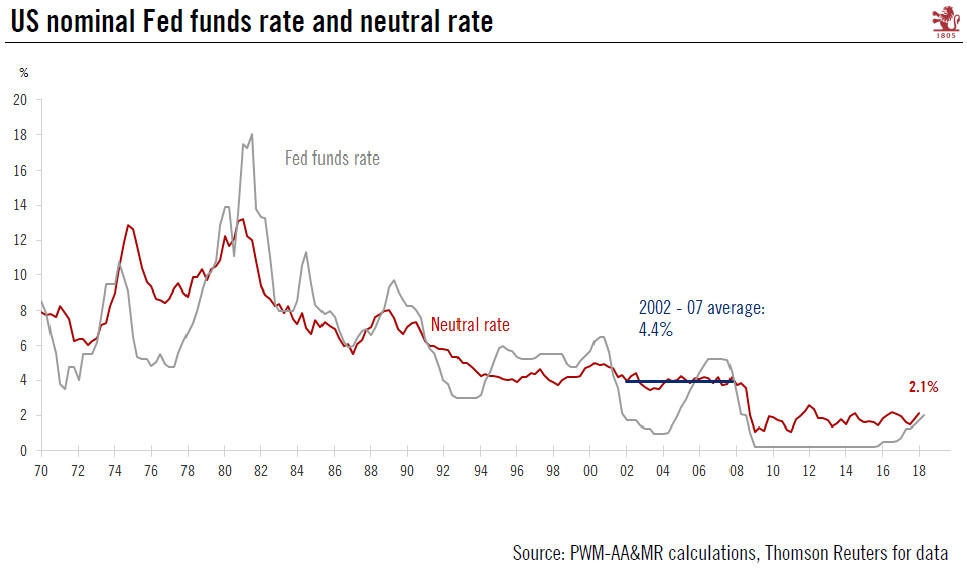

We are now very close to the neutral rate of interest in the US, meaning Fed policy is ceasing to be expansionary.After seven quarter-point rate hikes in the US since the end of 2015, we reckon we are close to a neutral rate of interest – the rate of interest consistent with trend growth, stable prices and full employment. We calculate that the current neutral rate is 2.1%, compared with a Fed funds rate of 2.0%.A neutral rate of 2.1% is considerably lower than the 4.4% rate that prevailed before the global financial crisis, underlining that event’s enduring impact. Only a lasting period (which we think unlikely) of sustained growth and inflation would push the neutral rate back up to pre-crisis levels. Instead, in our baseline scenario of decent economic growth and inflation, we expect

Topics:

Jean-Pierre Durante considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We are now very close to the neutral rate of interest in the US, meaning Fed policy is ceasing to be expansionary.

After seven quarter-point rate hikes in the US since the end of 2015, we reckon we are close to a neutral rate of interest – the rate of interest consistent with trend growth, stable prices and full employment. We calculate that the current neutral rate is 2.1%, compared with a Fed funds rate of 2.0%.

A neutral rate of 2.1% is considerably lower than the 4.4% rate that prevailed before the global financial crisis, underlining that event’s enduring impact. Only a lasting period (which we think unlikely) of sustained growth and inflation would push the neutral rate back up to pre-crisis levels. Instead, in our baseline scenario of decent economic growth and inflation, we expect the neutral rate to reach 3% in 2020 and 3.5% in 10 years from now, still significantly lower than pre-crisis levels. US short-term interest rates appear unlikely to recover to pre-crisis levels and much more likely to be capped at circa 3.5% in the current economic cycle.

That means that if the Fed continues to tighten policy as we expect (we foresee two more quarter-point hikes in 2018 to bring the Fed funds rate to 2.5% and a further two in 2019 to bring it up to 3.0%), then Fed monetary policy will be slightly restrictive by end-2018 and remain so in 2019. The Fed can justify this more restrictive monetary stance by pointing to the record low level of unemployment.

Leaving aside the question of its inflated balance sheet, our analysis suggests the Fed will have largely completed the normalisation of its monetary policy at end 2018, leaving it with some room to respond to possible adverse shocks such as a recession.