“The US dollar’s strength isn’t so much a function of the strength of the US economy or US political leadership, but rather, the fact that we’re competing in a horse race against a bunch of other horses that are completely lame.” Rick Rule – Rule Investment Media The former President and CEO of Sprott, was last on the show at the beginning of February, so it’s an understatement to say he and GoldCore TV host Dave Russell had a few things to catch up on! From US...

Read More »A Volcker Pan Recession

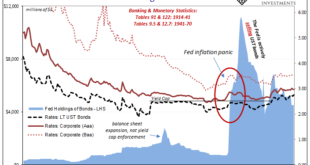

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money. Once Paul Volcker took over in ’79, he acted on the belated realization, seeking to get the Great Inflation under control by restricting, well, something that seems like money. All the...

Read More »Hong Kong Stocks Pivot Euro$ #5

The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices. Everyone still thinks there’s a direct monetary injection in this case by the central monetary agency which causes stocks to rise for no good reason. While we don’t have to argue the Fed’s bank reserves here, the truth of the matter is stocks have been severed...

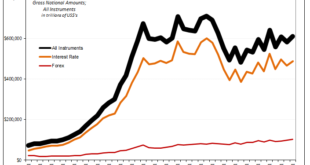

Read More »The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

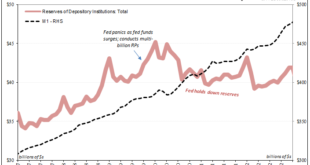

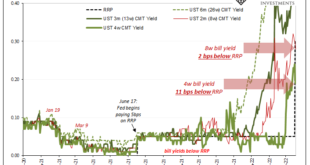

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps. That RRP, or reverse repo program, is meant to be something of a...

Read More »Consumer Prices And The Historical Pain(s)

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history. Then, suddenly, consumer prices skyrocketed and it left many Americans wondering if there would ever be an end to the massive volatility. At its peak in March 1947, the US CPI had gained 19.67%...

Read More »So Much Fragile *Cannot* Be Random Deflationary Coincidences

At first glance, or first exposure to this, there doesn’t seem to be any reason why all these so many pieces could be related. Outwardly, from the mainstream perspective, anyway, you’d think them random, and even if somehow correlated they’re supposed to be in the opposite way from what’s happened. Too much money, they said. It began with the Fed’s Reverse Repo (RRP) use suddenly going nuts. From seemingly out of nowhere, this was mid-March last year, and, from what...

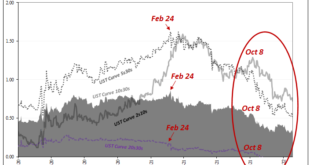

Read More »The Red Warning

Now it’s the Russian’s fault. Belligerence surrounding Donbas and Ukraine, raw materials and energy supplies to Europe threatened by Putin’s coiled bear. Why wouldn’t markets grow worried? There’s always a reason why we shouldn’t take these things seriously, or quickly dismiss them out of hand as the temporary product of whichever political fear-of-the-day. This isn’t to write that these things aren’t important in any sense; no doubt anyone in or near Ukraine right...

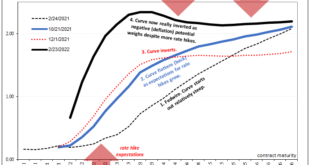

Read More »After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness. And yet, on the other hand, growth and inflation expectations, the long end could...

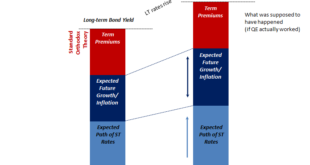

Read More »Good Time To Go Fish(er)ing Around The Yield Curve

It should be as simple as it sounds. Lower LT UST yields, less growth and inflation. Thus, higher LT UST yields, more growth and inflation. Right? If nominal levels are all there is to it, then simplicity rules the interpretation. Visiting with George Gammon last week, he confessed to committing this sin of omission. Rates have gone up, he reasoned reasonably, therefore it would seem to follow how the market must be shifting expectations toward the more optimistic...

Read More »US CPI Reaches Seven On US Goods Prices, With Disinflation Setting In Everywhere Else (incl. US Services)

How is that US Treasury rates out in the independent longer end of the yield curve have now “suffered” a seven percent CPI to go along with double taper and triple maybe quadruple (if the whispers are to be believed) rate hikes this year, yet have weathered all of that allegedly bond-busting brutality with barely a market fluctuation? The short end of the curve, as noted here, is being pressured by only the last of those things, rate hikes, and from them creating...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org