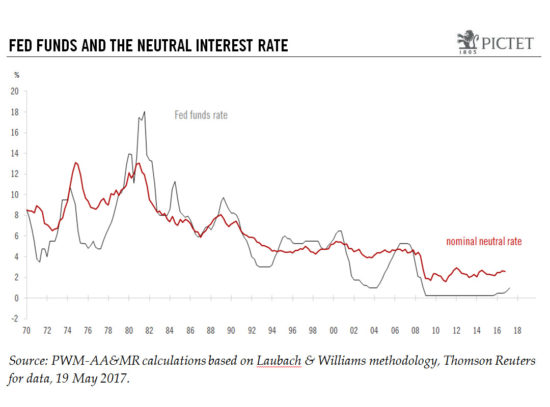

Analysis of the ‘neutral’ rate of interest suggests there is considerable market complacency surrounding the potential for further hikes in the Fed funds rate.Janet Yellen refers regularly to the concept of ‘neutral’ interest rate as a reference point for monetary policy. The neutral rate is very helpful in determining whether the Fed’s monetary stance is relaxed or restrictive and can also provide insight into the Fed’s next possible moves.The financial crisis has had a considerable impact on the neutral rate. It is currently estimated at 2.6% and has not been showing many signs of bouncing back towards pre-crisis levels (4.5%). But this could change.The ‘neutral’ rate can be understood as the interest rate expected to prevail when economic growth is in line with long-term potential prices are stable, and full employment has been achieved. Historically, the Fed funds rate tends to hover around the neutral rate, although gaps can open up between the two, most notable in 2001-2006, when the Fed funds rate was much lower than the neutral rate.Pictet Wealth Management’s baseline scenario is that US GDP will grow by 2.2% in 2017 and 2.3% in 2018, and that headline inflation will reach 2.4% in 2017 and 2.5% in 2018.

Topics:

Jean-Pierre Durante considers the following as important: Fed balance sheet reduction, Fede normalisation, Macroview, Neutral interest rate

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Analysis of the ‘neutral’ rate of interest suggests there is considerable market complacency surrounding the potential for further hikes in the Fed funds rate.

Janet Yellen refers regularly to the concept of ‘neutral’ interest rate as a reference point for monetary policy. The neutral rate is very helpful in determining whether the Fed’s monetary stance is relaxed or restrictive and can also provide insight into the Fed’s next possible moves.

The financial crisis has had a considerable impact on the neutral rate. It is currently estimated at 2.6% and has not been showing many signs of bouncing back towards pre-crisis levels (4.5%). But this could change.

The ‘neutral’ rate can be understood as the interest rate expected to prevail when economic growth is in line with long-term potential prices are stable, and full employment has been achieved. Historically, the Fed funds rate tends to hover around the neutral rate, although gaps can open up between the two, most notable in 2001-2006, when the Fed funds rate was much lower than the neutral rate.

Pictet Wealth Management’s baseline scenario is that US GDP will grow by 2.2% in 2017 and 2.3% in 2018, and that headline inflation will reach 2.4% in 2017 and 2.5% in 2018. Given that our analysis tends to confirm that the neutral rate serves as a reference for the policy rate, and given the on-going economic recovery, this implies the neutral rate is likely to rise from now on, and could stabilise at close to 3% in 2020.

But a rise in the neutral rate to this level risks forcing the Fed to frontload its rate hikes (four hikes in 2017 and three in 2018). Such potential Fed hawkishness is not being completely priced in by the market at the moment and therefore could imply serious adjustments in financial markets.

One important caveat: since the financial crisis, the Fed’s balance sheet has ballooned in tandem with its efforts to pump money into the financial system. ‘Normalisation’ of Fed policy will involve bringing the size of its balance sheet under control as well as approaching the neutral rate. Reduction of the Fed balance sheet would have an impact on the yield curve and contribute to higher market interest rates, without touching the Fed funds rate. In a nutshell, higher market rates as a result of normalisation of the Fed’s balance sheet is likely to mean the trajectory for Fed fund hikes is less steep than it might otherwise be.