Macroview The pace of capital outflows from China has slowed significantly since the central bank intervened in the market earlier this year. Capital outflow pressures remain, but are likely to stabilise at a moderate level going forward.We estimate capital outflows of about USD41 bn in August, roughly the same as in the previous month. This is a much more moderate level of outflows than previously. We estimate that, in all, outflows amounted to USD1.3 tn between Q2 2014 and Q2 2016, with about one third (USD434 bn) in the second half of last year. But since early this year, the People’s Bank of China (PBoC) has conducted a series of market interventions to stabilize the currency and has tightened existing capital control measures. As a result, the pace of capital outflows has slowed significantly.Another reason we believe outflow pressures are likely to stabilise at a moderate level is the dominant role that Chinese corporates have played in outflows up to now. But after more than two years of exporting capital, this process is probably winding down. In addition, the 'hot-money' from carry trades that previously entered China has mostly left the country as any potential gains from interest rate differentials has been eroded by the depreciation of the Rmb. Since any remaining hot money now faces much more stringent PBoC regulations, its impact will also likely be limited.

Topics:

Dong Chen considers the following as important: Chinese devaluation, Chinese forex reserves, Chinese monetary policy, Macroview, People's Bank Of China

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The pace of capital outflows from China has slowed significantly since the central bank intervened in the market earlier this year. Capital outflow pressures remain, but are likely to stabilise at a moderate level going forward.

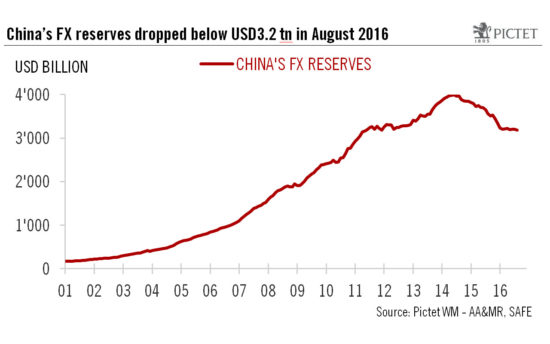

We estimate capital outflows of about USD41 bn in August, roughly the same as in the previous month. This is a much more moderate level of outflows than previously. We estimate that, in all, outflows amounted to USD1.3 tn between Q2 2014 and Q2 2016, with about one third (USD434 bn) in the second half of last year. But since early this year, the People’s Bank of China (PBoC) has conducted a series of market interventions to stabilize the currency and has tightened existing capital control measures. As a result, the pace of capital outflows has slowed significantly.

Another reason we believe outflow pressures are likely to stabilise at a moderate level is the dominant role that Chinese corporates have played in outflows up to now. But after more than two years of exporting capital, this process is probably winding down. In addition, the 'hot-money' from carry trades that previously entered China has mostly left the country as any potential gains from interest rate differentials has been eroded by the depreciation of the Rmb. Since any remaining hot money now faces much more stringent PBoC regulations, its impact will also likely be limited.

On the policy front, the expectations for further monetary easing by the Chinese central bank have declined significantly in recent months as policy makers have become more cautious about surging housing prices and resulting household indebtedness. As such, we do not expect any interest rate cut for the rest of 2016. The more neutral monetary policy stance now being adopted by the central bank may, along with other factors, serve to dampen expectations of currency depreciation and, therefore, capital outflows.