Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast. The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data as well. In particular, fixed investment in advanced economies plunged from 9.7% year-on-year (y-o-y) growth in Q1 2018 to -1.2% y-o-y in Q1 2019. The slowdown in domestic fixed investment hit countries and regions throughout the world at about the same time, in Q3 18. In fact, with the exception of

Topics:

Jean-Pierre Durante considers the following as important: 5) Global Macro, Featured, global recession, global slowdown, Growth forecast, Macroview, newsletter, World growth

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast.

The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data as well. In particular, fixed investment in advanced economies plunged from 9.7% year-on-year (y-o-y) growth in Q1 2018 to -1.2% y-o-y in Q1 2019. The slowdown in domestic fixed investment hit countries and regions throughout the world at about the same time, in Q3 18. In fact, with the exception of the US, all the economies in our sample (covering 94% of advanced economies’ GDP) showed negative y-o-y growth in domestic fixed investment in Q1 19! |

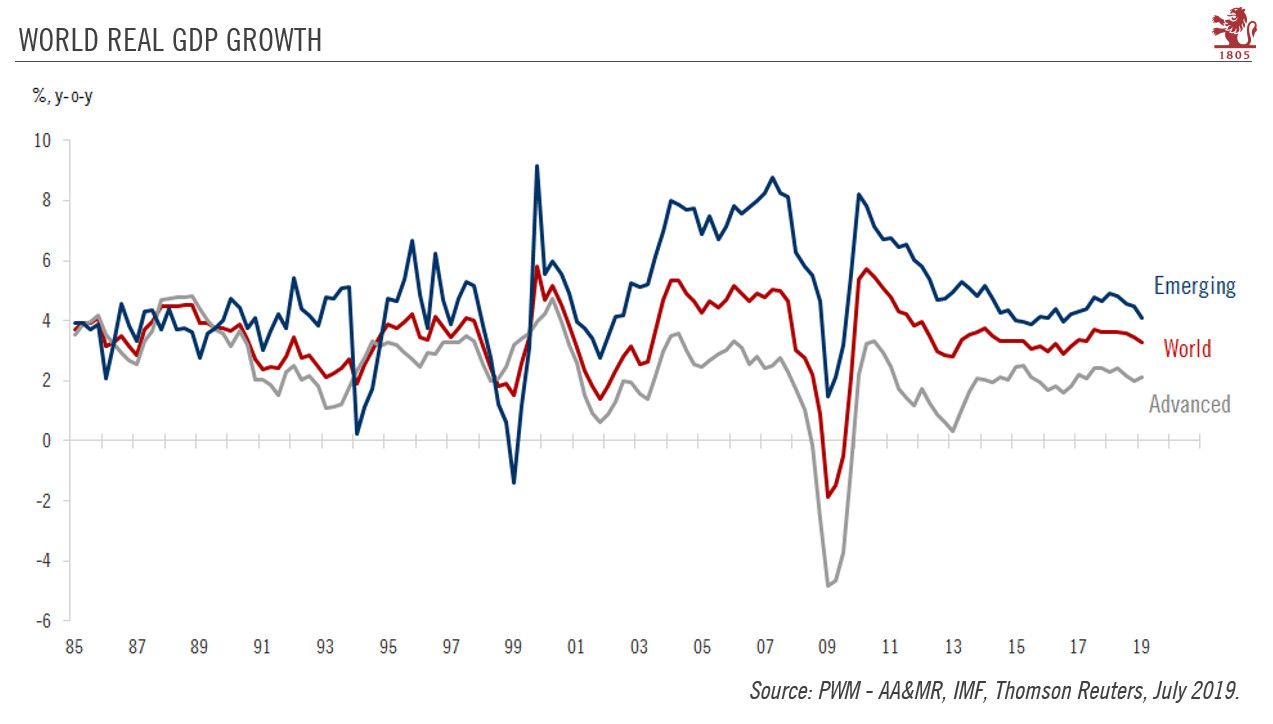

World Real GDP Growth, 1985-2019 |

The last two world recessions were accompanied by an ‘investment recession’ but not all ‘investment recessions’ are followed by a world recession. In 2015, a double-dip decline in fixed had only a small impact on global GDP growth. So, a global recession is not inevitable. Prompt reaction from the authorities could counteract the negative impact of the on-going contraction in fixed investment. The good shape of domestic demand in most countries could also cushion the downturn in industry.

However, given that the downturn in the investment cycle appears well advanced and given the multiplication of other worrying signs stimulus is now urgently needed. Among these signs are world industrial production. It contracted on a rolling three-month basis in both January and February, and while it has rebounded somewhat since then it remains very subdued. The negative demand shock that hit industrial companies in 2018 resulted in an involuntary build-up of inventories. Companies have reacted by reducing production. Unresolved trade disputes have made companies gloomy about the economic outlook and prompted them to slash investment plans. In all likelihood, the destocking process now underway will continue to weigh on industrial production in the quarters ahead.

Even were the authorities to step in with stimulus now, the rebound in activity would likely lag for a few quarters, only really being felt in 2020. Without a rebound, world real GDP growth in 2019 is unlikely to reach the 3.3% we forecast back in. As a result, we are scaling back our forecast to 3.1% global growth in 2019 and to 3.3% (from 3.6%) in 2020.

Tags: Featured,global recession,global slowdown,Growth forecast,Macroview,newsletter,World growth