance-compliant solutions and blockchain into its platform, says Qatar will be a springboard for further expansion in the Middle East and

Swiss ski resort accepts bitcoin for settling tax bills

January 30, 2020Zermatt is a regular haunt for well-heeled international winter sports lovers. (© Keystone / Christian Beutler)

The iconic ski resort of Zermatt has become the second local authority in Switzerland to allow residents to pay their tax bills using the cryptocurrency bitcoin.

Zermatt, which lies in the shadow of the Matterhorn mountain, said on Tuesday that it will allow people living there to pay the whole range of taxes in bitcoin with no limit on the amount they contribute in the cryptocurrency.

In 2018, the town of Chiasso in the Italian-speaking area of Switzerland said it would accept bitcoin up to a limit of CHF250 ($257) to settle tax bills. Zug, which is home to Switzerland’s self-styled “Crypto Valley”, has since 2016 accepted bitcoin worth up to CHF200 as

Negative interest rates have cost Swiss banks CHF8 billion

January 23, 2020The more francs and euros banks accumulate at central banks, the greater the risk of negative interest charges. (© Keystone / Ti-press / Alessandro Crinari)

Swiss banks have been forced to fork out CHF8 billion ($8.3 billion) in negative interest fees since the Swiss National Bank (SNB) imposed its policy in 2015. Last year saw the heftiest annual bill of CHF2 billion, according to research from German company Deposit Solutions.

The findings are largely in line with the Swiss Bankers Associationexternal link(SBA), which says negative interest costs their members around CHF2 billion a year. The SBA has vigorously campaigned against the central bank’s monetary policy stance while commercial banks are increasingly passing on charges to wealthy clients and

Neon banking app slashes fees in growth drive

January 22, 2020Neon appears to be aiming to be Switzerland’s answer to Revolut. (Neon)

Swiss financial services company Neon says it will scrap card fees for customers shopping abroad to spearhead an ambitious drive to boost the number of clients to 250,000 in the next two years.

The Zurich-based fintech company has laid down a challenge to foreign competitors, such as Revolut and N26, with its announcement. From Monday (January 20) customers will no longer have to pay a combined 3.3% commission and exchange rate mark-up using the Neon Mastercard outside of Switzerland.

“We are going into attack mode,” Neonexternal link co-founder and chief marketing officer Julius Kirscheneder told swissinfo.ch. “We want to move fast and challenge the market. There is a clear need for