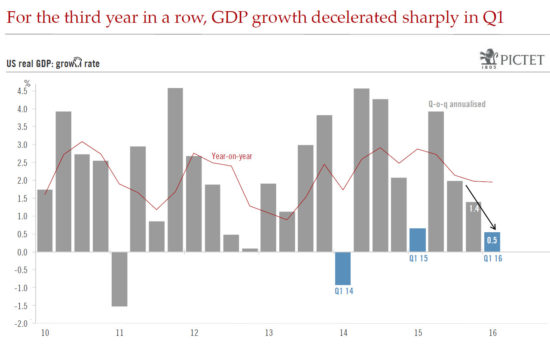

The domestic economy is picking up, but downbeat manufacturing and inflation data may still be factors in Fed policy decisions After a habitually disappointing first-quarter GDP figure of 0.5% (first estimate, to be revised on May 27), we expect a significant pick-up in US GDP to about 2.5% in the second quarter, not least because of strong consumer spending, which, according to our estimates, could grow by 3.0% in Q2 2016. Admittedly, consumer spending in the first quarter was surprisingly subdued, suggesting a good part of the windfall from past declines in oil prices has still not been spent by US consumers, and instead showed up in a relatively high savings rate. But more recent data on retail, housing and auto sales dovetail with our belief that job and wage growth will translate into stronger spending. Furthermore, the negative impact of the collapse of oil investment on first-quarter GDP can be expected to fade significantly. Our central scenario for 2016 as a whole is that the US economy will remain relatively healthy and record annual growth of the order of 1.8%. But we see only a modest pick-up in core inflation, which should mean that the pace of Fed rate tightening remains pedestrian.

Topics:

Bernard Lambert considers the following as important: Fed rate rises, Macroview, US economy, US growth prospects

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The domestic economy is picking up, but downbeat manufacturing and inflation data may still be factors in Fed policy decisions

After a habitually disappointing first-quarter GDP figure of 0.5% (first estimate, to be revised on May 27), we expect a significant pick-up in US GDP to about 2.5% in the second quarter, not least because of strong consumer spending, which, according to our estimates, could grow by 3.0% in Q2 2016. Admittedly, consumer spending in the first quarter was surprisingly subdued, suggesting a good part of the windfall from past declines in oil prices has still not been spent by US consumers, and instead showed up in a relatively high savings rate. But more recent data on retail, housing and auto sales dovetail with our belief that job and wage growth will translate into stronger spending. Furthermore, the negative impact of the collapse of oil investment on first-quarter GDP can be expected to fade significantly.

Our central scenario for 2016 as a whole is that the US economy will remain relatively healthy and record annual growth of the order of 1.8%. But we see only a modest pick-up in core inflation, which should mean that the pace of Fed rate tightening remains pedestrian.

Minutes from the latest Federal Market Open Committee meeting, released in May, have enticed futures markets increasingly to pencil in the idea of a Fed rate hike in June or July. Certainly, sound job and spending data suggest the US economy is closer to meeting the criteria set by the Fed for a further rate hike and the Goldman Sachs financial condition index shows that financial conditions have eased considerably since late January.

However, there are constraints on how far the Fed will be able to go in rate tightening. Of itself, the rise in the US dollar — spurred by a prospective rate hike — is leading to renewed tightening of financial conditions. And while news on the consumer spending front is good, manufacturing has been somewhat disappointing, with the Markit PMI survey for May showing activity contracting for the first time since 2009. Future potential rebounds in the trade-weighted dollar could destabilise dollar-exposed emerging market debtors. And given a global glut of investable savings, a rate increase would likely attract even more foreign investor inflows. Because the Fed cannot afford to let the dollar rise too high and because of the risk of attracting further deflationary capital inflows, we expect any rate increases this year to be limited in scope.

A further spanner in the works is the US’s declining potential growth rate (currently about 1.7%) and the relatively modest inflationary pressures, in spite of some modest pick-up in the pace of wage increases. We forecast that core PCE inflation (the Fed’s favourite point of reference) will reach 1.9% by year-end, compared with 1.6% in April. In addition, longer-term inflation expectations have declined.

All in all, the Fed is caught between signals that justify a certain hawkishness and factors that would justify continued dovishness. There remains the possibility that higher wage increases, combined with higher oil prices, could push up inflation further than our central scenario allows for, possibly above the Fed's target. But while the chances of a Fed increase in June or July might have increased, we still believe that September is more likely. In any case, we believe the Fed will act very carefully — possibly limiting itself to just one increase this year in light of the constraints it faces.