Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative “empirical evidence” that greenlights this unprecedented NIRPy step (in addition to QE of course). Today, in his...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

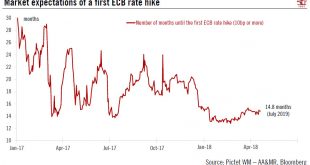

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB...

Read More »Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the...

Read More »Upside risks to wages from IG Metall negotiations

The outcome of German wage negotiations will have important implications for the broader inflation outlook in the euro area, and thus for ECB policy.German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in...

Read More »ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” – in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi...

Read More »ECB closer to the 2% inflation target than meets the eye

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its...

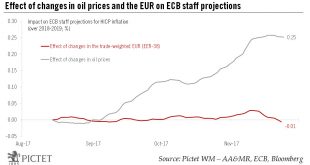

Read More »Oil prices to push ECB staff projections for inflation slightly higher

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the...

Read More »ECB on autopilot, sticks with very dovish message

Macroview There were few surprises at the ECB's Vienna meeting, apart from the modesty of staff projections for inflation. Greek banks' funding was left on hold. Read full report here The ECB left all its policy settings and its forward guidance unchanged at its 2 June Governing Council (GC) meeting in Vienna, implying low interest rates for an extended period of time. The bank’s focus remains on the implementation of new policy measures, with corporate bond purchases starting on 8 June...

Read More »The ECB seeks balance between caution and confidence

Macroview Signs that inflation is picking up should not prevent ECB heads from striking a dovish tone when they meet in Vienna on 2 June Read full report here The next ECB meeting on 2 June in Vienna will be all about communication. Mario Draghi will need to strike a fine balance between confidence and cautiousness. While we expect the first upward revision to ECB staff projections since Quantitative Easing (QE) started in March 2015, including a rise in its forecast for 2018 HICP...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org