This crypto mine in Gondo could not keep up with competitors with cheaper electricity. (Keystone/ Valentin Flauraud) There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps. This week saw a special event in the bitcoin life cycle, called “Halving”. Like a super-rapid solar eclipse, blink and you missed it. So what happened? Bitcoin is produced as a reward for “miners” (those warehouses of souped-up PCs) who create blocks of bitcoin transactions. The total supply of bitcoin is limited to 21 million, programmed to emerge at a regular pace until the year 2140. Part of the bitcoin supply

Topics:

Matthew Allen considers the following as important: 6a.) Bitcoin&Blockchain, Crypto, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

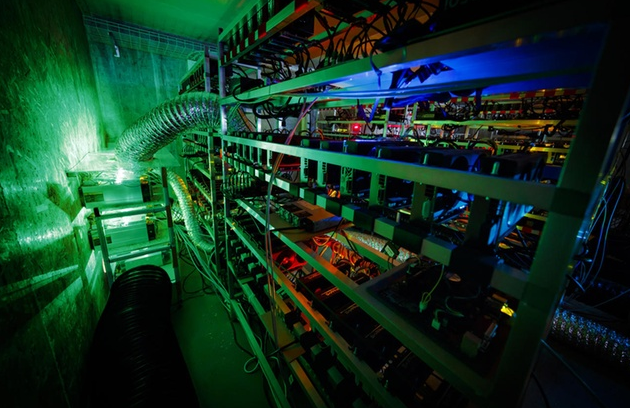

This crypto mine in Gondo could not keep up with competitors with cheaper electricity. (Keystone/ Valentin Flauraud)

There was a time when any Tom, Dick or Harry could create (or “mine”) bitcoin with a modified PC. Now only warehouses packed full of specialised computing gear stand any real chance. The bones of defunct crypto mines litter the Swiss Alps.

This week saw a special event in the bitcoin life cycle, called “Halving”. Like a super-rapid solar eclipse, blink and you missed it. So what happened?

Bitcoin is produced as a reward for “miners” (those warehouses of souped-up PCs) who create blocks of bitcoin transactions. The total supply of bitcoin is limited to 21 million, programmed to emerge at a regular pace until the year 2140.

Part of the bitcoin supply equation involves slowing down production over time. Every few years, the bitcoin reward that miners receive is slashed in half. Last week they got 12.5 bitcoin for producing a block of data, halfway through this week it became 6.25.

Bitcoin mining is a competitive vocation. It uses a lot of electricity. That produces heat. A location with low electricity bills and a cool climate gives a competitive edge.

Some people thought that might be Switzerland. They were wrong.

Around four years ago a crypto mine called AlpEreum popped up near a hydro-electric dam in central Switzerland. It found it could not compete with mines in China, Iceland and the US.

A couple of years later, another mine set up in a small village called Gondo, right on the Italian border. Gondo was big into gold mining in previous centuries and was a popular border crossing for smugglers. Then it suffered a devastating landslide and the young folk started to move out.

Alpine Mining said it would restore Gondo’s fortunes with the latest high-tech mining operation – this time for cryptocurrencies. It proved an irresistible story, so I went along to check it out. But that project was also unprofitable. Alpine Mining is still in Gondo, but more in the field of crypto and artificial intelligence research.

Around the same time, an outfit called Unity Investment (it also operates under the name Unicrypt) tried to set up a mining warehouse near to Zurich. In March, the company announced it was moving the facility to New York to take advantage of cheaper electricity bills.

One German outfit, Envion, moved to Switzerland and ran into an acrimonious legal dispute between the founders and CEO. Another eco-friendly mobile mining operation, Swiss Alps Mining, had the idea of occupying deserted alpine hiking huts. The operation appears to be still running, so if any alpine walker runs into one of these pods then please let me know.

Miners return

But the story doesn’t end there for crypto mining in Switzerland, thanks to the emergence of financial derivatives around the likes of bitcoin. This is where Switzerland’s financial know-how could give it an edge. Numerous Swiss firms are springing up with the intention of occupying this space.

Chinese mining giant, Bitmain, once set up ancillary operations in Zurich, but had to close down. In its place came the firm Matrixport, with links to Bitmain, offering financial services.

Now one of the world’s largest mining pools (cooperatives of several mining outfits), called Poolin, is eyeing up Switzerland from across the border at its European HQ in Berlin. Poolin creates around 18% of all bitcoin mined every day (plus a range of other cryptocurrencies), according to Vice-President Alejandro De La Torre. It wants to put this stockpile to good use. Switzerland’s crypto financial service industry looks an attractive option.

“Switzerland has a strong banking tradition and we are exploring the idea of expanding our operation into financial services,” he said. “We also have a lot of contacts in the Swiss Crypto Valley.” Right now, there are no concrete plans to report, but watch this space.

Tags: crypto,Featured,newsletter