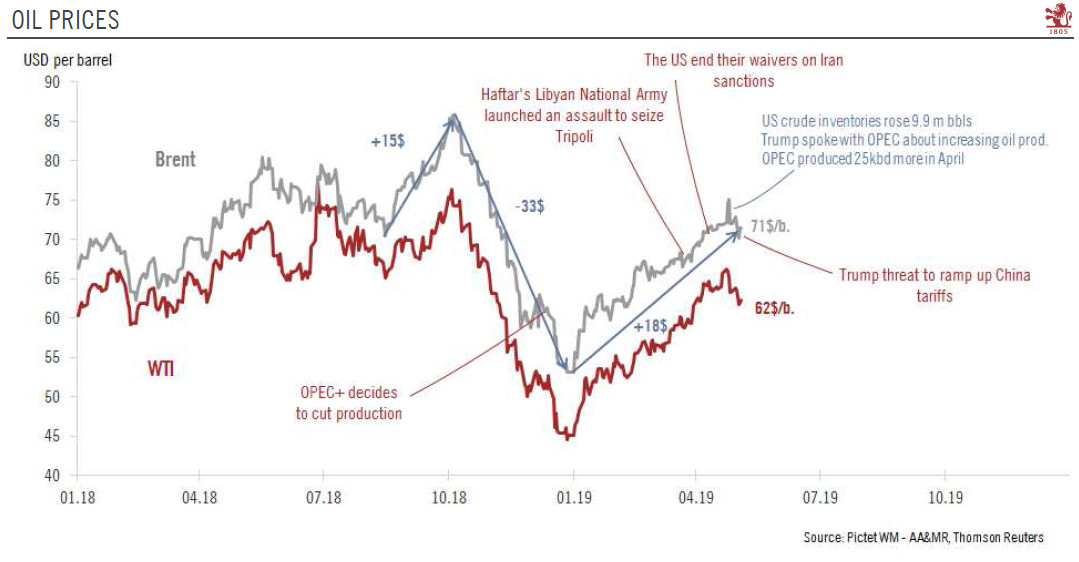

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could shake global growth if implemented and, as a result, weaken oil demand. But in all eventualities, the most likely consequence is higher oil price volatility in the short term.However, over the longer term, the major risk surrounding the oil market could be a supply glut. When the new Permian pipelines

Topics:

Jean-Pierre Durante considers the following as important: Macroview, oil market, oil prices, US China

This could be interesting, too:

Jeffrey P. Snider writes I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Joseph Y. Calhoun writes Weekly Market Pulse: Oil Shock

Jeffrey P. Snider writes Houston, We Have An Oil (and inventory) Problem

Stephen Flood writes The Black Friday Stock Market Crash – Gareth Soloway

We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.

The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.

Trump’s recent threat to increase US tariffs on Chinese imports could shake global growth if implemented and, as a result, weaken oil demand. But in all eventualities, the most likely consequence is higher oil price volatility in the short term.

However, over the longer term, the major risk surrounding the oil market could be a supply glut. When the new Permian pipelines are completed – probably at the end of the year – US export capacity will jump by two million barrels per day (mbd) and the price of Brent could test the USD50s in 2020.