We continue to forecast a gradual pick-up in the pace of economic expansion from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand. Read the full report here According to Markit’s preliminary estimates, the euro area composite PMI decreased slightly from 53.1 in March to 53.0 in April. Nevertheless, the employment component improved in both the manufacturing and services sectors. Looking at forward-looking components, the manufacturing new export orders and new business indices were also up. Overall, in terms of real activity, April’s composite PMI suggests that the pace of economic growth in Q2 was marginally weaker than the average seen in Q1, and is consistent with real GDP in the euro area rising at a quarterly rate of around 0.3% quarter-over-quarter in Q2, slightly below our forecast. However, Q1 figures to be published on April 29, could still surprise on the upside given the latest underlying data. Looking at price dynamics, deflationary forces moderated somewhat in April. The input prices index rose above 50 for the first time in three months, possibly reflecting the recent increase in oil prices, while the output prices index also rose slightly. Our simple gauge of (dis)inflationary pressures reached a four month high. But there is still a long way to go before inflation reaches a satisfactory level.

Topics:

Nadia Gharbi considers the following as important: 1Q growth forecast, Deflation, Euro PMI, Macroview

This could be interesting, too:

Stephen Flood writes Rick Rule – Gold Helps Me Sleep at Night

Jeffrey P. Snider writes A Volcker Pan Recession

Jeffrey P. Snider writes Hong Kong Stocks Pivot Euro$ #5

Jeffrey P. Snider writes The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

We continue to forecast a gradual pick-up in the pace of economic expansion from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand.

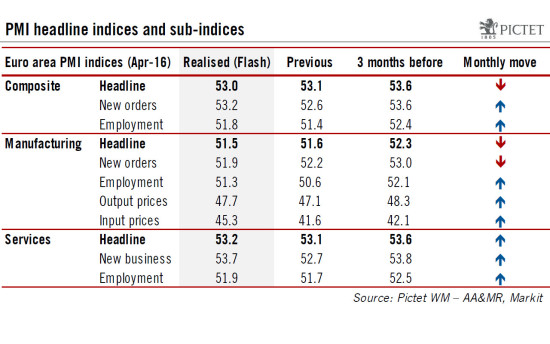

According to Markit’s preliminary estimates, the euro area composite PMI decreased slightly from 53.1 in March to 53.0 in April. Nevertheless, the employment component improved in both the manufacturing and services sectors. Looking at forward-looking components, the manufacturing new export orders and new business indices were also up.

Overall, in terms of real activity, April’s composite PMI suggests that the pace of economic growth in Q2 was marginally weaker than the average seen in Q1, and is consistent with real GDP in the euro area rising at a quarterly rate of around 0.3% quarter-over-quarter in Q2, slightly below our forecast. However, Q1 figures to be published on April 29, could still surprise on the upside given the latest underlying data.

Looking at price dynamics, deflationary forces moderated somewhat in April. The input prices index rose above 50 for the first time in three months, possibly reflecting the recent increase in oil prices, while the output prices index also rose slightly. Our simple gauge of (dis)inflationary pressures reached a four month high. But there is still a long way to go before inflation reaches a satisfactory level. As a result, the ECB’s monetary stance is unlikely to change at this stage and will remain accommodative.

We continue to forecast a gradual pick-up in the pace of economic expansion from 1.5% in 2015 to 1.8% in 2016, largely led by domestic demand. While private consumption is likely to remain robust, we also expect a credit-led rebound in investment to support aggregate demand. In this, regards, banking credit indicators have been encouraging so far this year. In terms of downside risk, it seems that downward pressure from weak global trade has softened somewhat, as suggested by German manufacturing PMI and hard data. Political uncertainty remains the main risk for our economic outlook at this stage.