Switzerland’s central bank is exploring the potential of blockchain but is in no rush to produce digital cash. © Keystone / Gaetan Bally Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word. And it turns out that an SNB issued digital Swiss franc for institutional players (such as banks) is not a done deal either. “We are conducting cutting-edge research in this area but there are no plans to issue a wholesale CBDC at this time,” says the SNB’s Head of Banking Operations Sébastien Kraenzlin. “Central banks need to be ready to respond

Topics:

Matthew Allen considers the following as important: 1) SNB and CHF, Business, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

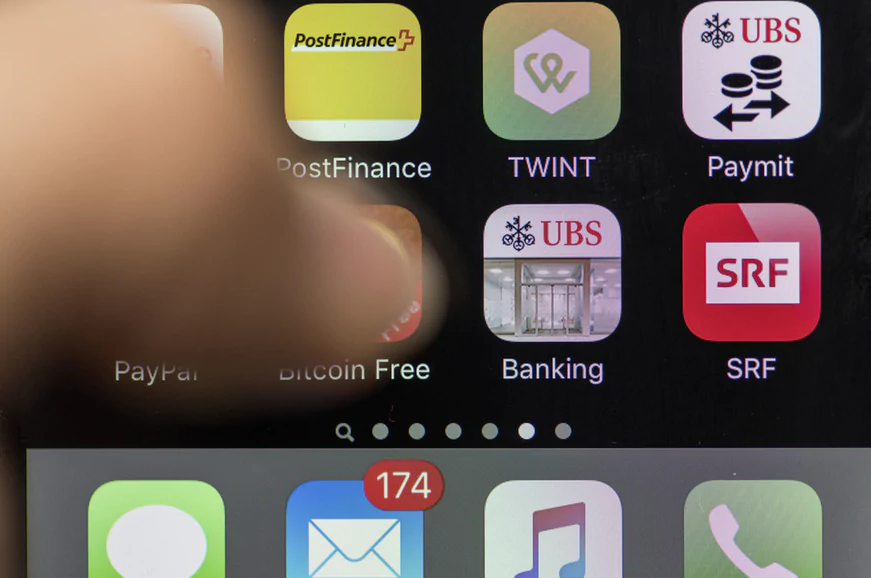

Switzerland’s central bank is exploring the potential of blockchain but is in no rush to produce digital cash. © Keystone / Gaetan Bally

Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word.

And it turns out that an SNB issued digital Swiss franc for institutional players (such as banks) is not a done deal either. “We are conducting cutting-edge research in this area but there are no plans to issue a wholesale CBDC at this time,” says the SNB’s Head of Banking Operations Sébastien Kraenzlin.

“Central banks need to be ready to respond promptly to market developments,” he adds. “There won’t be a Big Bang move of the financial market infrastructure into the DLT world, but possibly more of a transition where existing and new financial market infrastructures co-exist.”

Kraenzlin’s comments reflect a widely-held view among the traditional financial sector: that Distributed Ledger Technology (DLT) could fit within the current infrastructure to offer some improvements without tearing up the whole system.

Such a view sits at odds with those who reject the “best of both worlds” philosophy. DLT (whose most famous incarnation is blockchain) is a unique digital system in its own right, say many in “Crypto Nation” Switzerland. Rather than squeeze it into the existing framework as a complementary add-on, DLT should be free to operate independently as a “better” alternative.

It should be noted that no-one has proved that DLT can yet handle the same volumes of transactions as the existing infrastructure as effectively or securely. Indeed, some efforts at DLT-only systems have thrown up serious security problems.

Golden copy

So why is the SNB exploring DLT and CBDC? I went to its Zurich headquarters to ask Kraenzlin about the Swiss centre of the Bank for International Settlements’ Innovation Hub.

The SNB and the Swiss centre are working on a proof of concept with Swiss stock exchange operator SIX, which is currently building a digital asset trading platform. This will examine how central bank money could be integrated into a DLT ecosystem and the advantages, if any, over the traditional trading system. Preliminary results will be available by the end of 2020.

Any blockchain-style challenger will have its work cut out beating the efficiency, speed, scale and security of existing infrastructures run by SIX, says Kraenzlin.

But there are still inefficiencies that DLT might realistically help solve. The average time for settling financial market transactions is not seconds, but between one and two hours. This is because parties must first move their money and/or assets from their own domestic systems to SIX.

And this is only one part of the story. Transactions also need to be cleared and reconciled – a tedious two to three-day process of balancing the books.

Kraenzlin sees potential value in a trustworthy distributed ledger producing “a golden copy” of transactions for everyone to see. DLT could conceivably vanquish the need to move assets between different systems and alleviate the complexities of reconciliation.

Fintech solutions

Enhanced book-keeping might not sound as sexy as a new form of people’s cash, but it could make a bigger splash.

Kraenzlin believes that, with a bit of tweaking, “the existing financial market infrastructure could provide market solutions for instant payments and financial inclusion requirements.” Non-blockchain fintech innovations may also prove a better option for faster and more cost-efficient payment solutions.

For example, Revolut and other fintech firms currently process cross-border transactions at very low costs. SWIFT, the system of sending transactions around the world, now allows financial institutions and people to track their payments much like tracing the location and status of parcel deliveries.

Injecting a dose of innovation into a tried and tested, yet evolving, system may well help resolve inefficiencies in the payment world. In this case, who needs a potentially disruptive central bank issued currency for the masses, argues the SNB, despite what others may say?

The revolution versus evolution debate will doubtless continue for some time.

Tags: Business,Featured,newsletter