Increased US export capacity would probably force OPEC+ to change its current tactics. After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018. The recent release of the International Energy Agency’s annual report is an occasion to answer this question and to reassess prospects for global oil supply and demand. Global oil demand is expected to increase by 7 million barrels per day (mbd) between 2018 and 2024. Peak oil is still far off. In 2019, oil will be supported by steady demand

Topics:

Jean-Pierre Durante considers the following as important: 7) Markets, Featured, Macroview, newsletter, oil demand, oil prices, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Increased US export capacity would probably force OPEC+ to change its current tactics.

After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.

The recent release of the International Energy Agency’s annual report is an occasion to answer this question and to reassess prospects for global oil supply and demand.

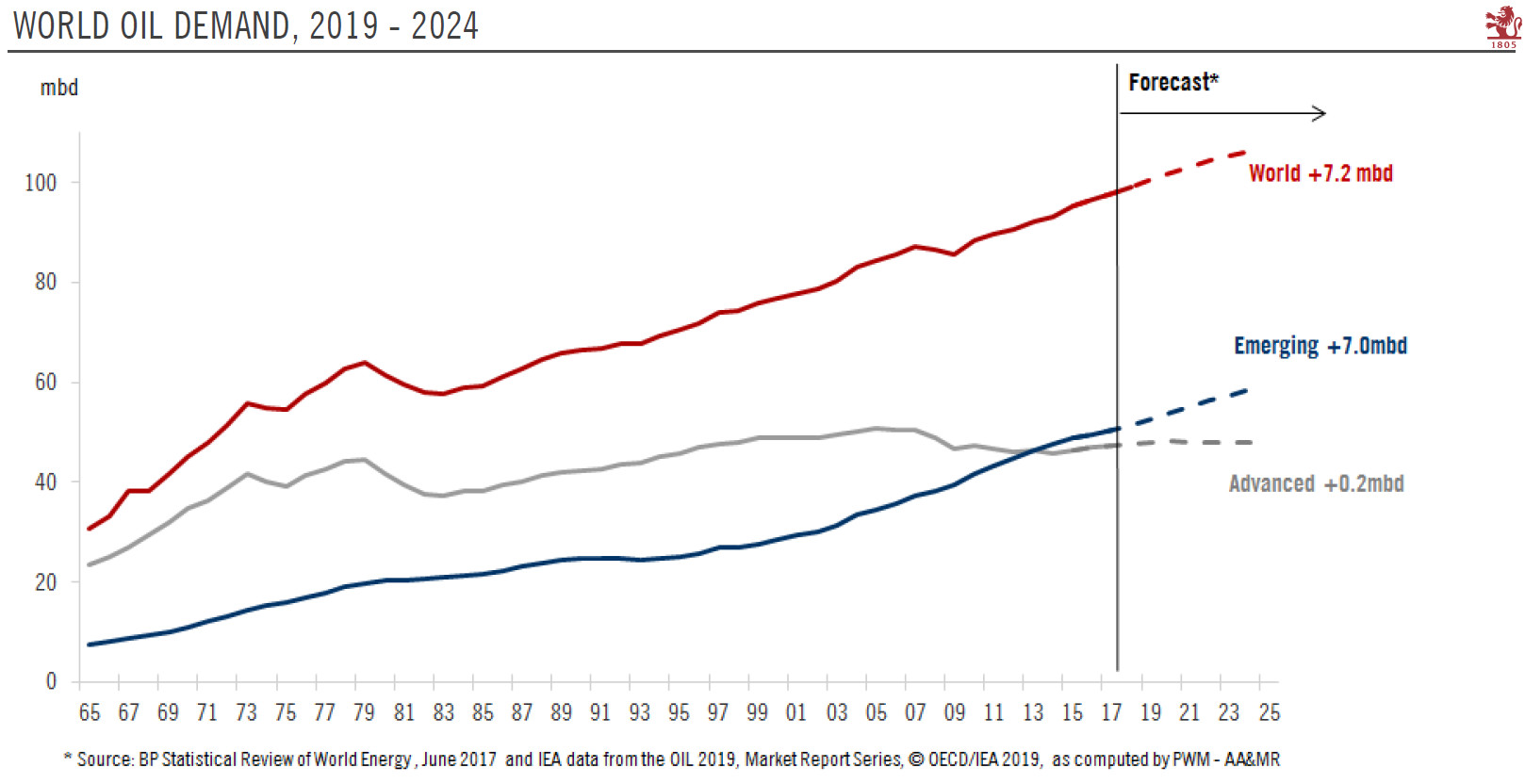

Global oil demand is expected to increase by 7 million barrels per day (mbd) between 2018 and 2024. Peak oil is still far off.

In 2019, oil will be supported by steady demand from emerging economies and a stronger-than-expected uptick in demand from advanced economies.

Our leading indicators of global activity are showing some encouraging signs. We could avoid a global recession in 2019. Thus, oil demand will be supported by slow but positive economic growth.

| Global oil production is expected to rise by 6.9mbd between 2018 and 2024. With the exception of Iraq, the bulk of the additional oil production will come from non-OPEC countries, with the US remaining the top producer.

The capacity constraints on US oil exporters are offering a temporary opportunity to OPEC+ producers, which they have been exploiting to the full by complying with December’s agreement on oil production cuts. As a result, the massive oversupply of H2 2018 has shrunk considerably and we are now close to a supply-demand equilibrium. The rest of the year will largely depend on the coming on stream of new US pipe-line facilities. A significant increase in US export capacity would probably force OPEC+ to change tactics, shifting from production cuts to gaining market share. In that case, the oil market would risk being flooded and Brent would likely test the low USD50s per barrel again. But it seems the bulk of new US export capacity will only come on stream in 2020. It would be in OPEC+’s interest to exploit the current window of opportunity until then via higher prices. The OPEC+ decision to postpone until June a decision on prolonging the production cuts into H2 indicates that OPEC producers are following changes in US output closely. The current context would tend to support Brent oil prices in the USD60 – USD70 per barrel range this year. We are sticking to our year-end forecast of USD70 for Brent. |

World Oil Demand, 2019-2024 |

Tags: Featured,Macroview,newsletter,oil demand,oil prices