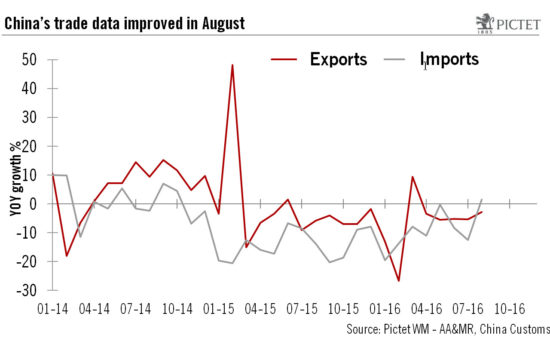

Improved export and import data, together with fiscal measures, mean that the Chinese economy remains on track to achieve 6.5% growth this year According to data released last week, China’s exports in August fell 2.8% year over year, which was better than Bloomberg consensus forecasts of a 4% drop and the 4.4% fall seen in July. Exports improved across the board, with exports strongest to developed economies. China’s headline export growth in year-over-year terms has been negative since early last year, but there has been some sequential improvement in recent months.The improvement in import data in August was even more striking. August imports rose by 1.5% over a year before, compared with the Bloomberg consensus forecast of a 5.4% decline and a 12.5%drop in imports in July. The jump in import growth was driven mainly by a rebound in the volume of commodity imports.The strong growth in commodity imports suggests a short-term recovery in China’s domestic demand, which may reflect reconstruction activities following serious floods over large parts of southern China this summer and the government’s continued support for infrastructure investment. The more upbeat import numbers are also in line with the official manufacturing PMI figure for August released earlier this month, which was the highest reading since October 2014.

Topics:

Dong Chen considers the following as important: China trade data, Chinese exports, Chinese growth, Chinese imports, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Improved export and import data, together with fiscal measures, mean that the Chinese economy remains on track to achieve 6.5% growth this year

According to data released last week, China’s exports in August fell 2.8% year over year, which was better than Bloomberg consensus forecasts of a 4% drop and the 4.4% fall seen in July. Exports improved across the board, with exports strongest to developed economies. China’s headline export growth in year-over-year terms has been negative since early last year, but there has been some sequential improvement in recent months.

The improvement in import data in August was even more striking. August imports rose by 1.5% over a year before, compared with the Bloomberg consensus forecast of a 5.4% decline and a 12.5%drop in imports in July. The jump in import growth was driven mainly by a rebound in the volume of commodity imports.

The strong growth in commodity imports suggests a short-term recovery in China’s domestic demand, which may reflect reconstruction activities following serious floods over large parts of southern China this summer and the government’s continued support for infrastructure investment. The more upbeat import numbers are also in line with the official manufacturing PMI figure for August released earlier this month, which was the highest reading since October 2014.

In summary, the August trade data generally point to a gradual rebound in global demand and some recovery in China’s domestic demand, both of which suggest a more upbeat macro picture for the near term. In addition, a recent State Council meeting revealed new plans to provide fiscal support to infrastructure investment.

But we do not expect any sustained improvement in fixed-asset investment going forward and any further fiscal stimulus may be limited to assuring growth targets are achieved and room is made for structural reforms (such as cutting overcapacity in heavy industries). As a result, we are maintaining our forecast of 6.5% GDP growth in China for 2016.