The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in particular US shale oil, is expected to continue to play an important role. Oil prices in 2018 will largely depend on OPEC members and Russia remaining disciplined enough to keep production slightly below demand. In this context, we are sticking with our forecast, based on long-term fundamentals, which

Topics:

Jean-Pierre Durante considers the following as important: Macroview, Oil price dynamics, oil price equilibrium, oil price forecast, oil supply and production

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level.

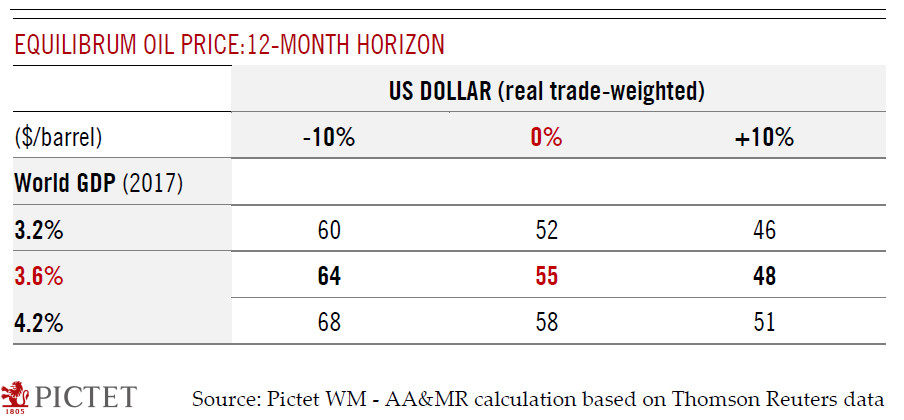

After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in particular US shale oil, is expected to continue to play an important role. Oil prices in 2018 will largely depend on OPEC members and Russia remaining disciplined enough to keep production slightly below demand. In this context, we are sticking with our forecast, based on long-term fundamentals, which currently points to an equilibrium oil price of USD58 for the WTI (USD64 for Brent) and USD55 at end-2018 (USD61 for Brent).

This forecast is based on our projections for world GDP forecast and assumes a stable USD. Only a significantly weaker US dollar (which is not in our central scenario for 2018) would likely push the long-term equilibrium above the USD60 threshold (see table). A temporary gap between the spot and equilibrium price is always possible due to factors that are not encompassed in the model (such as geopolitical tensions).

Assuming that OPEC and its non-OPEC partners stick to the 30 November agreement and taking into account increased non-conventional production, total oil supply could increase by 1.5mbd in 2018. Accordingly, given our forecast for a rise in oil demand next year, there could be a slight shortfall in supply (-0.3mbd compared with -0.5mbd in 2017), potentially supporting oil prices.

However, there are some caveats. It may be too much to assume that OPEC members will remain as disciplined at they have been. In particular, the fruits of heavy Russian investments are likely to appear in 2018. The prospect of losing market share will create a strong incentive for Russia to renege on the production agreement. Moreover, central government control over producers is notoriously looser in Russia than in the OPEC countries. All in all, despite the 30 November agreement, OPEC/Russian production risks being slightly higher in 2018 than in 2017.