The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on board the impact of the latest US fiscal stimulus (which led us to revise our forecast for real global GDP growth in 2018 up from 3.7% to 3.9%), the potential for further upwards revisions is limited, in our view. In addition, recent leading indicators suggest that economic activity may have peaked in a

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil price equilibrium, oil price forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

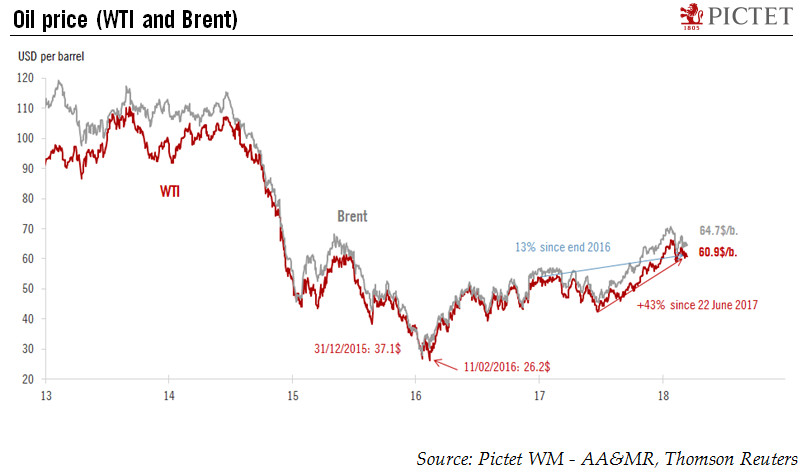

The current spot price is already close to oil’s upwardly revised equilibrium price.

Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.

Now that markets have fully taken on board the impact of the latest US fiscal stimulus (which led us to revise our forecast for real global GDP growth in 2018 up from 3.7% to 3.9%), the potential for further upwards revisions is limited, in our view. In addition, recent leading indicators suggest that economic activity may have peaked in a number of major economies. The dollar’s relatively steep decline in 2017 (which tended to support demand) also seems to be over. Indeed, robust US economic growth and the chance of tighter monetary policy would appear quite supportive of the US dollar.

On the supply side, too, fundamentals seem only moderately supportive of oil prices. While OPEC members and Russia continue to show discipline in respecting their agreement to limit production, US oil producers have increased their output quite aggressively since the end of 2016. After an abrupt slowdown in December caused by harsh winter conditions, drilling activity has resumed at a brisk pace. And nventories have recently shown signs of stabilising at their 2015 level.

Based on our macro-fundamental equilibrium model, if the global economy grows by 3.9% in 2018 as we expect and the dollar remains stable around its current level, then the equilibrium price for a barrel of WTI may fall slightly to USD59 / bbl by the end of this year (and to around USD 62 / bbl for Brent), this is our core scenario. Only a marked depreciation of the US dollar seems liable to push the oil price equilibrium significantly higher (a 10% drop in the dollar would push the WTI equilibrium price up towards USD66 / bbl). By contrast, should the US dollar appreciate by 10%, the equilibrium price for WTI would fall to USD54 / bbl by the end of the year.