Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant destabilising of supply.Combining supply and demand scenarios gives us an indication of price pressures for the years to come. In our baseline scenario, one that excludes a reduction in Iranian production or further falls in Venezuelan production, we still see 2018 as a difficult year, with a 0.2mbd

Topics:

Jean-Pierre Durante considers the following as important: Iranian oil sanctions, Macroview, oil price equilibrium, oil price forecast, Oil supply demand balance

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.

The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant destabilising of supply.

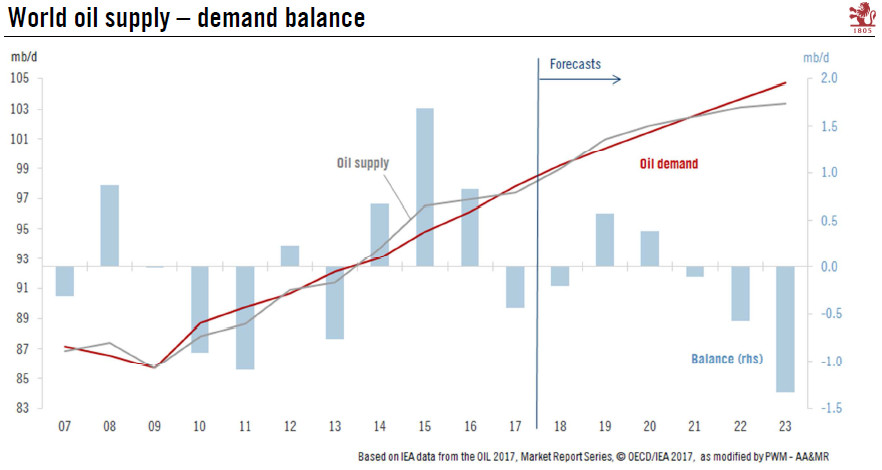

Combining supply and demand scenarios gives us an indication of price pressures for the years to come. In our baseline scenario, one that excludes a reduction in Iranian production or further falls in Venezuelan production, we still see 2018 as a difficult year, with a 0.2mbd supply shortfall. However, in this scenario, we should already be back to over-supply in 2019-20, mostly thanks to additional supply from North America. In short, the stress period is limited to 2017 and 2018.

But a full reinstatement of US sanctions would hit significantly the global supply/demand balance. If we assume a 1mbd reduction in Iranian production, then the existing projected shortfall in oil supplies (- 0.2mbd) will worsen to -1.2mbd this year. The oil surplus foreseen for 2019 (+0.6mbd) would turn into a deficit (-0.4mbd). Such an outcome would inevitably have severe consequences for prices.

On top of the threats to Iranian production, political troubles in Venezuela have led to a collapse of its oil output (-0.9mbd since end 2015). Alternative sources of supply are far from being assured in the short term. For Saudi Arabia, recent price increases are in line with their oil policy, while in the US bottlenecks in shale oil transportation could cap expansion of supply.

Compared to issues with oil supply, the demand side appears more straight forward. Given sustained economic expansion in most regions of the world, the pace of oil demand growth is in large part dominated by questions related to economic growth in emerging economies and the energy transition in advanced ones. Based on IEA analysis, global oil demand is expected to increase by 6.9mbd between 2017 and 2023.

All in all, the oil supply/demand balance risks shifting towards lasting shortages, with severe consequences on oil price. Our end-of-year forecast is revised upwards to USD70 for West Texas Intermediate (WTI) oil and USD78 for Brent (this compares with current equilibrium price of USD63 for WTI and USD66 for Brent). A significant premium above the long-term fundamental oil price equilibrium could prevail until the Iranian and Venezuelan crises unwind or some clear supply substitute emerges.