Swiss Franc EUR/CHF - Euro Swiss Franc, February 27(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan’s Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week. European bourses are mixed, with shares in Italy and Germany moving higher, but not sufficiently to offset the other markets, leaving the Dow Jones Stoxx 600 off 0.2%. In late morning turnover, information technology and materials are leading the gainers, while real estate and telecom’s are the largest drags. News that Italy’s Intesa will not be purchasing General is helping lift the Italian banking sector which declined in four of last week’s five sessions. The FTSE Italia All-Share Banks Index is up 2.4%, recouping the pee-weekend loss. Bond markets are mostly firmer. The benchmark 10-year JGB yield is off two bp to yield less than four basis points. German bounds are flat to slightly lower, while other EMU member yields are off 3-5 bp. This is allowing the spreads to narrow a bit. US 10-year yields had approached 2.

Topics:

Marc Chandler considers the following as important: equities, EUR, Eurozone M3 Money Supply, Eurozone Private Sector Loans, Featured, FX Trends, GBP, JPY, newslettersent, Spain Consumer Price Index, U.S. Durable Goods Orders, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss Franc |

EUR/CHF - Euro Swiss Franc, February 27(see more posts on EUR/CHF, ) |

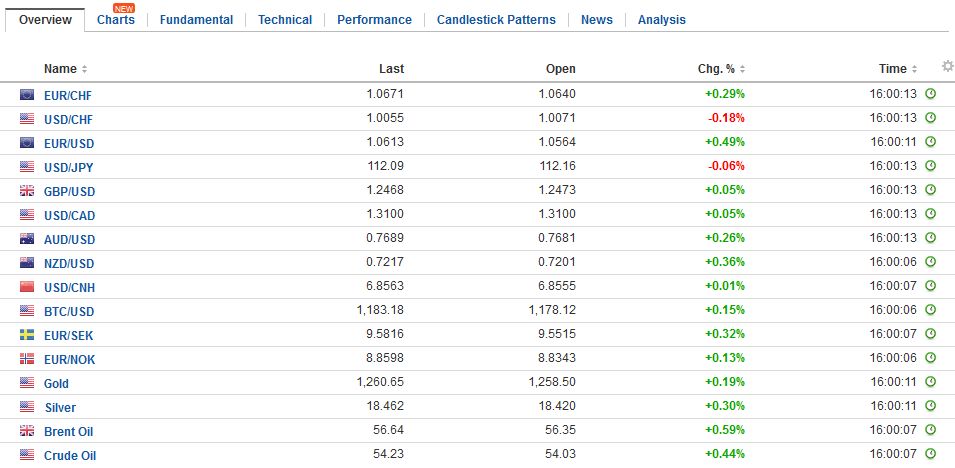

FX RatesThe late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan’s Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week. European bourses are mixed, with shares in Italy and Germany moving higher, but not sufficiently to offset the other markets, leaving the Dow Jones Stoxx 600 off 0.2%. In late morning turnover, information technology and materials are leading the gainers, while real estate and telecom’s are the largest drags. News that Italy’s Intesa will not be purchasing General is helping lift the Italian banking sector which declined in four of last week’s five sessions. The FTSE Italia All-Share Banks Index is up 2.4%, recouping the pee-weekend loss. Bond markets are mostly firmer. The benchmark 10-year JGB yield is off two bp to yield less than four basis points. German bounds are flat to slightly lower, while other EMU member yields are off 3-5 bp. This is allowing the spreads to narrow a bit. US 10-year yields had approached 2.30% before the weekend. It is now 2.33%. As we have noted the correlation on of the percent change of the dollar and interest rate spreads (10-year vs. Japan and 2-year vs. Germany) continues to be robust. As the US 10-year yield approached 2.30%, the US premium over Japan narrowed. It finished last week near 2.24%. It began the month at 2.36%. It is slightly firmer today. The dollar made a marginal new low just above JPY111.90 in early Asia before recovering toward JPY112.35. The intranet technical reading warns of a likely range-bound North American session. |

FX Daily Rates, February 27 |

| The US premium over Germany on two-year money is pushing through 2.10% today. It is the most since 2000. It finished last month near 1.90%. The German debt market is a safe haven, and the combination of political anxiety and the shortage of German paper (for investment and collateral purposes) has seen the German two-year yield fell to record lows and approach minus 100 BP.

The euro initially approached $1.0550 in Asia where it caught a good bid, and by early Europe, had approached $1.0590 where sellers awaited. The intranet technical s warn that the pre weekend high near $1.0620 may be out of reach. Sterling has the dubious honor of being the weakest of the major currencies today. It has repeated been pushed below $1.24 over the last couple of weeks but has not closed below there since January 20. While it was heavy in Asia, it did not record the low (~$1.2385) until very early in European turnover. The proximate cause appears to be press reports suggesting that UK Prime Minister May appears to be willing to accept another Scottish referendum if it takes place after the UK leaves the EU. However, sterling may also be better offered on news that the UK may seek to send free movement of EU migrants immediately after triggering Article 50, which is expected to take place in the coming weeks. The EU is likely to object on the grounds that the UK is still an EU member until the end of the negotiations, and that such action is a clear violation of the operative rules. This would seem to poison the already anticipated awkward and strained negotiations. The intranet technical’s warn of the cap near $1.2450. |

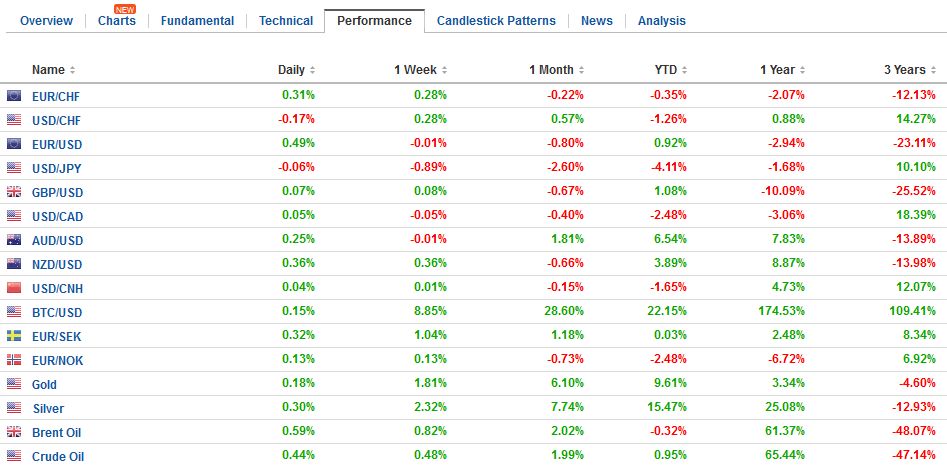

FX Performance, February 27 |

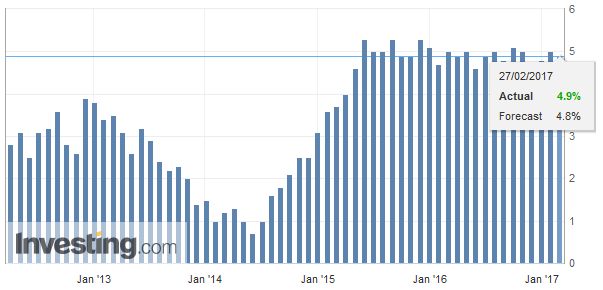

EurozoneEMU money supply (January) was also reported. M3 rose 4.9% at annualized rate. Growth has hovered between 4.8% and 5.1% with a single exception since last April. Meanwhile lending to households ticked up to 2.2% from 2.0% in December. |

Eurozone M3 Money Supply YoY, January 2017(see more posts on Eurozone M3 Money Supply, ) Source: Investing.com - Click to enlarge |

| Loans to non-financial businesses rose 2.3% over the past year, the same pace as December. Separately, the EC reported that economic confidence in the region rose to a six-year high in January. |

Eurozone Private Sector Loans YoY, January 2017(see more posts on Eurozone Private Sector Loans, ) Source: Investing.com - Click to enlarge |

Spain

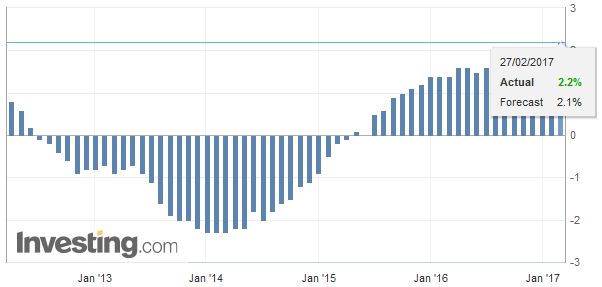

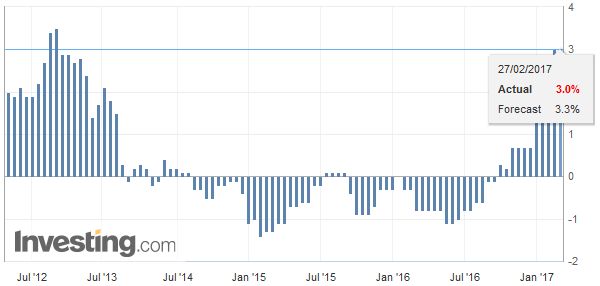

The news stream has been light. Spain is the first to report preliminary February CPI. It fell 0.3% as had been expected, which lifted the year-over-year rate to 3.0% from 2.9%. Recall that in February 2015, Spain was still experiencing deflation (CPU -1.0% year-over-year). |

Spain Consumer Price Index (CPI) YoY, January 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

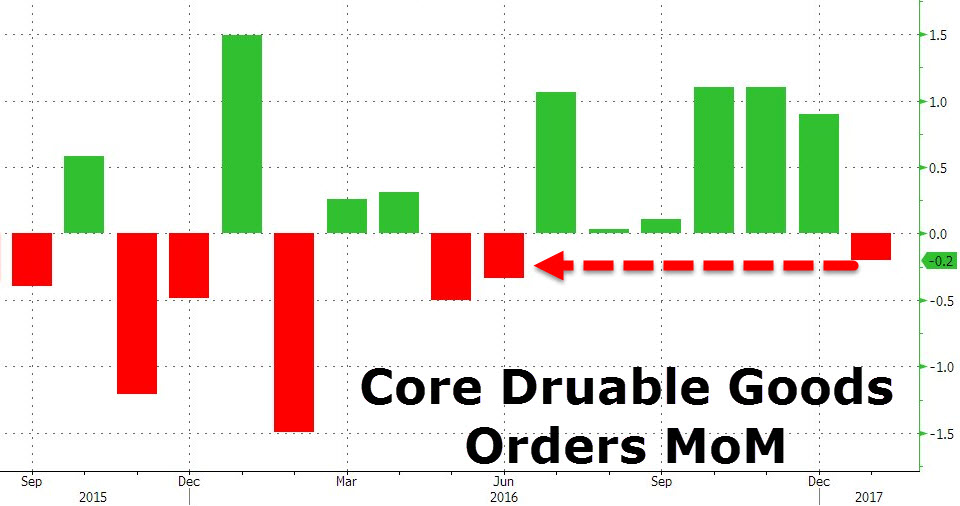

United StatesThe US reports a preliminary estimate for durable goods orders (expected 1.7% after -0.5% in December), pending homes sales (expected 1.0% after 1.6% increase in December) and the Dallas manufacturing survey (where we expect an upside rise to the Bloomberg median estimate of 19.4 from 22.1 in January). The focus this week is on President Trump’s speech tomorrow evening to a joint session of Congress, the Beige Book Wednesday, followed by Yellen’s speech on the economic outlook at the end of the week. In all at least eleven Fed officials are scheduled to speak this week. Bloomberg calculates the odds of a March hike at 40%. The CME, where the Fed funds futures trade, puts the odds at 26%. Some participants may be waiting for the February non-farm payroll report (March 10) before making up their mind. The early call is for a 175k increase after January’s 227k. |

US Core Durable Goods Orders, January 2017(see more posts on U.S. Core Durable Goods Orders (ZH), ) Source: macro.ecoblogs.org - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,equities,Eurozone M3 Money Supply,Eurozone Private Sector Loans,Featured,newslettersent,Spain Consumer Price Index,U.S. Durable Goods Orders