The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts. The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession. Business sentiment has been deteriorating for some time. By May the world Purchasing Manager Index for Manufacturing (PMI) had recorded its longest continuous deterioration on record (13 months), even longer than that seen during the Global Financial Crisis. Indeed, world PMI fell below 50 in May (to 49.8)—the threshold between

Topics:

Jean-Pierre Durante considers the following as important: 5) Global Macro, Featured, global recession, global slowdown, Macroview, newsletter, oil price forecast, oil prices, US oil inventories

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

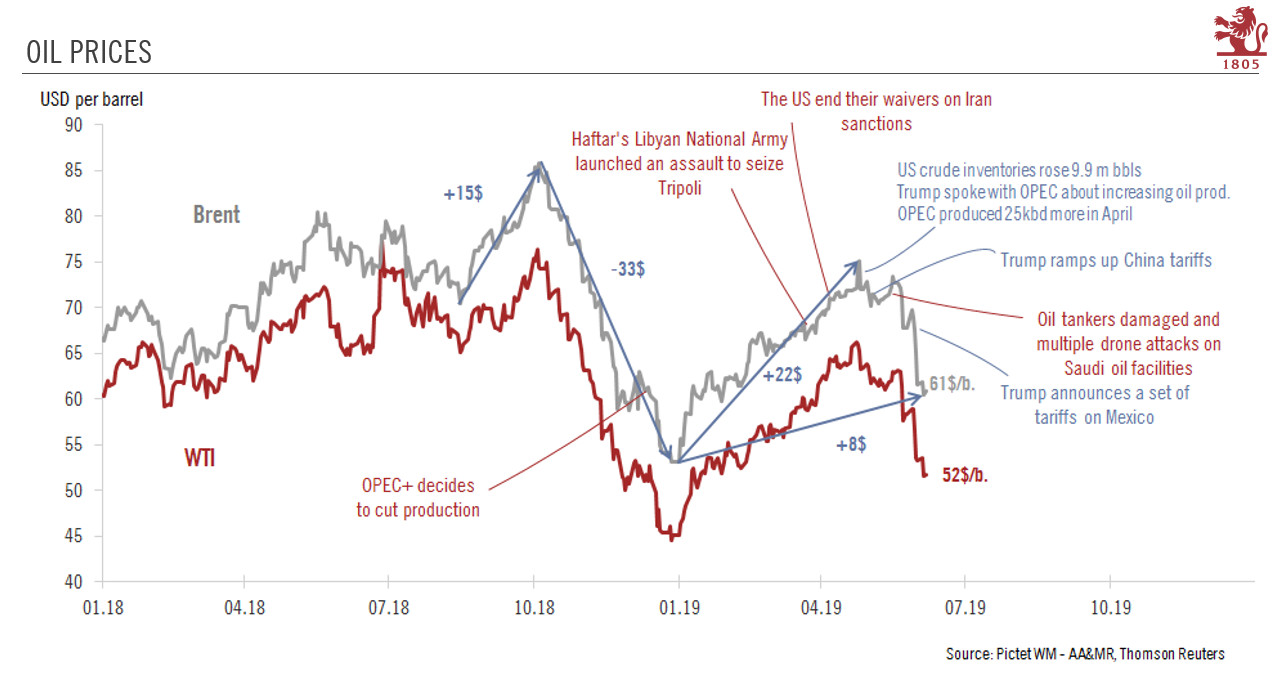

| The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.

The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession. Business sentiment has been deteriorating for some time. By May the world Purchasing Manager Index for Manufacturing (PMI) had recorded its longest continuous deterioration on record (13 months), even longer than that seen during the Global Financial Crisis. Indeed, world PMI fell below 50 in May (to 49.8)—the threshold between expansion and contraction in activity—for the first time since February 2016. With this in mind, the latest escalation in trade tensions could prove to be a decisive blow for economic activity. The latest PMI data suggest that world GDP growth is set to slow to 2.2% year on year in 2019, including quarter-on-quarter growth of 1.9% annualised in Q2 and 1.8% in Q3. To be clear, the latest global PMI point to a world economy heading toward recession, defined as real global GDP growth of below 2%, which is not in our central scenario. |

Oil Prices, 2018-2019 |

Oil stocks have also had a role in pushing prices lower. While OECD inventories suggest that oil is fairly priced at the moment, the 89 million-barrel rise in US oil stocks since September says otherwise. High US oil inventories are a reminder that the US cannot export all the oil it can produce given pipeline capacity constraints. But when new pipelines facilities become operational (probably at the end of the year) the US will add some 2mbd to its export capacity. This will probably be enough to shift the oil market into oversupply.

We still believe there is a risk of spikes in prices in the short term due to a tight supply situation and renewed tensions between the US and Iran. However, we see a shift toward oversupply as the US adds export capacity next year. At the same time, the escalation in trade tensions has considerably increased the risk of a sharp global economic slowdown, which will dampen the demand for oil, pushing us to reduce our year-end forecast from USD70 to USD65 per barrel for Brent and from USD60 to USD55 for WTI. Our central price forecast for Brent continues to be USD50 in 2020.

Tags: Featured,global recession,global slowdown,Macroview,newsletter,oil price forecast,oil prices,US oil inventories