Takeaways from the press conference following the ECB's policy meeting of 21 April 2016 Read the full report here The 10 March ECB meeting was all about bold action and strong signals. The main message from the 21 April meeting was one of continuity, consistency and cohesion. The ECB’s assessment of economic conditions has not changed materially in the past few weeks, with the view that existing and upcoming policy measures will help to push inflation higher over the medium-term. In the words of ECB President Mario Draghi, “ECB policies are working, just give them more time”. In a response to renewed criticism by German finance minister Wolfgang Schäuble, Draghi noted that the Governing Council was unanimous on the ECB’s independence as well as the appropriateness of current policies. Perhaps as a condition for such cohesion, Draghi repeatedly shrugged off questions about so-called “helicopter money” by saying that the GC did not discuss this option, which was fraught with “operational, legal and institutional difficulties”. In terms of policy guidance, Draghi repeated that interest rates were expected to remain “at present or lower levels for an extended period of time”, not fully ruling out further cuts, although he sounded cautious about the extent to which rates could be lowered given the “complexity” of the issue.

Topics:

Frederik Ducrozet considers the following as important: ECB, ECB independence, ECB policy meeting, ECB press conference, Macroview

This could be interesting, too:

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes US-China Exchange Export Restrictions, Yuan is Sold to New Lows for the Year, while the Greenback Extends Waller’s Inspired Losses

Marc Chandler writes Markets do Cartwheels in Response to Traditional Pick for US Treasury Secretary

Marc Chandler writes FX Becalmed Ahead of the Weekend and Next Week’s Big Events

Takeaways from the press conference following the ECB's policy meeting of 21 April 2016

The 10 March ECB meeting was all about bold action and strong signals. The main message from the 21 April meeting was one of continuity, consistency and cohesion. The ECB’s assessment of economic conditions has not changed materially in the past few weeks, with the view that existing and upcoming policy measures will help to push inflation higher over the medium-term. In the words of ECB President Mario Draghi, “ECB policies are working, just give them more time”.

In a response to renewed criticism by German finance minister Wolfgang Schäuble, Draghi noted that the Governing Council was unanimous on the ECB’s independence as well as the appropriateness of current policies. Perhaps as a condition for such cohesion, Draghi repeatedly shrugged off questions about so-called “helicopter money” by saying that the GC did not discuss this option, which was fraught with “operational, legal and institutional difficulties”.

In terms of policy guidance, Draghi repeated that interest rates were expected to remain “at present or lower levels for an extended period of time”, not fully ruling out further cuts, although he sounded cautious about the extent to which rates could be lowered given the “complexity” of the issue.

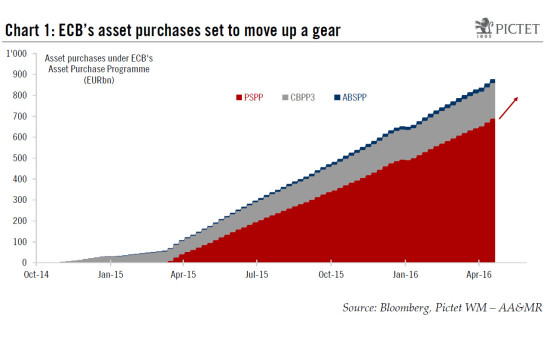

Lastly, the details of the Corporate Sector Purchase Programme, which is set to start in June, went beyond market expectations, targeting all non-bank investment-grade issuers, with maturities between 6 months and 30 years and an issue share limit of 70%.

All in all, Draghi reaffirmed the ECB’s determination to act while calling for patience while policy measures produce their full effects. This strengthened our view that, barring a new shock, the ECB’s monetary stance is unlikely to be recalibrated anytime soon, apart from a possible extension of asset purchases beyond March 2017 along with technical changes to QE rules – both of which could be announced around September 2016.