We are sticking with our core scenario of a 10-year Treasury yield of 2.8-3.0% by year’s end. However, the chances of a yield as low as 2.5% are rising.At the beginning of 2017, in our outlook for sovereign bonds, we forecasted that the 10-year US Treasury yield would rise to 2.8-3% by year’s end. However, yields have been stuck in a range of 2.2-2.6%, so a review looks warranted.Indeed, the risk has increased of an alternative to the core scenario, but we are sticking to our target. We expect the 10-year TIPS yield to rise to 0.8% thanks to an acceleration of US economic growth and a continuation of the Fed’s tightening cycle. In addition, we see the 10-year inflation breakeven rebounding to 2.2%, in line with a ramp up in US inflation towards the Fed’s target. Hence, we remain bearish on 10-year US Treasury in our tactical asset allocation (six to 12 months).Nonetheless, we believe there is a 30% chance for an alternative scenario, with lower-than-expected growth meaning the T-bond yield is lower than 2.8-3% by year’s end. US inflation could continue to disappoint in 2017, with the inflation breakeven staying stuck at around 2%.Moreover, disappointment regarding the implementation of thorough tax reforms to stimulate US GDP growth in 2018 could mean the 10-year US TIPS yield remains at its current level of 0.5%.

Topics:

Laureline Chatelain considers the following as important: bond market scenario, Macroview, rising us yields, US bond yields, US Treasuries forecast

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We are sticking with our core scenario of a 10-year Treasury yield of 2.8-3.0% by year’s end. However, the chances of a yield as low as 2.5% are rising.

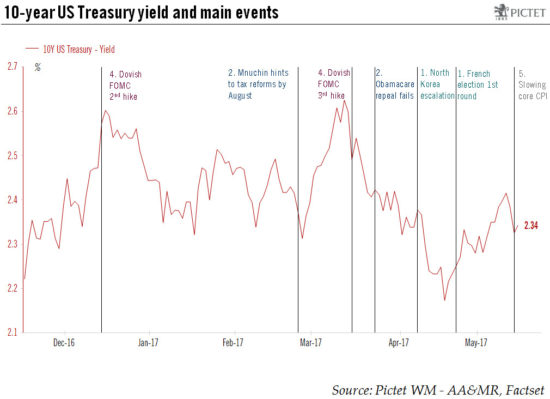

At the beginning of 2017, in our outlook for sovereign bonds, we forecasted that the 10-year US Treasury yield would rise to 2.8-3% by year’s end. However, yields have been stuck in a range of 2.2-2.6%, so a review looks warranted.

Indeed, the risk has increased of an alternative to the core scenario, but we are sticking to our target. We expect the 10-year TIPS yield to rise to 0.8% thanks to an acceleration of US economic growth and a continuation of the Fed’s tightening cycle. In addition, we see the 10-year inflation breakeven rebounding to 2.2%, in line with a ramp up in US inflation towards the Fed’s target. Hence, we remain bearish on 10-year US Treasury in our tactical asset allocation (six to 12 months).

Nonetheless, we believe there is a 30% chance for an alternative scenario, with lower-than-expected growth meaning the T-bond yield is lower than 2.8-3% by year’s end. US inflation could continue to disappoint in 2017, with the inflation breakeven staying stuck at around 2%.

Moreover, disappointment regarding the implementation of thorough tax reforms to stimulate US GDP growth in 2018 could mean the 10-year US TIPS yield remains at its current level of 0.5%. In this event, we would expect a strong flattening of the yield curve, which would mean that the 10-year US Treasury yield remains capped at around 2.5% (irrespective of further rate hikes from the Fed).