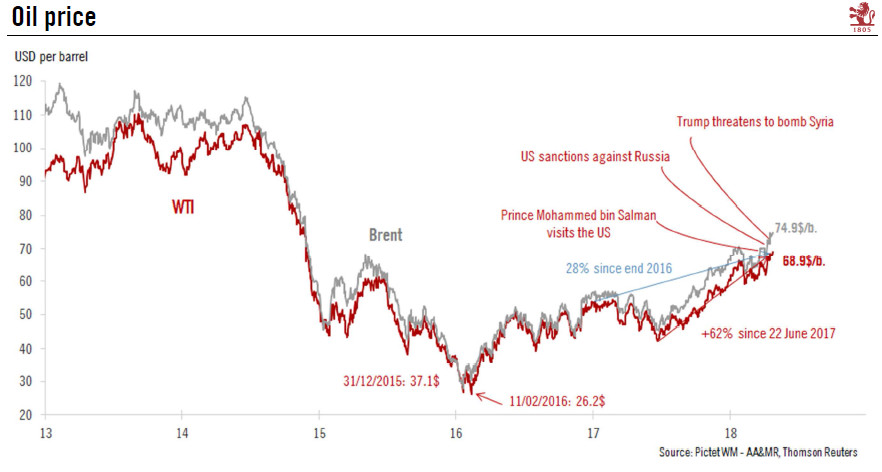

Oil prices are significantly above their long-term equilibrium, but should converge towards their equilibrium in the coming months.Oil prices have surged to their highest levels since 2014 (USD69.56 for West Texas Intermediate (WTI) on 19 April and USD75.27 for Brent on 24 April ). They are now USD6 to USD9 above our calculation of their long-term fundamental price equilibrium.Three factors explain the current price premium:Geopolitics: Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against Russia and western airstrikes against Syria, geopolitical developments have been to the fore in recent weeks. Worries about Middle East stability have resurfaced. In particular, Iranian supply could be cut if a breakdown in the nuclear agreement leads

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil price equilibrium

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Oil prices are significantly above their long-term equilibrium, but should converge towards their equilibrium in the coming months.

Oil prices have surged to their highest levels since 2014 (USD69.56 for West Texas Intermediate (WTI) on 19 April and USD75.27 for Brent on 24 April ). They are now USD6 to USD9 above our calculation of their long-term fundamental price equilibrium.

Three factors explain the current price premium:

- Geopolitics: Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against Russia and western airstrikes against Syria, geopolitical developments have been to the fore in recent weeks. Worries about Middle East stability have resurfaced. In particular, Iranian supply could be cut if a breakdown in the nuclear agreement leads to fresh sanctions.

- Financial market sentiment. The rise in oil prices has reflected a relief rally in financial markets. Oil prices rose in tandem with equity markets and interest rates last week.

- OPEC discipline. OPEC members and Russia continue to respect the production quotas agreed last November. On top of that, troubles affecting some big producers (notably Venezuela) mean their oil output has been even lower than self-imposed limits.

Looking ahead, the price premium for oil could prevail for a while—in particular if OPEC members and Russia agree to extend production cuts beyond the end of the year.

However, US production is well on the way to adding an extra 1 million barrels per day to oil output and could compensate for any further OPEC/Russia cuts. On the demand side, world GDP growth appears unlikely to accelerate further at this point.

At this stage, we do not see fundamental forces at work pushing prices any higher. Oil supply and demand appears relatively well balanced. As a result, our estimation of fundamental oil price equilibrium remains unchanged at USD63 per barrel for WTI and USD66 for Brent. We expect to see prices attracted towards their long-term fundamental equilibrium levels over a three- to six-month horizon.