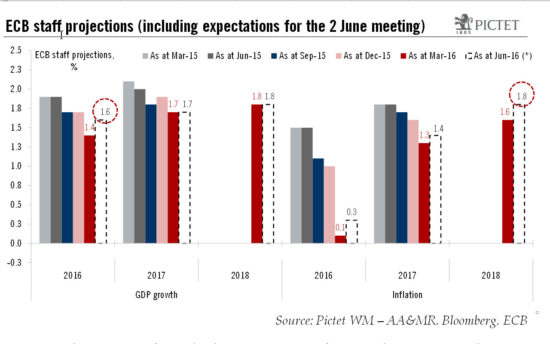

Macroview Signs that inflation is picking up should not prevent ECB heads from striking a dovish tone when they meet in Vienna on 2 June Read full report here The next ECB meeting on 2 June in Vienna will be all about communication. Mario Draghi will need to strike a fine balance between confidence and cautiousness. While we expect the first upward revision to ECB staff projections since Quantitative Easing (QE) started in March 2015, including a rise in its forecast for 2018 HICP inflation from 1.6% to 1.8%, the ECB’s Governing Council (GC) should maintain a clear dovish bias, keeping its options open at this stage. There are, we believe, more than enough arguments (or excuses) the ECB can and will use to justify a cautious stance. Meanwhile, the ECB’s focus will remain on the implementation of its policy measures, including corporate bonds purchases (CSPP) programme, starting in June, and the first TLTRO-II on 24 June. Recent comments from officials suggest that the ECB will delay any response to bond scarcity issues until after the summer, perhaps hoping that a higher pace of corporate bonds purchases will help buy more time. As things stand, we view Germany as the main constraint in terms of implementing QE.

Topics:

Frederik Ducrozet considers the following as important: ECB governing council, ECB policy, ECB staff projections, ECB Vienna meeting, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Signs that inflation is picking up should not prevent ECB heads from striking a dovish tone when they meet in Vienna on 2 June

The next ECB meeting on 2 June in Vienna will be all about communication. Mario Draghi will need to strike a fine balance between confidence and cautiousness. While we expect the first upward revision to ECB staff projections since Quantitative Easing (QE) started in March 2015, including a rise in its forecast for 2018 HICP inflation from 1.6% to 1.8%, the ECB’s Governing Council (GC) should maintain a clear dovish bias, keeping its options open at this stage. There are, we believe, more than enough arguments (or excuses) the ECB can and will use to justify a cautious stance.

Meanwhile, the ECB’s focus will remain on the implementation of its policy measures, including corporate bonds purchases (CSPP) programme, starting in June, and the first TLTRO-II on 24 June. Recent comments from officials suggest that the ECB will delay any response to bond scarcity issues until after the summer, perhaps hoping that a higher pace of corporate bonds purchases will help buy more time. As things stand, we view Germany as the main constraint in terms of implementing QE. Depending on assumptions about the pace of German Bund buying, we estimate that the ECB could hit issuer and/or issue constraints sometime between November 2016 and April 2017. As a result, we continue to expect QE rules to be adjusted eventually, most likely starting with an increase in issuer limits in September. Further adjustments may become inevitable if, as we expect, the QE programme is eventually extended beyond March 2017.

Also at the 2 June meeting, Greek debt is likely to be made eligible again for all ECB refinancing operations through the reintroduction of a collateral waiver, reducing Greek banks funding costs by more than 100bp compared with Emergency Liquidity Assistance (ELA). However, QE eligibility is likely to be debated only after the review of Greece’s bailout package is completed.