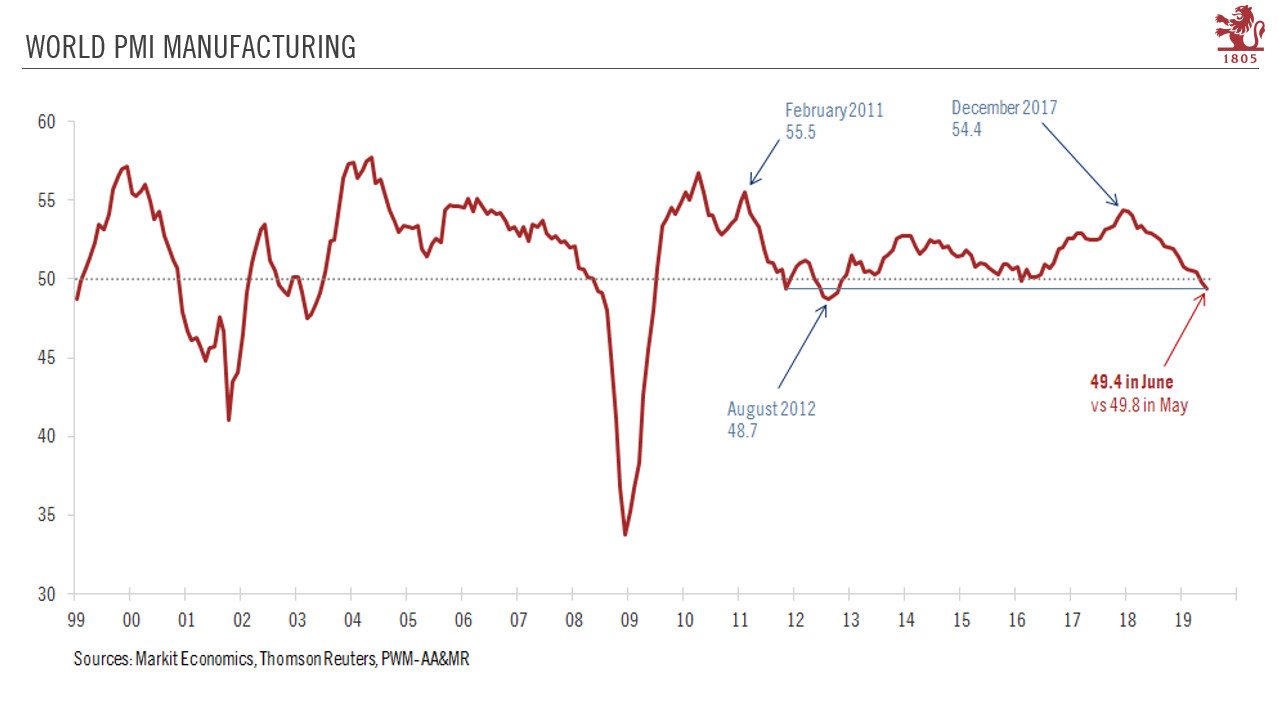

In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting. Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting. One needs to go back to 2012 to see something comparable. Even if the direct impact of the trade war has been limited so far, the indirect impact is becoming more evident, with declining business sentiment eating into corporate investment plans and leading to a decline in industrial orders. The

Topics:

Jean-Pierre Durante considers the following as important: 5) Global Macro, Featured, Global business sentiment, Macroview, newsletter, world manufacturing, world PMI, World Trade

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.

Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting. One needs to go back to 2012 to see something comparable. Even if the direct impact of the trade war has been limited so far, the indirect impact is becoming more evident, with declining business sentiment eating into corporate investment plans and leading to a decline in industrial orders. The decline in new orders and slowdown in the growth of international trade suggest that global investment will weaken further in the quarters ahead. All regions have been hurt in tandem, probably due to rising trade tensions. While trade in goods has deteriorated in advanced and emerging economies alike, the downturn has been particularly stark in emerging economies. Asia has been the worst hit, followed by Latin America. Our proprietary model for international trade (based on an assessment of new orders) is not (yet) catastrophic as it is still pointing towards positive, albeit weakening, growth (1.0%) in the months ahead. |

World PMI Manufacturing, 1999-2019 |

Concordant evidence of a slowdown in the investment cycle and in international trade is quite worrying for the global economic outlook. Various forward indicators suggest that world GDP growth could have fallen from 3.5% year on year (y-o-y) in Q4 2018 to 2.4% in Q2 2019. If we assume that growth will stabilise at 2.4% in Q3 and Q4, this translates into average annual growth of 2.5% in 2019, well below our core scenario of 3.3% set out earlier this year. But world GDP will have to rebound from 1.4% quarter-on-quarter annualised in Q2 to 3.0% in both Q3 and Q4 if we are to see annual growth stabilise at 2.4% this quarter and next.

The fragile truce in the Sino-US trade war is unlikely to revive GDP growth much in H2 2019. The world economy is in urgent need of stimulus, failing which growth forecasts will have to be revised down. However, we see some encouraging news in the form of a rebound in trade in Asia and car registrations in emerging markets in general, the resilience of domestic economies in advance countries and monetary policy stimulus.

Tags: Featured,Global business sentiment,Macroview,newsletter,world manufacturing,world PMI,World Trade