Various factors have contributed to the oil price rally since August, but while a further short-term surge is possible the fundamental long-term equilibrium price for WTI remains USD55-USD58.Recent developments have brought noticeable changes to the outlook for the supply-demand balance. First of all, the steady decline in the value of the US dollar since the end of 2016 has been stopped. In fact, the dollar appreciated by 4% between end September and 7 November.Second, world economic activity has gained steam. In its last update, the International Monetary Fund revised its world GDP growth forecast up to 3.6% in 2017 and 3.7% in 2018. Third, US oil production has hit some obstacles. The number of rigs has declined after an impressive 143% increase in in the 16 months to August 2017. As a

Topics:

Jean-Pierre Durante considers the following as important: commodities, Oi price forecast, Oil price dynamics, oil price equilibrium, Oil price rally

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joaquimma Anna writes Top Commodities to Invest in for 2024: Maximizing Returns in a Volatile Market

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

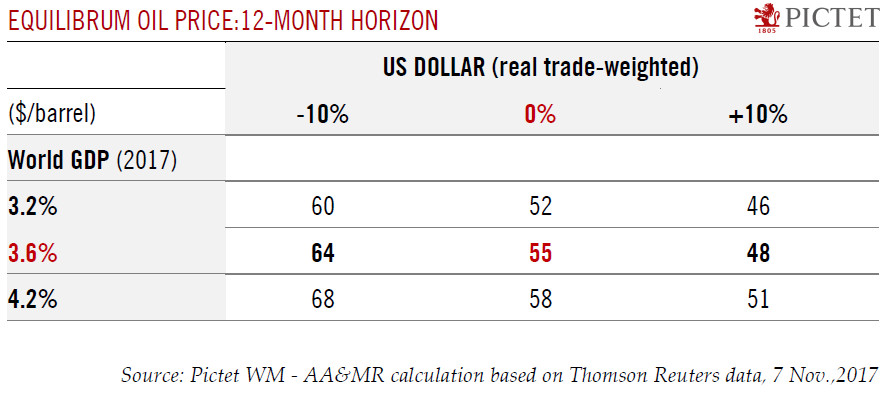

Various factors have contributed to the oil price rally since August, but while a further short-term surge is possible the fundamental long-term equilibrium price for WTI remains USD55-USD58.

Recent developments have brought noticeable changes to the outlook for the supply-demand balance. First of all, the steady decline in the value of the US dollar since the end of 2016 has been stopped. In fact, the dollar appreciated by 4% between end September and 7 November.

Second, world economic activity has gained steam. In its last update, the International Monetary Fund revised its world GDP growth forecast up to 3.6% in 2017 and 3.7% in 2018. Third, US oil production has hit some obstacles. The number of rigs has declined after an impressive 143% increase in in the 16 months to August 2017. As a consequence, US shale oil and gas production has stalled in recent months. At the beginning of the year, trends suggested that shale activity would have added 1 million barrels per day (mbd) to US oil production by the end of this year. However, it now looks as if additional output will be probably closer to 0.5mbd.

Moreover, US crude inventory has fallen steadily (-15% since March) to reach its lowest level since January 2016. All in all, the loss in momentum in US oil production should help to support oil prices in the months ahead.

Less dynamic US oil production combined with stronger world economic activity are likely to support oil prices in the coming months. The recent political shakeup in Saudi Arabia is also likely to generate uncertainties about supply that could sustain oil prices. However, our fundamental evaluation of oil price equilibrium shows that at current levels oil is fairly valued. So, at this stage, there is no significant upward or downward pressure on prices. Moreover, on a 12-month horizon, the oil price equilibrium is unlikely to change significantly (USD55 for the WTI, according to our core economic scenario). Only a significantly weaker US dollar (which is not in our scenario for 2018) would probably be able to push the long-term equilibrium above the USD60 threshold.

All in all, while a temporary surge in oil prices is possible, the WTI can be expected to converge towards its long-term equilibrium, which is situated in a range between USD55 and USD58 (USD61-USD64 for Brent).